February dairy market review

Thursday, 23 March 2023

By Patty Clayton

Milk production

GB milk deliveries continued to record strong year on year growth through February, with estimated volumes up 3.0% on the year at 952m litres. Seasonal growth is in line with typical patterns, marginally up on the 5-year average for this time of year.

The growth in milk production has been driven by a favourable milk to feed price ratio over the autumn and winter. However, the reductions in milk prices since the beginning of 2023 could start to impact on yields, especially if input costs remain high.

Global milk deliveries in January grew by 1.1% year-on-year, equivalent to an additional 8.6m litres of milk per day. Increased deliveries were recorded in all key regions with the exception of Australia. However, production in January 2022 was relatively muted, which will impact on the annual comparisons.

Overall, global milk production is expected to increase by around 0.7% in 2023, according to Rabobank. Most of the growth is likely to occur in the first half of the year, with some potential for lower milk deliveries at the end of the year. Growth is expected to be limited by lower milk prices, smaller herds, and the impact of unfavourable weather in some regions.

Wholesale markets

Prices on dairy wholesale markets have been weakening in all key markets since the summer of 2022. With the northern hemisphere flush approaching, the general view is this trend will continue into the first quarter of 2023. EU product prices were anywhere from 17% to 37% lower year on year. The exception to this is in cheese prices, which have declined in recent months but remain above year earlier levels.

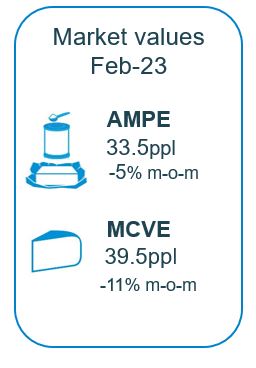

As of February, milk market values in the UK are around 8ppl lower than a year earlier, with AMPE and MCVE down by 31% and 14% respectively.

Farmgate prices

The latest published farmgate price was for January, with a UK average of 49.2ppl. Since then however, market-related farmgate prices have been declining in response to the reduced market returns and higher milk availability.

In the first three months of this year, cuts to milk prices (excluding aligned) have ranged from 1.23ppl and 10.0ppl, with most buyers announcing further cuts for April.

These cuts translate to a drop of 6.53ppl on the average price paid on market related contracts (excluding aligned liquid) based on announced prices to March 2023[1]. Over the same period, prices paid on retailer aligned contracts have been cut by 4.72ppl on average.

In general, inflation in key input costs has slowed in recent months, although prices for fuel, fertiliser and feed remain high in historic terms. The combination of high production costs and declining prices means farm margins will come under increased pressure through the season.

This is expected to lead to reduced yields later in the year, with GB milk production in the 2022/23 season to record minimal growth of 0.5%.

[1] Announced price changes to March 2023 applied to contracts included in the AHDB league table, excluding retailer aligned prices

Sign up for regular updates

You can subscribe to receive Dairy market news straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.