Current marketing year sees record EU rapeseed imports to date: Grain Market Daily

Wednesday, 9 October 2019

Market Commentary

- Yesterday, UK feed wheat futures (Nov-19) rose slightly to £138.00/t off the back of sterling weakening to close 0.7% down.

- With trade seeing limited new purchases for October, we were unable to publish a FOB price yesterday. The potential implementation of tariffs in the event of a no-deal Brexit have meant ports are currently ‘near to full’ for export schedules before the impending deadline.

- So far this week, Paris rapeseed futures (Nov-19) have increased €1.25/t to close at €388.25/t yesterday.

Current marketing year sees record EU rapeseed imports to date

EU imports of rapeseed have hit record levels this season as the continent tries to meet its import requirements. A difficult growing season for both the domestic and the European crop has left the continent requiring c.5.5Mt in imports, according to the EU commission.

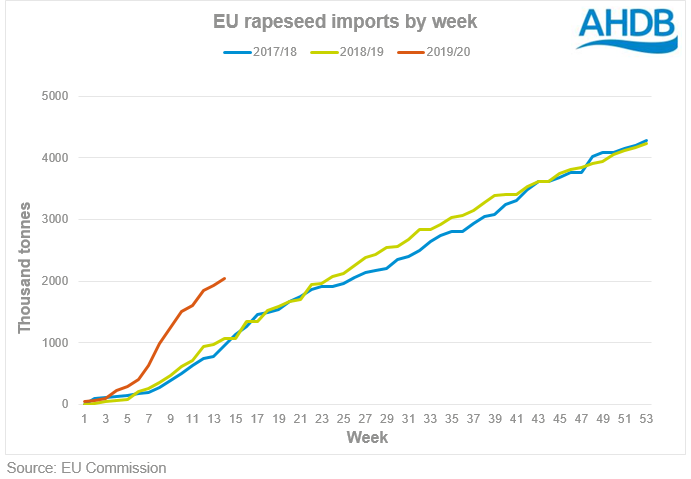

Since 1 July, the EU has imported just over 2.04Mt of rapeseed by 6 Oct, according to the EU commission. This import volume is 92% higher than last year for the same period, making it the largest on record. EU exports of rapeseed have declined 78% over the same period.

Widespread pest damage and dry conditions last year, in conjunction with a reduced EU rapeseed planted area, resulted in a production figure of 16.93Mt. This is 20.6% lower than the five-year average. According to the EU commission balance sheet, rapeseed usage figures for the EU point towards 22.94Mt, meaning a deficit of 6.02Mt is required to be met from imports and carryover stocks. With over 2.0Mt brought in already, import demand sits around 3.5Mt for the remainder of the season.

A front-loaded rapeseed export schedule for Ukraine has seen their share of EU import origins at 80.7%. However, this rapid schedule has meant almost 70% of Ukraine’s rapeseed exportable surplus has been shipped already, according to UkrAgroConsult. Therefore, other origins will be needed to make up the EU deficit.

Canadian origin import volumes into the EU have reached a record for July to October of over 290Kt so far, making up 14.2% of total imports. The wide price spread of nearby futures, averaging €72 (Matif vs. Winnipeg) since 1 July, has helped imports. However, end-uses for Canadian origin can be more challenging, given the GM traits of the rapeseed. A lack of GM markets for rapemeal and oil potentially limits the amount of Canadian supply that can be imported.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.