Bullish outlook for new-crop global and domestic grains: Grain Market Daily

Thursday, 28 April 2022

Market commentary

- Old crop (May-22) UK feed wheat futures settled at another contract high yesterday of £332.20/t, gaining £0.20/t from Tuesdays close. New crop (Nov-22) futures also closed at a new contract high (£296.60/t), up £3.35/t from the previous session.

- May-22 Paris Rapeseed futures lost ground yesterday, closing at €1045.00/t, down €14.75/t from Tuesdays close. The Nov-22 contract settled at €855.00/t, down €1.50/t on the day.

- Indonesia extended its ban on palm oil exports yesterday to include crude and refined palm oil, which is a switch from the decision a day earlier to just cover refined oil under the ban. On the back of this, US soya oil markets shot up, with the May-22 Chicago soyabean oil futures contract gaining $55.34/t on the day to close at a new contract high of $1935.64/t.

Bullish outlook for new-crop global and domestic grains

Following on from our Spring Market Outlook webinar on Tuesday, we take a look at both the global and domestic situation for grain for next season.

2022/23 smaller global supply

Globally, it comes as no shock that we are going to finish this season with tight end-season stocks for 2021/22 for grains. Even before war broke out in Ukraine, the situation was looking tight, with the Russian invasion adding further pressure to markets. We’ve obviously seen the impact of this in price movements over the past couple of months. Both the May-22 and Dec-22 Chicago wheat futures contracts have increased by over 40% since the start of the year.

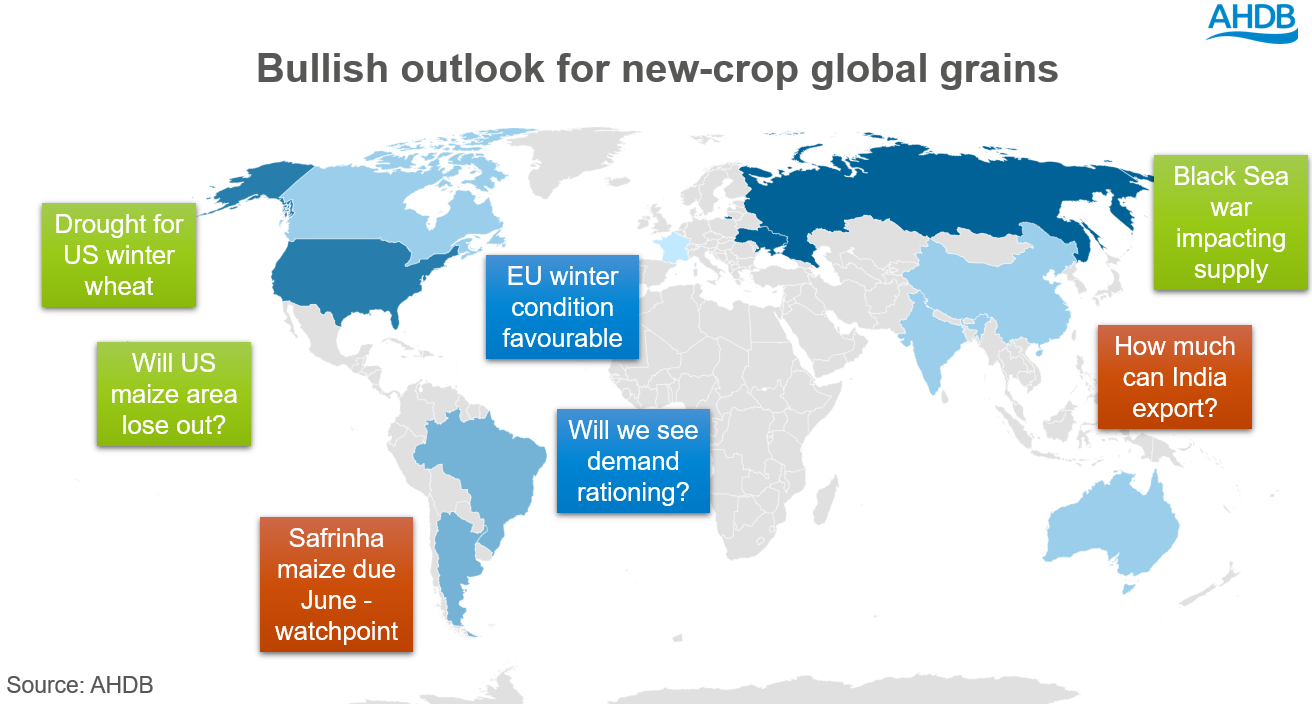

Moving ahead to next season and the outlook currently looks bullish. The war in Ukraine has had an impact on what is planted for 2022/23. Even if the war subsided and Ukraine could, in theory, start to export again, there could be challenges. It is thought that the quality of the crop that is in store is deteriorating, and damage has been done to internal infrastructure, including ports. Therefore, it wouldn’t be as simple as it may first seem.

It's not just the situation in the Black Sea that is in focus, the drought in the US and the impact on its winter wheat crop is a big watch point currently, with crop conditions falling. On the flip side, in key maize growing regions, rain fall has halted maize plantings, and soyabeans are expected to snatch some of that maize area too.

While we could expect a relatively good EU grain output next season, as well as a possible drop back in livestock demand due to a squeeze on margins, it is unlikely that this will offset the expected tightening in total global supply. The market will be very reactive to any new news that comes out over the coming months, due to the current situation.

Another tight year for UK S&D?

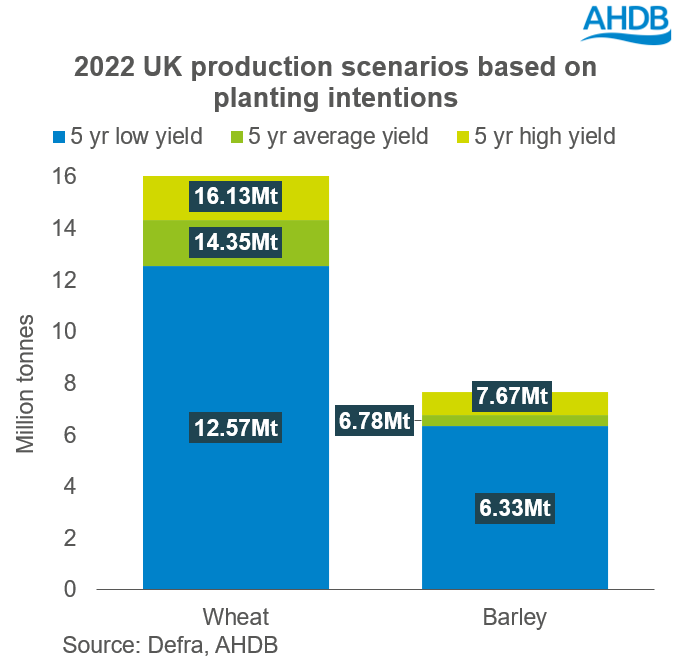

While we are not at the end of the 2021/22 season yet, it’s safe to say that the amount of both wheat and barley left to be carried into next season will be tight. Looking to harvest 2022, according to the results of the Early Bird Survey, the wheat area is projected to be up by 1% at 1.805Mha. Total barley area is expected to be down by 4%, at just over 1.1Mha. It is worth noting that these were based off planting intentions at the end of last year and these areas may have changed, especially with rising wheat prices.

Looking ahead to harvest and possible output, obviously there are a number of factors which could impact total production. The great British weather obviously being the big one. While we have had favourable conditions for spring plantings, we are obviously a long way off harvest yet. The huge rise in input costs this year may well have an impact on production for 2022/23, obviously this depends on applications and when fertiliser was purchased.

That said, using the area collected in the Early Bird Survey and the five-year average Defra yield, we could see a sizeable wheat crop of over 14Mt for the next season. For barley however, unless we see high yields, or more area than intended, we may see another circa 7Mt crop. Again, I will caveat that with the fact this is based off planting intentions and average Defra yields. The AHDB Planting and Variety Survey results will be published in early July and will give an up-to-date view of what is in the ground for harvest.

In terms of demand next season for wheat especially, the big watch point really is bioethanol. It is expected that both bioethanol plants will be up and running at full capacity at some point early next season. We may well see a shrinking back in animal feed demand, as the pig herd finally starts to come back and with tight margins from the laying sector. For ruminants, a lot will rely on forage quality and availability. That said, it is unlikely that animal feed demand for domestic grain will come back hugely, with maize currently uncompetitive. For barley specifically, the brewing, malting and distilling sector is now operating back up at pre pandemic levels, so demand is likely to remain strong.

A lot can happen between now and next season. From a domestic point of view, weather will be a watch point as well as input costs. Domestic prices are very much supported at the moment by the global market, with prices very strong due to the tight global situation. As it stands, it looks like prices will remain supported going forward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.