Benign weather supports Australian wheat and barley: Grain market daily

Wednesday, 4 September 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £182.10/t yesterday, rising £0.65/t from Monday’s close. The May-25 contract gained £0.60/t over the same period, to close at £195.25/t.

- UK feed wheat futures followed strengthening in global wheat markets, in particular Chicago wheat futures which had not been trading on Monday due to a public holiday (Labor day). Gains were made following an improved outlook for US grain exports and persisting dryness in key maize growing areas in the US.

- Paris rapeseed futures (Nov-24) closed at €469.75/t yesterday, falling €1.50/t from Monday’s close. The May-25 contract gained €0.25/t over the same period, to close at €473.00/t.

- Paris rapeseed futures had lost nearly €20/t in the first few hours of trading yesterday following China’s announcement of launching an anti-dumping investigation into Canadian rapeseed imports. However, the market partially recovered later in the day as the global rapeseed market is still fundamentally tight and tracked wider support from gains in Chicago soyabean futures.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Benign weather supports Australian wheat and barley

On Monday, the latest quarterly Australian Crop Report was released by ABARES (part of Australia’s Department of Agriculture, Fisheries and Forestry) with revisions to estimates made in June. While conditions have varied across key growing states, improved conditions in New South Wales, Queensland and Western Australia have outweighed less favourable conditions in South Australia and Victoria. This has led to a forecast of the fifth largest winter crop production on record.

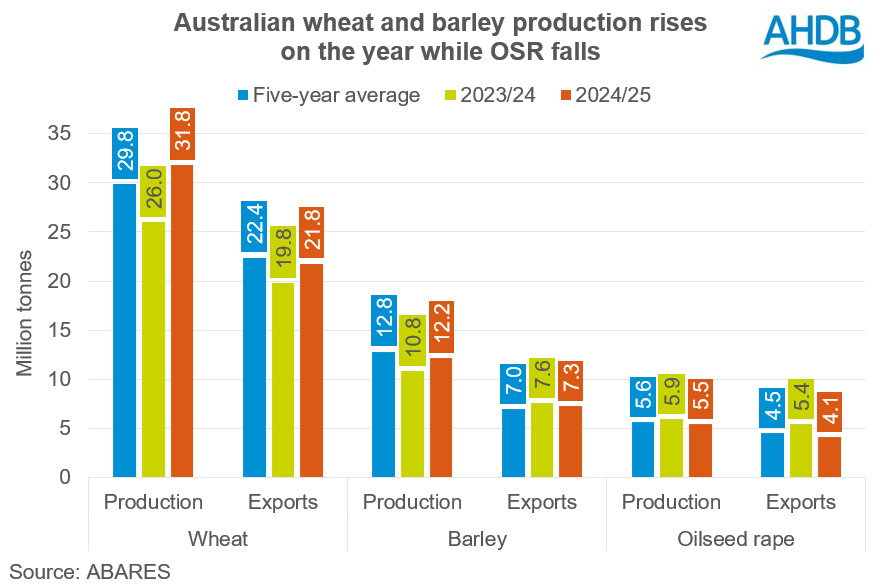

- Wheat production has risen 9% from June’s estimate to 31.8 Mt and is now 23% up on the year and 7% above the five-year average. Exports have also risen from June’s estimate to 21.8 Mt, up 10% on the year.

- Barley production has increased by 6% from June’s estimate to 12.2 Mt which is 13% up on the year but 5% less than the five-year average. Exports have also been forecasted upwards from June’s initial estimates to 7.3 Mt but remain lower than last year by 4%.

- Rapeseed production has risen 2% from June’s estimate to 5.5 Mt. The smaller rapeseed area (3.2 Mha) due to greater cereals planting has contributed to the 8% fall in production on the year and is 3% less than the five-year average. Lower production on the year has partly led the 24% year-on-year decline in exports to 4.1 Mt.

How could this impact global markets?

Looking at wheat, the continued favourable outlook for Australian production could offer some relief to the tightness in wheat stocks of major global exporters this season, which the USDA are currently forecasting down 8% from last year and 12% below the five-year average. Something to watch out for.

For barley, China is a key export destination for Australia, accounting for approximately 80% of exports (USDA). However, there have been reports suggesting that Chinese purchasing of imported feed grains may fall due to present ample supply and lower-than-expected demand. Therefore, this could spill pressure over to global barley markets should Chinese demand fall short of usual purchasing, as Australia looks for alternative destinations.

Lower year-on-year rapeseed exports from Australia had been forecast back in June’s ABARES report attributed to the challenging start to the year for rapeseed, with expectations left unchanged in Monday’s figures. Following news that China has launched an anti-dumping investigation into Canadian rapeseed imports, some market participants have suggested that there could be increased Australian rapeseed exports to China in place of Canada. However, as Canada and Australia share some similar export destinations, it could be that global rapeseed trade flows adjust with minimal impact on global rapeseed prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.