Arable Market Report - 19 August 2024

Monday, 19 August 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

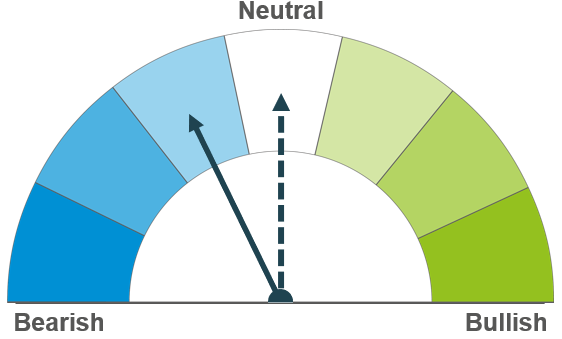

Wheat

Maize

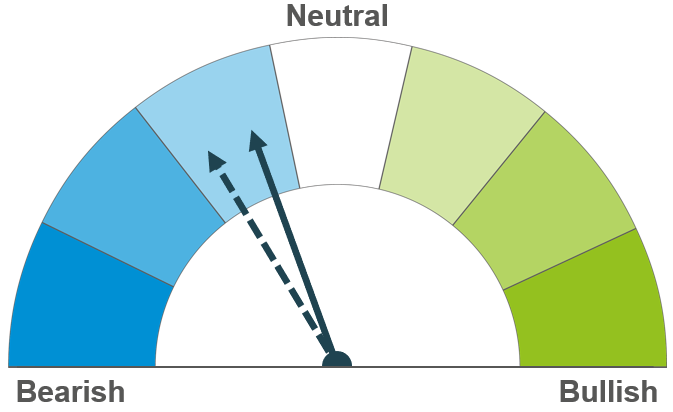

Barley

European harvest results remain in focus, though Black Sea supplies will likely limit any support short-term. Longer-term, a historically tight global outlook could help underpin prices.

US and EU maize crop conditions remain a watchpoint in markets. Longer-term, with a tighter wheat balance, demand for maize will be key to price direction.

Barley prices will continue to follow the wider grains markets. Though in Europe, it’s thought that barley production has not been impacted to the same extent as wheat, which could alter the price relationship between the two grains.

Global grain markets

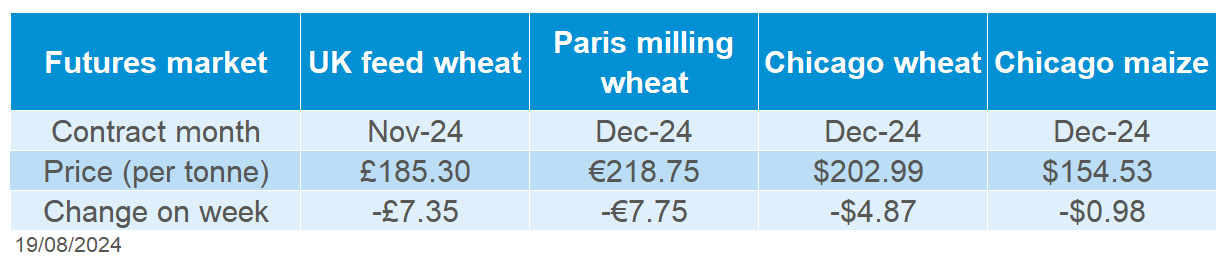

Global grain futures

Global grain markets were overall pressured last week (Friday to Friday). Chicago wheat and Paris milling wheat futures (Dec-24) were down 2.3% and 3.4% respectively. The Dec-24 Chicago maize futures contract fell 0.6% over the same period. Despite concerns over western European production and news of a missile strike on the port of Odesa, competitive Black Sea supplies weighed on prices last week.

On Wednesday evening, Russian missiles hit port infrastructure in Odesa, raising concerns over grain shipments from Ukraine. Though, reports suggest that the attack is unlikely to be part of a more aggressive move against Ukrainian exports. As such, any market support was limited.

Competitive Black Sea supplies continue to weigh on global grain prices. At the beginning of last week, Egypt purchased 280 Kt of wheat from Ukraine and Bulgaria, from the 3.8 Mt they had originally sought. It is suggested that Egypt is negotiating a purchase of 1.8 Mt of wheat from other origins, including Russia. This is something to keep an eye on this week.

Poor crop conditions in western Europe remain a key focus in grain markets. FranceAgriMer said on Wednesday that as French wheat harvest nears completion, wheat quality appears mixed, especially on specific weights. Protein levels were also varied, though the national average appeared close to last season. More detailed quality results are expected in the coming weeks.

Wheat markets saw minimal price reaction after last week’s USDA World Agricultural Supply and Demand Estimates (WASDE). Wheat production in the US and EU this season was cut in last Monday’s report. However, increased estimates for Australia and Ukraine outweighed the cuts, leaving production by major exporters up slightly from July’s report. The world wheat ending stocks estimate tightened slightly, though was in line with what analysts were expecting.

UK focus

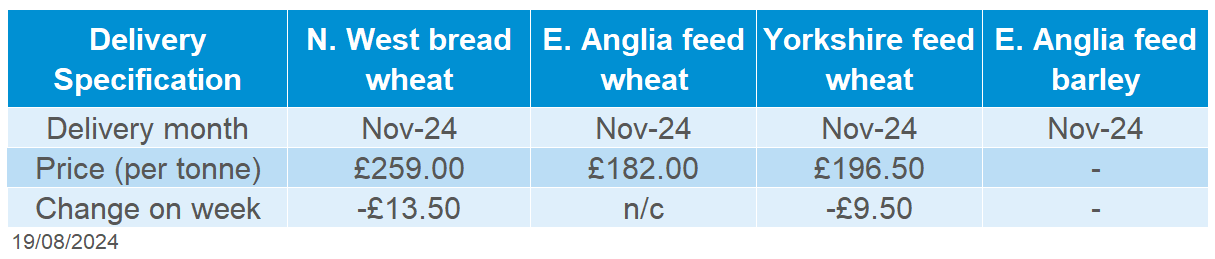

Delivered cereals

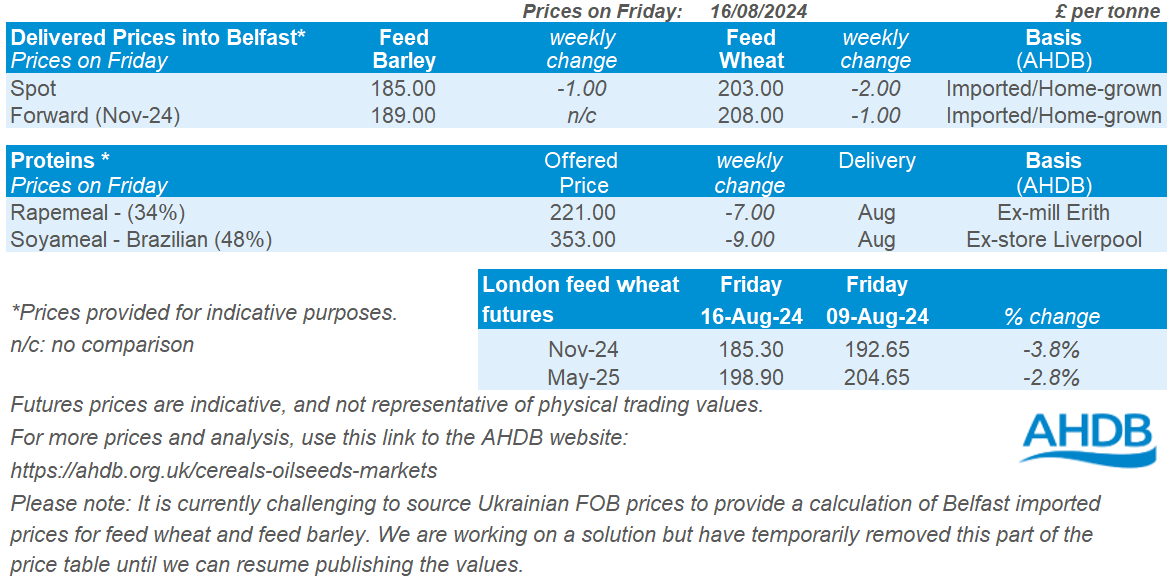

Domestic wheat futures followed global markets down last week (Friday to Friday). Nov-24 UK feed wheat futures closed on Friday at £185.30/t, down £7.35/t on the week. The May-25 contract fell £5.75/t over the same period, ending Friday’s session at £198.90/t.

UK delivered prices followed futures movement Thursday to Thursday. Feed wheat delivered into East Anglia for September delivery was quoted at £179.50/t, down £10.50/t on the week. Bread wheat to be delivered into the North West in September was quoted at £255.50/t, down £14.00/t on the week.

On Friday, AHDB’s second harvest progress report was released, showing that over the past fortnight, the UK harvest has continued to progress at pace. By 14 August, winter barley harvest was all but complete and winter oilseed rape harvest was 93% complete. Wheat harvest reached 37% completion, while oats and spring barley were 22% and 7% complete respectively. The first yield estimate for wheat came in 7% below the five-year average.

Oilseeds

Rapeseed

Soyabeans

Heavy supplies of soyabeans are expected to weigh on rapeseed markets in the short-term. However, fundamentally, rapeseed supply is looking tight this season and so prices could stay supported longer-term.

Although historically low prices have incentivised some demand, an improved outlook on US soyabean production will likely pressure prices short-term. It also adds to expectations of heavy supplies longer-term.

Global oilseed markets

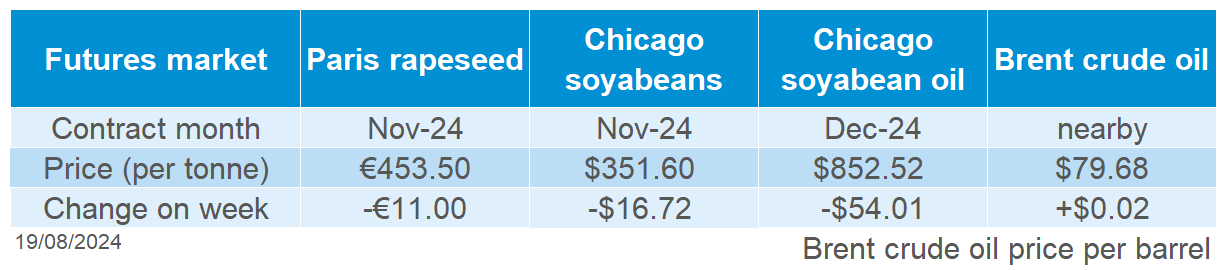

Global oilseed futures

Global oilseeds markets were pressured last week (Friday – Friday). Notable pressure was felt from the heavier-than-expected 2024/25 global soyabean ending stocks forecast from the USDA earlier in the week. The most actively traded Chicago soyabeans contract (Nov-24) closed at a new contract-low of $351.60/t on Friday (16 August), despite strong US weekly export sales. The vegetable oils complex also remains softer, and Brent crude futures (nearby) closed below $80/barrel on Friday.

Last Monday, the USDA released its monthly World Agricultural Supply and Demand Estimates (WASDE). For 2024/25 US soyabeans, the forecasted yield, harvested area and production all exceeded average analyst expectations. In addition, 2024/25 global ending stocks for soyabeans were forecasted at 134.3 Mt, far greater than the average analyst estimate (127.97 Mt), and the five-year average of 99.8 Mt.

Net sales of US soyabeans for the next marketing year (Sept 2024 – August 2025) were 1.3 Mt last week, the greatest weekly sale for the new season so far. However, total US soyabean net sales for the 2024/25 marketing year are currently at 5.9 Mt, the lowest net sales for this point ahead of the season starting since 2019/20.

The most actively traded Malaysian palm oil contract (Nov-24) reported a fourth consecutive weekly loss due to lower exports in addition to an already pressured vegetable oils complex. Brent crude futures (nearby) rose 3.3% on Monday to close at $82.30/barrel due to escalated geo-political tensions in the Middle East. However, later in the week, oil was pressured following concerns regarding the economic outlook in China, closing at $79.68/barrel on Friday.

Rapeseed focus

UK delivered oilseed prices

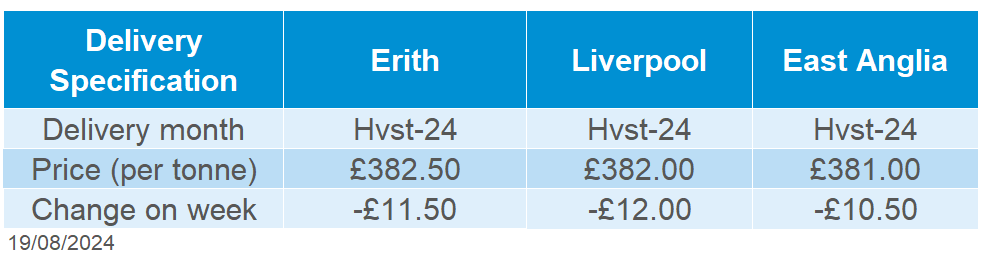

Paris rapeseed futures fell on the week (Friday to Friday). Despite a modest appreciation mid-week, the Nov-24 contract fell €11.00/t to close at €453.50/t on Friday. Rapeseed markets were pressured at the beginning of the week by the heavier global ending stocks of soyabeans. A weaker euro mid-week against the US dollar, helped to support Paris rapeseed markets as well as estimates of lower-than-average oil content for the French crop (FranceAgriMer). Towards the end of the week, continued weakness in Chicago soyabean futures weighed on Paris rapeseed futures.

Rapeseed to be delivered into Erith in November was quoted at £390.50/t, losing £12.50/t on the week.

Last Monday, the Canadian government confirmed that rainfall during July was below normal for most areas in the Prairies, alongside above average temperatures. As at the end of July, 87% of agricultural land in the Prairies, which produces nearly all Canada’s rapeseed, was classified as in abnormally dry to exceptional drought conditions. This is up from 32% at the end of June.

Russia’s ban on rapeseed exports has been lifted and replaced by a 30% export duty with a floor of €165/t effective September 2024 to August 2026.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.