Arable Market Report - 17 October 2022

Monday, 17 October 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

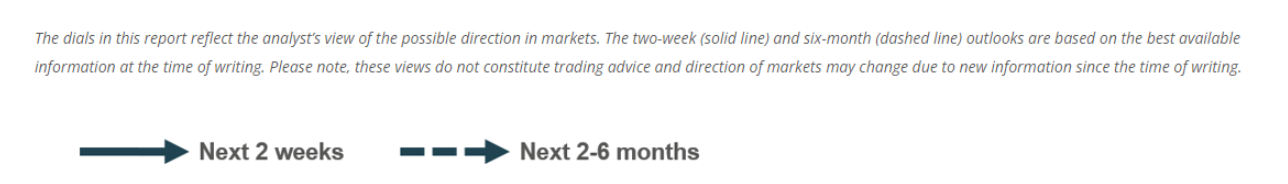

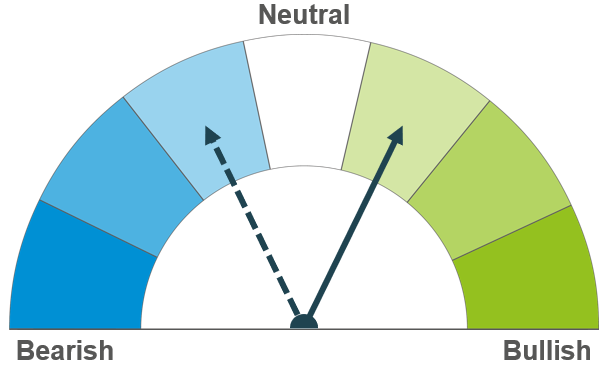

Short term, markets remain supported by concerns of Black Sea supply. Volatility is set to continue as new news emerges on the continuation of the export corridor, and of the escalating conflict. Longer term, southern hemisphere production will be a key factor to watch for global supply, and recessionary concerns could pressure markets.

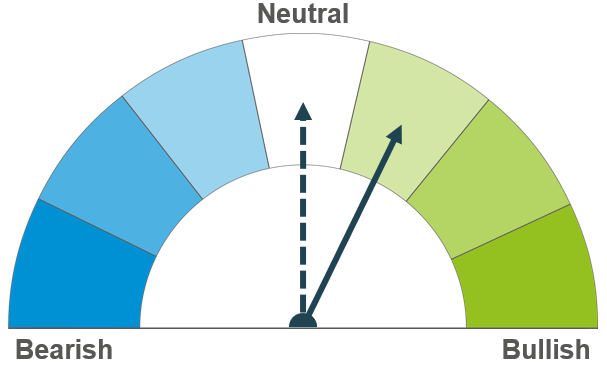

The war in Ukraine, and tight global supply, are factors keeping markets supported short term. Longer term, with a currently tight global balance, large South American plantings and recessionary impact on demand could loosen this picture slightly.

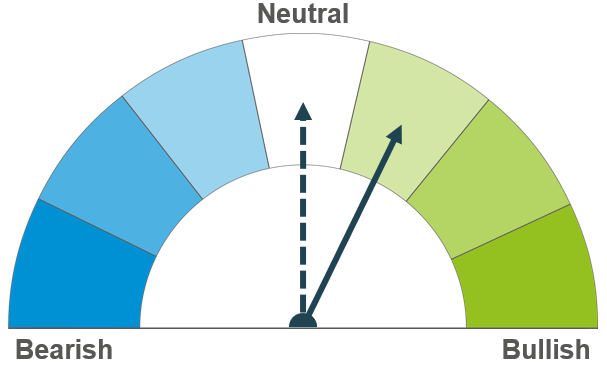

Barley markets continue to follow the wider grain complex, supported by supply outlooks remaining tight.

Global grain markets

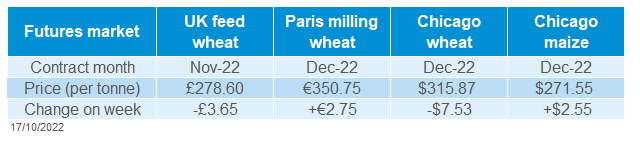

Global grain futures

Last week global grain markets differed in their movement across the week (Friday to Friday). Price movements continue to be volatile, following news closely on the Black Sea conflict as a key market driver.

Last Monday, nearby Paris and Chicago wheat markets closed at the highest points since June 2022. This support follows the escalation of the missile strikes across Ukraine, following the bombing of the bridge linking Russia to Crimea.

Concerns have also been growing for the renewal of the UN corridor deal with Russia which allows the current flow of exports from Ukraine. This deal is set to expire towards the end of November. On Thursday, Russia’s Geneva UN ambassador said Russia could reject the renewal of this deal. Though talks on Friday between Russia and Turkey were seen by the market as progress on renewing this deal, and as a result we saw some risk taken out of prices. As this situation develops, prices will continue to react.

US wheat markets felt overall pressure last week, despite Ukrainian supply uncertainty, due to a strengthening US dollar and progress seen on Friday for the renewal of the UN export corridor.

Looking to southern hemisphere production, heavy rains in the Australian east coast have been raising quality concerns for their wheat crop. However, the second largest national wheat crop on record is forecast at 32.2Mt this season (ABARES).

The Buenos Aires Grain Exchange revised their Argentinian wheat crop conditions, to reflect a higher percentage of poor/very poor crops, up 3 percentage points to 49% as at 12 October. This is due to drought and some frost seen across Argentina. Their production forecast was also reduced, down 1Mt to 16.5Mt.

Looking to global maize markets, they have been supported by the Black Sea supply concerns and overall tight supply and demand.

On Wednesday, the USDA lowered US maize yields (due to drought) in the World Supply and Demand Estimates (WASDE) as the market had expected. Maize yields were reduced by 0.03t/acre to 4.34t/acre compared to September’s estimates.

The WASDE still projects 2022/23 Argentinian maize production at 55Mt, but plantings are progressing slowly due to drought according to the Buenos Aires Grain Exchange. As at 12 October, 16.4% was complete. Can we see this production figure revised down?

UK focus

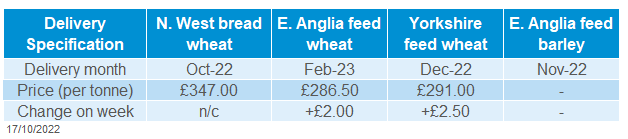

Delivered cereals

UK feed wheat (Nov-22) futures lost £3.65/t across the week, to close at £278.60/t on Friday. This followed Chicago wheat futures down and fell from Monday’s high of £293.20/t, the highest nearby price close since mid-June.

UK delivered prices followed futures contract movement Thursday to Thursday. Feed wheat delivered into East Anglia (February delivery) was quoted at £286.50/t, up £2.00/t.

The pound sterling strengthened slightly by 0.78% against the US dollar Friday to Friday, to close at £1=$1.117. Domestic markets are reacting quickly to the UK’s political news, adding potential further volatility to exchange rates.

On Wednesday, the latest HMRC trade data was released for August figures. From July to August, according to HMRC data, 110.8Kt of wheat has been exported over the two months. This is up 81Kt from the same period in the previous year. To access the full data release, click here.

Oilseeds

Rapeseed

Soyabeans

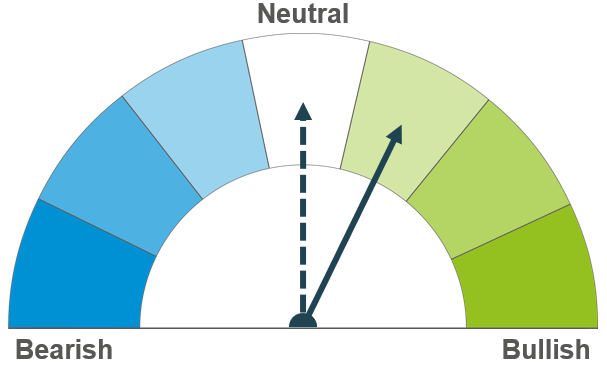

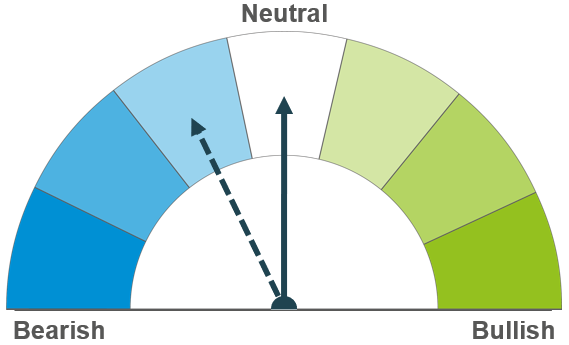

In the short term, rapeseed markets remain reactive to news on the Ukrainian export corridor. Longer term, soyabean markets and recessionary concerns will likely pressure prices.

Global ending stocks were revised up as expected in Wednesday’s WASDE, easing global S&D despite a smaller US crop. However, planting progression in South America over the next few weeks will be key to longer term direction.

Global oilseed markets

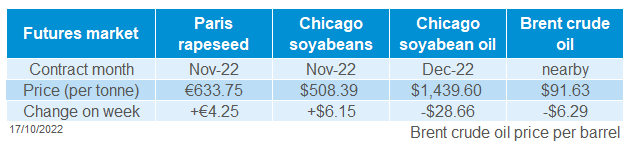

Global oilseed futures

Chicago soyabean futures (Nov-22) were up 1.2% over last week (Friday to Friday). Whereas Chicago soyabean oil futures (Dec-22) were down 2.0% over the same period, tracking the price movement of Brent crude oil prices.

US soyabean crushing in the month of September is expected to have reached an all-time high for this time of year, as processors have increased production with newly harvested US beans now on the market. Ahead of the monthly National Oilseed Processors Association (NOPA) report due out later today, analysts are expecting 4.4Mt to have been crushed last month (Refinitiv). If realised, this would be down 2.4% from August, but up 5.1% on the year. Analysts are also predicting that soya oil supplies held by NOPA members, as at 30 September, will be down 2.7% from the previous month and down 9.6% year-on-year. While we could see some support as a result, reduced yearly export demand (down 5.2% on the year) will likely outweigh increased domestic crushing demand.

In the latest WASDE released on Wednesday, US soyabean yields were unexpectedly pulled back to 1.33t/acre, resulting in production being cut to 117.38Mt. This is down 1.5% from September’s estimate. While reduced from previous estimates, this figure is still higher than both the 5-year and 10-year US production average. The cut in US production was also outweighed by a drop in export demand, and world ending stocks were revised up 1.6% from the previous month. Read more information in Thursday’s Grain market daily.

Brazilian soyabean plantings are underway and at the end of the week commencing 03 October, plantings were 10% complete, ahead of the 8% average for this point in the season (AgRural). While soyabean plantings are generally progressing quicker than expected in Brazil, the ongoing dry weather in Argentina remains a concern for growers. Plantings in Argentina are expected to begin over the next couple of weeks. However, if the dry weather persists, we could see a later start to the planting period. Currently there is some well-needed rain forecast in Argentina over the next week, how much falls though is something to watch.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures were up 0.7% across the week (Friday to Friday). The price movement was largely due to ongoing concerns surrounding the future of the Ukrainian export corridor. It’s possible that Moscow could reject a renewal of the corridor deal, maintaining the floor of support we have seen in global markets and keeping rapeseed price movements volatile.

UK trade data was updated last week. Over July and August, the UK imported 117.3Kt of rapeseed, down 43.7% from the same period last year. Access the full dataset here.

Please note that AHDB were unable to publish delivered oilseed prices last week due to insufficient quotes to calculate the published average.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.