Analyst Insight: In a flap about poultry feed demand?

Thursday, 12 May 2022

Market commentary

• Yesterday, old crop (May-22) UK feed wheat futures increased by £0.50/t, closing at £344.00/t, another contract high. Meanwhile, the new crop (Nov-22) contract jumped £8.50/t, closing yesterday at a contract high of £328.50/t.

• FranceAgriMer announced yesterday that its soft wheat export forecast had been cut. For 2021/22 exports outside the EU are now estimated at 9.25Mt down from the 9.5Mt estimated in April. The export forecast within the EU was cut from 8.1Mt to 8Mt.

• CF has issued its new season starting price for Nitram Ammonia Nitrate 34.5 N in the UK at £620/t cpt bagged merchant for delivery from May to July at seller’s option, which equates to roughly £635/t cpt bagged farm.

• Nearby Paris rapeseed futures declined by €2.00/t at the end of yesterday’s session, settling at €849.25/t. The new crop contract closed at €835.50/t, down €0.50/t from Tuesday.

In a flap about poultry feed demand?

With animal feed demand making up over 50% of total domestic consumption of UK cereals, it is important to monitor what is happening in the different sectors. The poultry sector makes up the largest share of animal feed demand within the UK. However, with tight margins for layers and avian flu still prominent, as well as the aftermath of COVID, we have seen poultry feed production decrease this season.

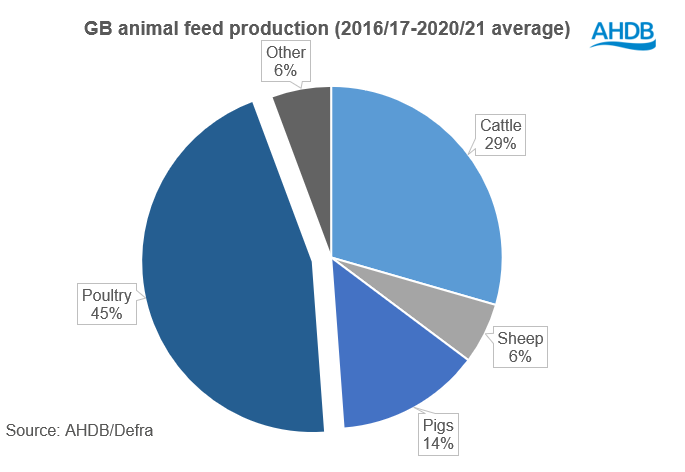

Poultry feed production, including integrated poultry units (IPU), accounts for 45% of the total amount of animal feed that is produced in GB, and is by far the largest sector. While diets vary, as a rough guide, poultry diets are made up of around 65% cereals, with wheat as the majority of that. Some barley is used, but to a much lesser extent, and in NI more maize tends to be used due to its price competitiveness.

UK egg laying flock set to slim down further

It has been widely reported that margins for laying producers have become increasingly tight, with rising feed, energy and labour costs, and little to no increase in the purchase price from retailers to compensate. According to a survey carried out by the British Free Range Egg Producers Association (Bfrepa) in mid-April, 51% of farmers said they would consider stopping production until prices improve, with more than 70% saying they would leave egg production altogether within a year if a price rise from retailers did not happen.

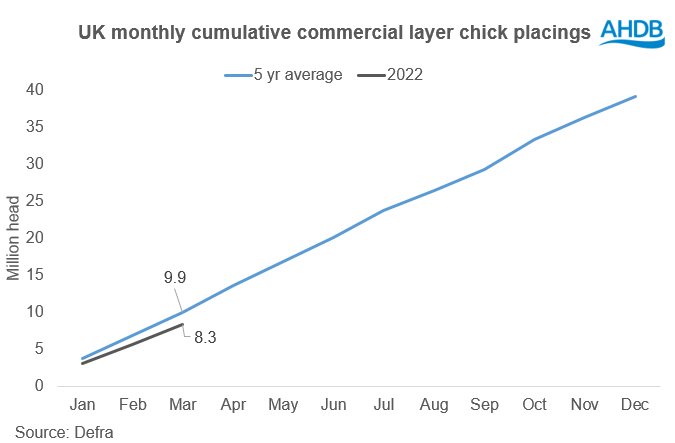

Looking at the latest Defra data, since December, placings of commercial layer chicks have been down considerably on year earlier levels, which means that there will be a further contraction in domestic laying flock.

Feed for layers (including IPU) makes up around 20% of total poultry feed production in GB and around 10% of total GB animal feed production (including IPU). If we do see a further contraction in the domestic egg laying flock, then this will have an impact on feed production, and in turn a reduction in cereal usage.

Broiler placings remain strong

Looking now at the other poultry sector and so far this year (Jan-Mar), commercial broiler chick placings in the UK have increased by 6.6% on year earlier levels to 323.7 million head. Poultry meat accounted for 36% of volume sales of meat, fish and poultry in GB over the last year (Kantar, 52 we 17 April 2022). All meat proteins have seen a decline in retail as shoppers move back to eating out, but poultry is performing better than the total market.

From a feed perspective, broiler chicken feed makes up nearly 60% of total poultry feed production (including IPU) in GB and accounts for over 25% of total GB animal feed production. In volume, broiler feed production alone is higher than total domestic pig feed production.

With demand looking likely to remain relatively strong for broilers at least in the short term, feed demand is likely to remain robust too. However, with soaring input costs for producers and processors, there may be more uncertainty in the mid to long term around the strength of growth by the broiler sector.

What does the future hold for the UK poultry industry?

With soaring energy and feed costs for producers, margins are getting squeezed tighter for poultry and egg producers in the UK. For layers in particular, the rise in inputs is not being matched by a rise in purchase price, which is leading to some cutting production while others exit altogether. This will have a negative impact on future feed usage, unless the industry becomes more profitable. For broilers, the largest consumer of feed on the poultry side, the outlook is slightly more optimistic at least in the short term. However, with ever increasing input costs and the wider cost of living crisis, we could see broiler demand for feed stall if consumer demand falters or margins get squeezed further.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.