Analyst Insight: 2020/21 barley market outlook

Thursday, 21 November 2019

Market Commentary

- As the prospects for a thaw in US-China trade relations have diminished, US Chicago maize and soybean have continued to fall.

- Chicago maize futures (May-20) have now fallen over 7% from the October high as production fears have mostly been factored in, as well as bearish export data and trade expectation weighing on markets. The globally bearish maize market has also weighed on UK feed wheat futures, with May-20 falling £1.65/t yesterday to close at £150.10/t.

- Chicago soybean futures (May-20) have also fallen back to September levels. The bearish US soyabean market has been partly preventing further gains in Paris rapeseed futures (May-20) and UK delivered prices.

2020/21 barley market outlook

With the adverse conditions directly impacting winter plantings across the UK, thoughts turn to what will be in the ground come harvest 2020. Comparing the recent weather to similar years and the rain impacted winter planting window of 2013/14 season led to greater changes in area planted to different crops. In 2013/14 the UK arable area recorded a 19% drop in the area planted to winter wheat, a 19% drop in winter barley and a 46% rise in spring barley. A rise in the spring barley area is now again the likely prospect for harvest 2020, as beyond the niche crop options, barley remains the predominant spring cropping option.

What will this mean for markets?

From a market point, the pricing structure of barley is linked not only to the domestic wheat market, but in surplus seasons, needs to price competitively into European markets. Looking to supply for 2020/21, then without a continued fast export pace, the large surplus the UK finds itself with this season could well lead to increased carryover stocks into 2020/21. Carryover stocks, coupled with a potential expansion in area mean 2020/21 could well be another season with a sizable exportable surplus.

Demand

While production changes, domestic barley demand is less elastic.

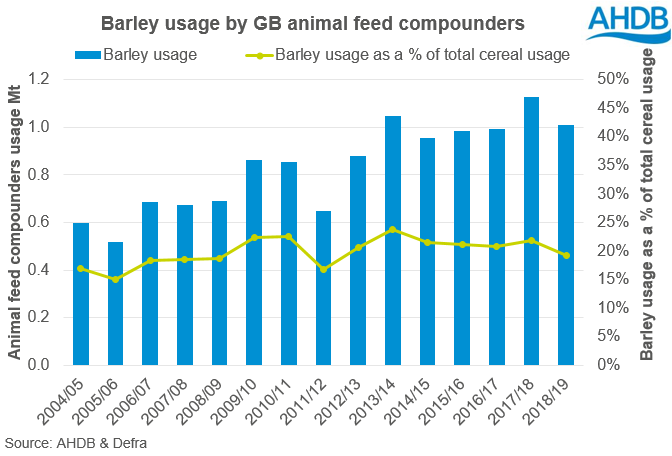

Demand for barley by the animal feed sector tends not to change to the same extent as year on year fluctuations in availability. While the proportion of barley used by GB animal feed compounders, relative to other cereals, reached a recent peak in 2013/14 at 24%, larger fluctuations in demand are driven by variations in overall seasonal demand for animal feed. Additionally, with a likely reduction in domestic wheat availability, as has been recorded in previous deficit years, imported maize volumes will likely increase in some rations, taking some of that demand away from barley.

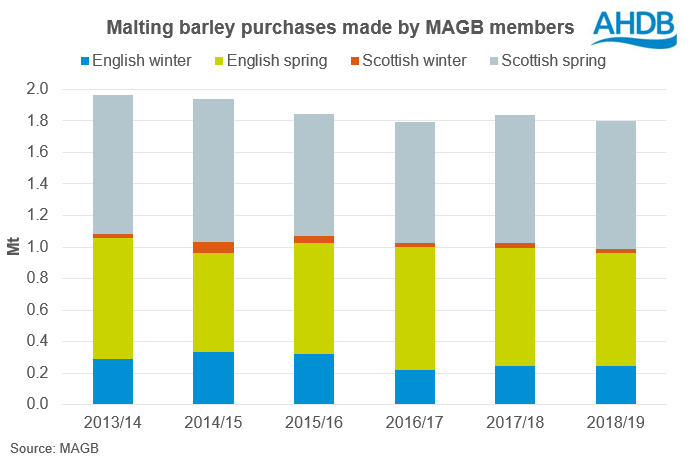

From a malting barley demand side, purchases made by members of the Maltsters Association of Great Britain have also remained fairly consistent over the past few years, with total seasonal purchases between 1.8-2Mt. Breaking down demand into regional and seasonal purchases, there are limited inter seasonal changes in demand, further extenuating potential swings in barley price and malting premiums.

Feed or malting?

Malting barley premiums over feed barley provide a production incentive. However, this premium is by no means fixed and adjusts to supply and demand. Likewise, it does not necessarily reflect the opportunity cost for having met malting specifications.

In years of greater malting barley supply, the malting barley premium over feed has diminished. Looking back at weekly average UK ex-farm prices, during August this premium is typically around £10-15/t. Yet this premium has stretched to over £40/t in years of tighter availability and as little as around £6/t in years of greater availability, such as 2013/14.

If there is an expansion in the spring barley area for next harvest, then depending on the growing and harvest conditions, the malting premium could well move towards the lows recorded in 2013/14 once again.

Although the domestic feed barley market could well be in a surplus position again in 2020/21, on an individual farm basis, generating higher yields through growing for feed markets could possibly provide greater gross margins. However, this is dependent on a number of factors including input costs.

While it is still too early to be definitive about any area changes for next season, the Early Bird Survey of planting intentions, to be released next week, will shed light on the intended planted areas for next season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.