- Home

- For the love of wheat: Grain Market Daily

For the love of wheat: Grain Market Daily

Market Commentary

- The euro has continued to fall against the dollar to close yesterday at €1 = $1.08, the lowest value since April 2017.

- Trade with china is key with many European industries so concerns surrounding coronavirus has really weighed on markets, especially car manufacturing.

- A fall in the euro has helped sterling to strengthen, closing last night to the highest close since June 2016 at £1=€1.20

- UK feed wheat futures (May-20) dropped £0.70/t from Wednesdays to close yesterday at £151.75/t whereas Paris wheat futures (May-20) stayed flat.

For the love of wheat

Both old and new-crop UK wheat futures have risen since the rain began in September 2019. The concerns surrounding new-crop drilling switched thoughts from a high export requirement in order to minimise carryover into 2020/21 to a potential need for a carryover into 2020/21.

The old-crop feed wheat contract (ICE May-20) has gained £15.25/t and the new-crop contract (ICE Nov-20) has gained £20.00/t since 2 September to yesterdays close.

The weather in the UK isn’t the only factor affecting domestic prices though. It is important to remember that we are a very small island in a very large global market. Within the EU28 the UK is only the third biggest wheat producer following France and Germany. In the Northern Hemisphere alone the UK is also competing with wheat king, Russia and also Ukraine.

Both French and Chicago wheat futures (May-20) have also experienced gains from September through to yesterday’s close of €17.75/t and $29.30/t respectively.

Despite long term gains though, since around 21 January losses have begun. The effects of coronavirus on the demand for a range of agricultural products has been a concern since the first registered death on 11 January. This has not just pushed wheat markets lower but corn and oilseeds too.

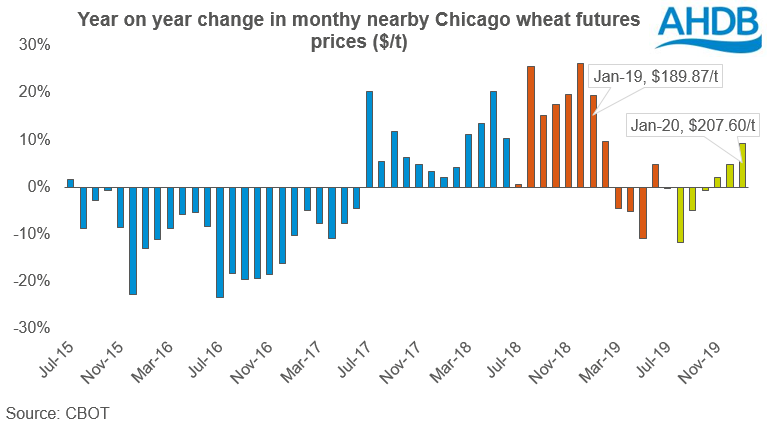

The average nearby Chicago wheat price in January was $207.60/t compared to last January of $189.87/t. But with an increased death toll from coronavirus and ships being turned away or diverted there could be some further concerns around demand.

Demand for wheat from the EU had remained fairly strong so far this season with the EU commission reporting increased weekly exports (averaging 544Kt a week) compared to the previous 2 seasons. The top destination is Algeria making up 18% of the market share of EU common wheat exports. If exports from elsewhere, particularly the US, slow this could add pressure to EU markets too.

UK wheat futures (nearby) prices currently sit below the same point as last year but the tight supply of the 2018/19 pushed prices relatively high. If there is no real bullish news globally it is likely to UK prices will also remain supressed. The strengthening of sterling will also be another factor weighing on UK physical prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.