- Home

- Markets and prices

- Dairy markets - Prices - Wholesale prices - UK wholesale prices

UK wholesale prices

Updated 25 June 2024

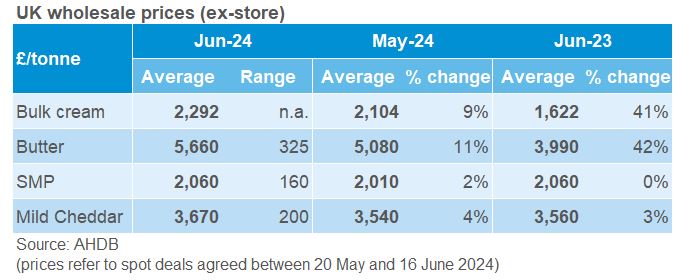

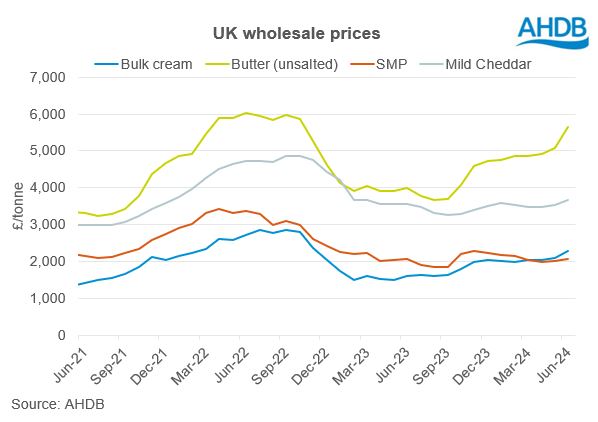

Indicative average prices for butter, skimmed milk powder (SMP) and mild Cheddar cheese on UK wholesale markets. Bulk cream prices are weighted average prices on agreed trades within the reporting period. Product specifications are available to download at the bottom of the page.

Overview

Butter leads the pack after availability issues

Weeks 21-24 (w/b 20 May – w/b 10 June)

The disappointing peak in milk production has increased concerns about product availability that has driven buyers to act fast to secure supplies and made sellers reluctant to part with product cheaply. The encouraging signals seen towards the end of the latest period have continued, albeit with some variation over the period. Important to note that average prices are reflective of the whole of the 4-week period.

Bulk cream have progressed over the course of the month, early on being closer to £2.16 but ending the period closer to £2.40, echoing movements on the continent. There was some volatility reported due to excess spot milk as a result of processing breakdowns.

Butter prices recorded the strongest growth by far, up £580 month on month to £5,660. There was some volatility caused by fluctuations in the exchange rate due to the weakening Euro following French election announcements. Reports indicated that butter stocks are now very low. Some sellers are now cashing in on product bought cheaply earlier on in the year as buyers scramble to secure coverage.

SMP markets continued to see the smallest change month on month, up by £50. The market was reported by some as “dead”, but a positive undertone was present. The GDT index fell marginally in the latest period.

Mild cheddar followed the trend set by butter and cream markets rising by £130/t. There was some range in valuations with prices in some quarters hitting as high as £3,800/t. Market tone is positive with buyers coming back online alongside some concerns around future stocks. Reports indicated that sellers are not interested in selling cheap and would prefer to mature it than undersell.

Additional information

The published prices will not necessarily match the overall actual price achieved by a milk processor as this will depend, amongst other things, on the proportion of product that is sold on the spot market and the proportion sold under longer term contracts and at what price this is done. The “average” prices should be used to track trends while the commentary will contain prices seen through the month.

Note there has been a change in the methodology for determining the bulk cream price from January 2021.

Information on prices and market conditions is gathered through a monthly phone survey of dairy product sellers, traders and buyers. Panel discussions cover ex-store prices on spot trades agreed within the reporting period and delivered within a maximum of 2 weeks for bulk cream and 6 weeks for butter, SMP or cheese.

For butter, skimmed milk powder (SMP) and mild Cheddar, prices are indicative of values achieved for spot trades and exclude contracted prices or forward sales.

For bulk cream, a weighted average price will now be reported. This is based on submissions of an average price for agreed spot trades made within the reporting period along with total volumes traded. Data is entered by panel members via the AHDB online wholesale price portal.

Prices for bulk cream were not weighted by traded volumes prior to January 2021.

Download dataset

Additional Information

Product Specification - Bulk cream

Product specification - Unsalted butter

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.