- Home

- Markets and prices

- Dairy markets - Prices - Wholesale prices - UK wholesale prices

UK wholesale prices

Updated 22 August 2025

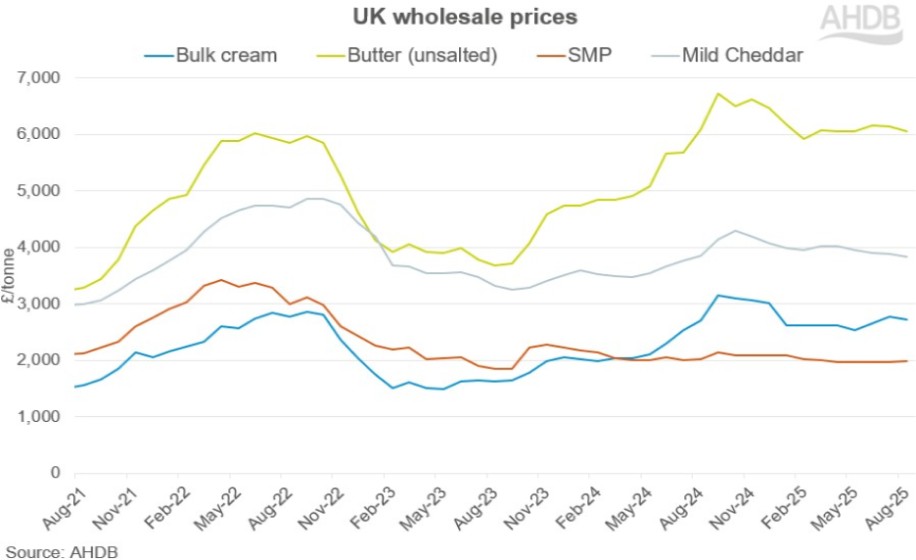

Indicative average prices for butter, skimmed milk powder (SMP) and mild Cheddar cheese on UK wholesale markets. Bulk cream prices are weighted average prices on agreed trades within the reporting period. Product specifications are available to download at the bottom of the page.

Overview

Fat prices ease in ‘deadly quiet’ market

Weeks 31-34 (28 July to 24 August 2025)

As peak holiday period took hold, market activity was said to be ‘deadly quiet’ in August. Wholesale prices fell across the board, with the exception of SMP, with butter and cheese now sitting marginally below values seen last year.

Bulk cream prices eased around £40/t month on month. Most commentators noted that cream started the period lower but increased in latest week to around £2.80/kg. Fluctuating demand has been the driver of weekly and monthly price movements.

Butter prices saw a much larger spread of pricing in August compared to recent months. On average prices dropped £100/t, with lack of demand, especially for export, the main driver of this trend. Several commentators noted that EU production has increased with recovering milk volumes, meanwhile US and NZ product remains very competitively priced for the global market. UK butter stocks are still reported to be running tight, with some deeming it more favourable to trade cream than process butter.

The SMP market was once again reported as stable. Trading volumes were still reported as minimal and the pricing range further contracted this month. This resulted in average prices making a marginal gain of £20/t month on month. SMP pricing has been within a +/- £30 range of £2,000/t for the last 7 months.

Mild cheddar prices continued the gradual decline seen since April, losing £60/t on average in August. Stocks of mild and medium cheddar are said to be building as buying demand remains weak, but milk production continues to strengthen. Elevated milk prices are said to be leaving sellers unwilling to significantly move product prices to ensure costs are covered.

Additional information

The published prices will not necessarily match the overall actual price achieved by a milk processor as this will depend, amongst other things, on the proportion of product that is sold on the spot market and the proportion sold under longer term contracts and at what price this is done. The “average” prices should be used to track trends while the commentary will contain prices seen through the month.

Note there has been a change in the methodology for determining the bulk cream price from January 2021.

Information on prices and market conditions is gathered through a monthly phone survey of dairy product sellers, traders and buyers. Panel discussions cover ex-store prices on spot trades agreed within the reporting period and delivered within a maximum of 2 weeks for bulk cream and 6 weeks for butter, SMP or cheese.

For butter, skimmed milk powder (SMP) and mild Cheddar, prices are indicative of values achieved for spot trades and exclude contracted prices or forward sales.

For bulk cream, a weighted average price will now be reported. This is based on submissions of an average price for agreed spot trades made within the reporting period along with total volumes traded. Data is entered by panel members via the AHDB online wholesale price portal.

Prices for bulk cream were not weighted by traded volumes prior to January 2021.

Download dataset

Additional Information

Product Specification - Bulk cream

Product specification - Unsalted butter

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.