Red diesel risk from rise in crude oil prices: Grain Market Daily

Friday, 5 March 2021

Market Commentary

- Old crop UK wheat futures (May-21) fell slightly yesterday at £205.50/t, down £0.25/t. New crop futures (Nov-21) were unmoved at £170.50/t. The May-22 contract increased £0.30/t to be at £175.30/t yesterday.

- French soft wheat exports to non-EU destinations rose to 821Kt in February, from 561Kt in January (Refinitiv). Despite a lull in purchases by China, exports to Algeria and Morocco increased. Season to February exports are now estimated around 5.0Mt, with around 2.5Mt to go to reach the full seasonal forecast.

- Favourable weather across France last week saw spring barley planting pace jump to 50% complete, from 19% the week previous (FranceAgriMer). The warmer weather aided soft wheat condition scores too, which were rated at 88% ‘good to very good’, up 1% on the week.

Red diesel risk from rise in crude oil prices

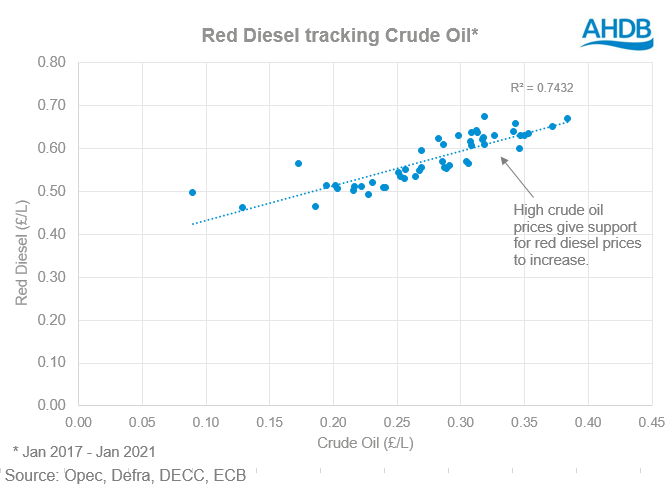

In February, I examined the fall in crude oil values in 2020 and what this meant for red diesel prices for the rest of this season. But, since then Brent crude oil prices (nearby) have gained $9.66/bbl to near 14 month highs. This was a result of production cuts and global vaccination program progress. So, has the outlook changed, and could this affect red diesel prices?

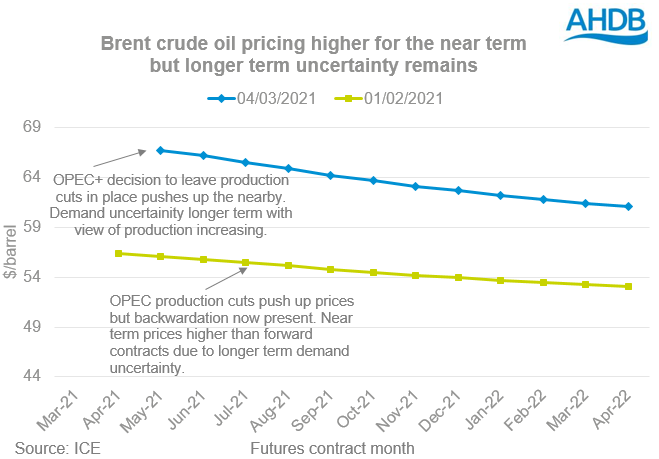

Yesterday, the Organization of the Petroleum Exporting Countries plus Allies (OPEC+) met. OPEC+ agreed to keep the present cuts on crude oil production in place until at least April. These cuts account for around 8% of the world demand so represent a hefty influence on markets. The cuts were agreed to continue based on the fragility of global demand recovery despite vaccination progress.

UK red diesel prices increased in February, tracking these gains in crude oil markets. Prices were quoted at an average of 52.43ppl on 2 February, according to BoilerJuice.com. On 3 March, this had increased to 54.58ppl. The UK spring drilling campaigns kick off soon, so red diesel price increases could squeeze crop margins a little tighter than this time last year.

The next OPEC+ meeting is in the first week of April. If the global demand picture is healthier with lockdown measures eased, the outcome could be a staggered rise in crude oil production. A cautious return to full production is likely, given the risk of ‘flooding the market’ if the 8% mentioned earlier was switched back on. It will be interesting to see this effect on prices of a larger supply based on demand levels. But between now and April, increases to crude oil values could continue to push red diesel higher.

Over the Jan – Jun period last year, red diesel averaged 53.72ppl according to the AHDB fuel prices. The low prices seen during the beginning of the pandemic from March to June helped to lower averages. But, Brent crude oil prices (nearby) increased 50% ($22.84/bbl) from 5 March 2020 to this morning.

Though fuel prices are a smaller part of farm business costs, they will affect your cost of production for each crop. Our FarmBench tool is a great application to track cost of production figures.

Our Spring Grain Market Outlook webinar will place next Tuesday (9 March). It will offer in-depth analysis of what the next few months could look like for UK crop markets. Click here to find out more and sign up.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.