Our changing eating habits

Wednesday, 2 May 2018

Over the last few decades, our eating habits have changed dramatically, with our diets becoming almost unrecognisable to those of, say, our grandparents and, in many cases, even our parents. The way we shop, cook and dine have been altered by our attitudes towards food. Here we look at the changing habits and what it might mean going forward.

A strict weekly routine

Attitudes towards mealtimes have changed through the generations. Chances are that our grandparents had a much stricter routine than we have now. Fifty to eighty years ago, it was typical for a family to have their meals at the same time every day (breakfast at 7am, lunch at noon and dinner at 5pm) so their body was accustomed to knowing when to expect food. However, a lot of people have lost this disciplined approach to meals. Skipping breakfast, snacking and several cups of coffee a day are notions that our grandparents would never have considered.

Today, however, we are surrounded by choice. Not only do we get to choose when we eat our food, but we are also provided with a vast selection of food choices. Takeaways, fast food and ready meals have changed the way that meals are prepared and eaten.

The rise of convenience

As has been seen, modern-day cooking allows far less time than days gone by. Long gone are the hours spent preparing a meal. Instead, convenience food has increasingly become the norm, with people reaching for ready-made and microwave meals several times a week. The time taken to prepare and cook a main meal has halved to 30 minutes compared to 1980. It is important to remember that convenience is not just about time, but also ease of cooking and, more recently, the trend has been in favour of the latter. Consumers are increasingly wanting meal solutions and are willing to pay a premium for it. Indeed, retailers are increasingly merchandising their fixtures accordingly.

.jpg)

Contrast this with the past when convenience food simply meant food in tins - a convenience because it allowed people to eat fruit and veg out of season and provided them with easy-to-prepare meat and fish.

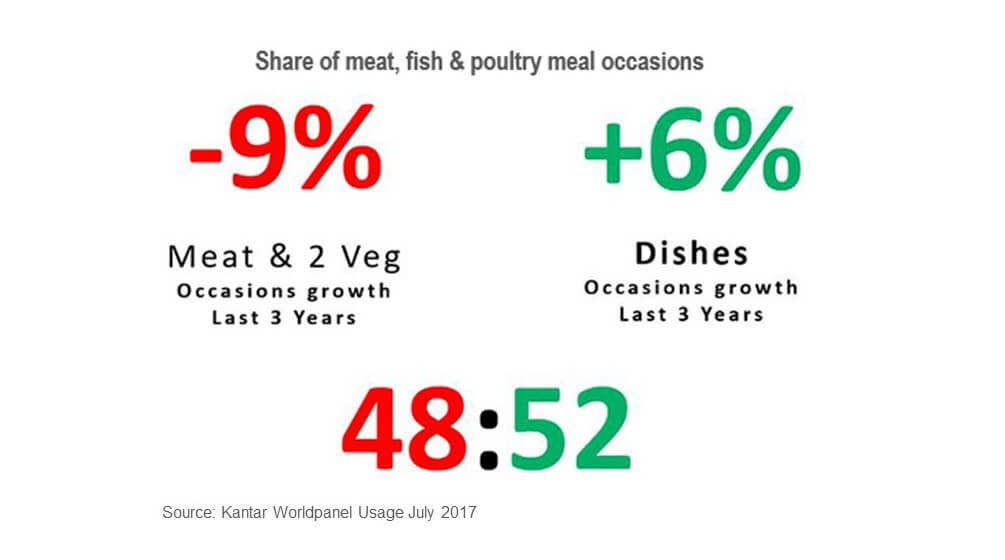

We are becoming Continental

While British food remains the nation’s favourite, its popularity is waning as we eat more international cuisine. This has been influenced by a number of factors, including that we travel abroad a lot more than previous generations, the advent and popularity of street food and the change in the social mix of the UK population. In 1993, only four per cent of the population was foreign born. This had risen to almost 14 per cent by 2015, according to ONS figures. This has meant that the popularity of old favourites, like the roast dinner, has been declining. By contrast, we have seen the growth of dish-based cuisines - meals comprising components rather than a protein at the heart of the meal, like pizza or spaghetti Bolognese. As a nation, we increasingly want interesting and different dishes.

Of course, the increasing focus on convenience will also be a factor in this trend, especially if you live in a smaller household and tend not to want to spend much time cooking, if it is only for you or a partner. In 1960, one-to-two-person households were just over 40% of the total. This figure had risen to 63% in 2016.

The rise of food allergies

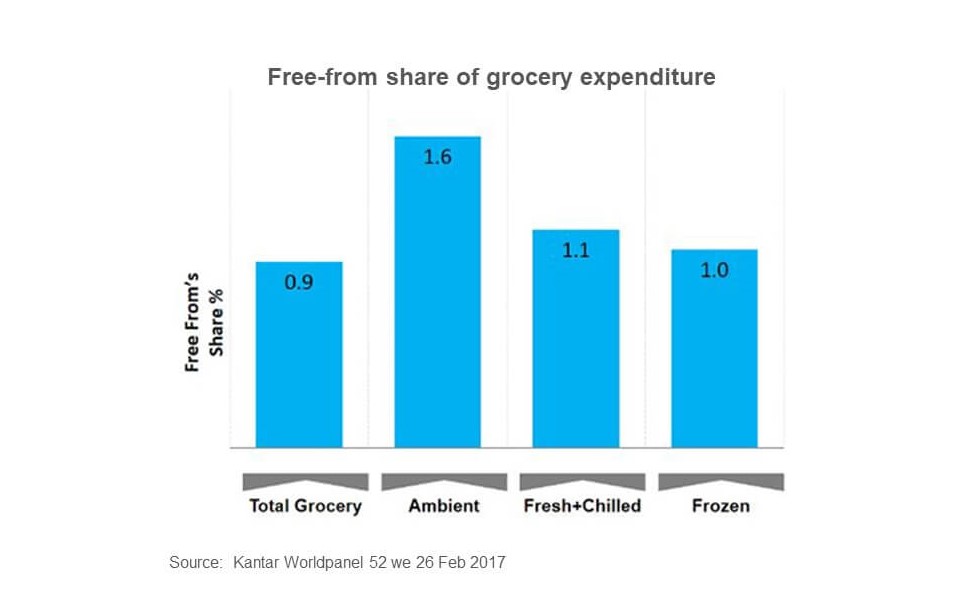

Food allergies and intolerances are more common now than they ever have been. This is often attributed to processed, unnatural and chemical-filled foods - none of which were present back in our grandparents’ days. This has led to a sharp increase in the sales of free-from products. According to Mintel, in 2017, the free-from food and drinks market was worth £718m and has seen strong growth in recent years. Some 39 per cent of UK adults claim to use/buy free-from food and drink, up from 31 per cent in 2016. Underlying growth was stronger in the dairy/lactose-free segment over 2014-17, helped by an expansion in the variety of products available and by companies promoting dairy alternatives on both health and ethical grounds.

While the growth figures for the free-from category look impressive, it is worth remembering that, according to Kantar data, the category still only accounts for 0.9 per cent of total grocery expenditure.

With real incomes barely in growth, the squeeze on household budgets does make this category vulnerable. As, according to Mintel, 47 per cent of free-from buyers spend less on these products when finances are tight.

To wrap up

What we eat, where we eat and our attitude to food has changed markedly in the last few decades, and continues to evolve. Recent media coverage around a vegan diet and plan/insect-based proteins is testimony to this. The challenge for the industry and, indeed, opportunity for the agricultural sector is to continue to adapt to the changing trends and, where possible, be ahead of the curve by understanding what factors may shape how future generations will behave when it comes to their diet and the way they shop and eat. A business-as-usual approach is not sustainable and it will be those players who can adapt and tap into the new trends that will be best placed to succeed.