Monday’s USDA report will only give part the picture: Grain market daily

Friday, 9 July 2021

Market commentary

- Nov-21 UK feed wheat futures made small gains yesterday, closing up £0.90/t at £167.00/t. Sterling dropped back against the euro and US dollar yesterday, giving support to UK prices. This was despite Paris wheat futures closing unchanged from Wednesday and declines in Chicago maize and wheat futures.

- Conab now estimate the Brazilian maize crop in 2020/21 at 93.4Mt, 3.0Mt less than in June. This is sharply lower than the 98.5Mt the USDA forecast in June, but it is still above many industry forecasts.

- Nov-21 Paris rapeseed futures gained €5.25/t yesterday to €513.75/t, roughly £441/t. Prices rose due to ongoing worries about the Canadian canola (rapeseed) crop despite a stronger euro.

- Chicago maize and soyabean prices have dipped after rain in the Midwest, where crops are at critical growth stages. Although not all areas received rain, it has cooled market sentiment for these crops.

Monday’s USDA report will only give part the picture

The USDA releases its next estimates of global supply and demand on Monday at 5pm (BST). The report will give more insight into the global outlooks. But, it is unlikely to answer the key questions about US maize and soyabean supply in the 2021/22 season.

The report will incorporate the larger US areas reported on 30 June. For maize, this could add around 4.5Mt to the total crop.

However, in July the USDA normally still uses the trend yield for both maize and soyabeans. In ten years, the USDA changed the yield used in July once. This happened in 2012, because of “persistent and extreme June and early July dryness and heat across the central and eastern Corn Belt.” As this year’s weather is not extreme, it is likely the USDA will leave the US maize yield unchanged from June.

The USDA usually waits until August to build current conditions into the yield. As such, the market will have to wait another month to get a fuller picture of US maize and soyabean production.

Polls by Refinitiv shows the market is expecting to USDA to:

- Increase US maize production by around 3Mt from the June report.

- Leave the US soyabean crop virtually unchanged.

- Reduce US wheat crop by nearly 1.5Mt, despite increasing winter wheat output. This will be the first forecast of spring wheat output.

- Cut over 6Mt from the Brazilian maize crop to 92.2Mt.

- Trim the Brazilian and Argentinian soyabean crops estimates by less than 0.5Mt each.

- Make small cuts to global end of season stocks for maize in 2020/21 and wheat in 2021/22, but little change to soyabean stocks.

Personally, I will also be looking at the Chinese maize import figures. The USDA Foreign Agricultural Service in Beijing forecast Chinese maize supply higher than the USDA. Therefore, as James highlights here, this could soften import demand in 2021/22.

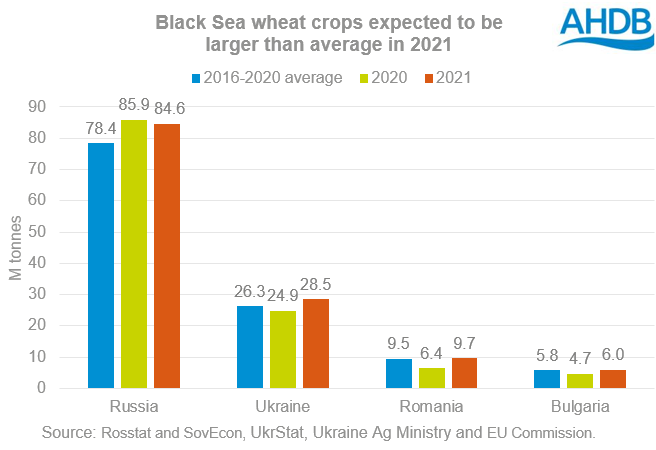

The size of the Black Sea wheat and barley crops will also be important. Good crops are expected in the region and these are weighing on wheat prices currently.

Drier than ideal conditions in some spring wheat areas of Russia (AMIS) need monitoring. Also, the impact of recent heavy rain in Ukraine is unclear. However, currently big crops are forecast across the Black Sea region. As harvests progress in the region, and these crops reach the market, this could push wheat prices lower, including in the UK.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.