Maize imports set to dominate UK cash prices: Grain Market Daily

Wednesday, 5 August 2020

Market Commentary

- Nov-20 feed wheat closed at £163.15/t yesterday down £0.95/t and approaching lows last seen on 26th June as harvest pressure mounts on global wheat futures. Sterling saw another day of strength against the US dollar to add to negative pressure, GBP/USD now stands at £1=£1.31 as at 8:30am.

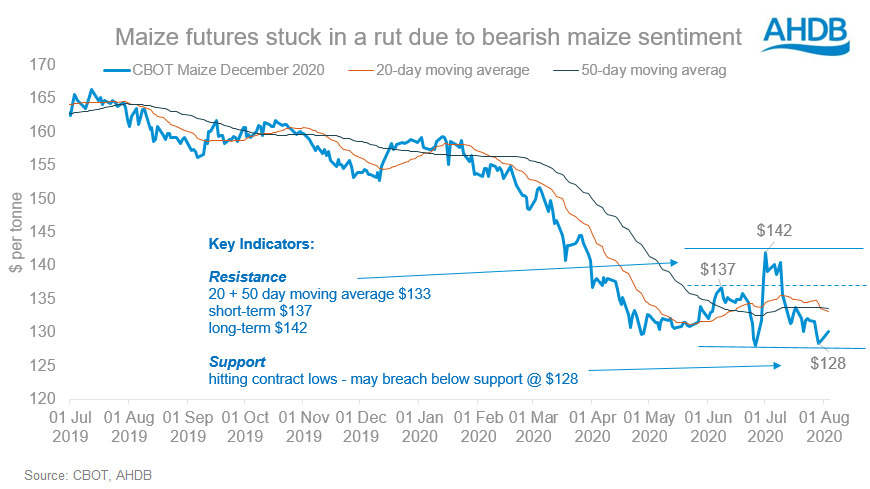

- Chicago maize futures set new contract lows yesterday as both US and Ukraine maize crops look in good condition and the new-crop balance is heavily weighted to oversupply. Dec-20 CBOT maize futures dropped as low as $3.20/bushel ($126.91/t / £96.88/t) setting the bearish tone for global feed grains in 2020/21.

- Consultancy StoneX (formally INTL FCStone) has forecast a larger Brazilian soybean harvest in the coming season as growers increase acreage to a record 38Mha. Production is forecast at 132.6Mt and exports at 81Mt (+9.5% yoy). China looks well supplied from South America.

- Egypt is back in the market for September wheat. Ukraine and Russia were the cheapest offers in the previous tender and would expect to see the same again. Egypt could be taking advantage of purchasing near-term supplies whilst prices look good.

Maize imports set to dominate UK cash price

Global maize production is forecast at 1,163Mt this season, 50Mt above 2019 levels (USDA). After two seasons of global maize deficits, 2020/21 sees a return to a small surplus of 3Mt. Whilst this surplus isn’t going to break any records, the increased supply profile, and uncertain global demand from coronavirus, provides a continued bearish sentiment.

Where will the UK import from?

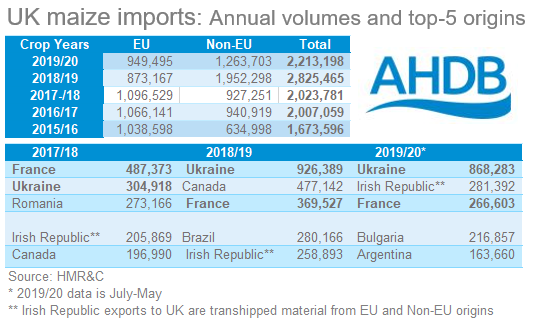

In recent seasons the UK has imported between 2Mt and 2.8Mt of maize. With a wheat crop significantly lower, the UK may easily breach the 3Mt mark for maize imports.

Ukrainian grain trade association (UGA) have increased their domestic maize crop estimate to 38.9Mt, 2.1Mt above previous forecasts, and exports are expected to break records in 2020/21.

In France, crop conditions are 77% good/excellent, down from 80% in the week prior. Production is forecast at 14.9Mt by Strategie Grains. This would be 2.6Mt greater than 2019/20, however with hot, dry weather forecast for August this is by no means set in stone.

In 2020 the Canadian maize area is forecast unchanged year-on-year at 1.44Mha. Vegetation indexes are currently good for Canadian crops, and their pricing into the UK will depend of final production numbers.

Whilst Romania’s crop is forecast 1Mt lower at 12.20Mt in 2020/21, recent rains may have boosted crop conditions and support yield potential to regain some more output.

How does this affect UK wheat prices?

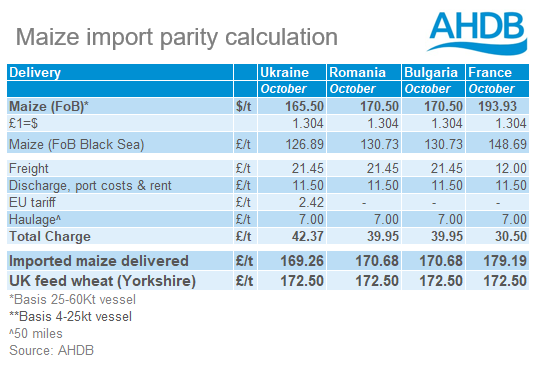

For October, feed wheat delivered into Yorkshire is estimated at £172.50/t at current prices. Imports of maize from Black Sea origins range from £169.70/t-£171.50/t, whilst French prices from the Atlantic coast are less competitive in the high £170s/t.

For the UK, Black Sea maize is cheaper into the northern deficit areas. This will act as a cap of how far physical prices can go. Granted, not all animal feed homes are going to be buying 30-60kt vessels in one go!

The latest EU Commission trade data shows the UK imported, 57.54kt of non-EU maize in July. There’s much more to come…

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.