Low stocks driving increased volatility: Grain market daily

Friday, 16 April 2021

Market commentary

- Nov-21 UK feed wheat futures prices rose £1.05/t yesterday to £173.10/t, the highest price to date for the contract.

- UK new crop prices followed a global trend. Markets reacted to forecasts for cold weather in the US, which could pose a threat to newly planted maize and spring wheat crops. Dry weather is also expected to continue for both US and European wheat growing areas.

- In the Chicago futures market, new crop wheat (Dec-21) rose $1.65/t yesterday, to $243.15/t. New crop maize (Dec-21) was up $0.39/t yesterday, to $201.27/t. The Nov-21 soyabean futures also gained $1.84/t to $466.23/t.

- French cereal crop condition scores for 12 April fell on the week (FranceAgriMer), showing the impact of recent harsh frosts. 88% of spring barley is now rated good or very good, down 4 percentage points over a week. Winter barley and soft wheat fared better, with the scores down 2 and 1 percentage points respectively.

Low stocks driving increased volatility

Forecasts showing less than ideal weather have driven the recent rise in global prices for grains and oilseeds.

Every spring, the market reacts to changing weather reports, due to the potential impact on crop size. We have highlighted a number of key weather watch points:

- Dryness in the US maize belt and South America

- The impact of dryness on US spring wheat planting

- Frost impact on French crops (above)

- Dryness risks for EU wheat

But this year, I think the market will be particularly sensitive. This is due to low stocks amongst the major exporters and the prospect of high demand next season.

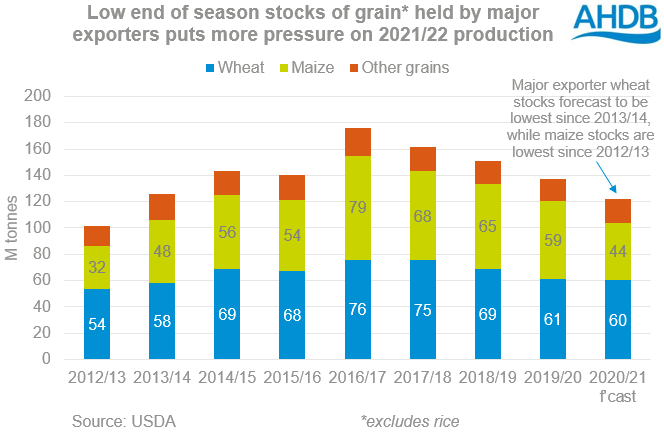

Demand for agricultural commodities has been strong this season, with maize and soyabean stocks in particular depleted. As a result, maize stocks in the major exporting countries are forecast at the lowest level since 2012/13. Further, stocks of wheat held by the major exporters are expected to reach the lowest level since 2013/14.

The low stocks across major exporters could mean increased volatility this spring. With little in reserve, the market is likely to react strongly to any weather-based threat to 2021/22 supplies. This poses both a challenge and an opportunity to anyone marketing grain.

Another reason I feel the market will be more sensitive is that the US area of maize and soyabeans is only expected to be slightly larger than last year, despite strong global demand. This means that yields will be even more important than usual to 2021/22 supplies. However, it is still possible that farmers plant more than they originally intended, updated acreage estimates won’t be confirmed until 30 June.

Weather stories will continue to move markets through spring and into summer. However, one other thing to bear in mind later in the year is the considerable risk premium built into new crop prices. If crops come through the key growing periods over the next couple of months unscathed, new crop prices could fall as the risk premium comes out. However, this is a big ‘if’ and there’s certainly still upward potential, given the expected tightness.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.