Is EU wheat competitive enough? Grain market daily

Wednesday, 22 September 2021

Market commentary

- UK feed wheat futures (Nov-21) closed lower yesterday, down £0.45/t, at £188.35/t. The contract has struggled to sustain above £190.00/t, having closed above this mark last Thursday. Movements have tracked those in Paris and Chicago markets.

- Russian consultancy SovEcon made a marginal upward revision of 200Kt, to its 2021/22 wheat production estimate. The consultancy now forecasts Russian output at 75.6Mt, the increase follows improved yields in Siberia.

- Strong demand for wheat is seen globally today, with tenders for feed wheat issued by Jordan, Pakistan, and the Philippines. The combined volume of these tenders is 984Kt.

Is EU wheat competitive enough?

This season (2021/22) the European Union is set to export 30Mt of wheat, according to the EU commission. Data released by the commission yesterday showed EU exports of common wheat totalled 6.53Mt from 01 July to 19 September.

So far, EU exports have been dominated by Eastern European states. This season, 35% of common wheat exports from the EU have originated in Romania, with a further 18% originating in Bulgaria. This is not a huge surprise; Romania has been a key origin in international wheat tenders so far this season. Production in the South East European state is up 5.9% on the five-year trim average, at 10.1Mt.

Exports from the EU have broadly kept up with the pace required to meet the 30Mt forecast. But, EU wheat prices, and Paris milling wheat futures, will need to remain competitive if the export outlook is to be met.

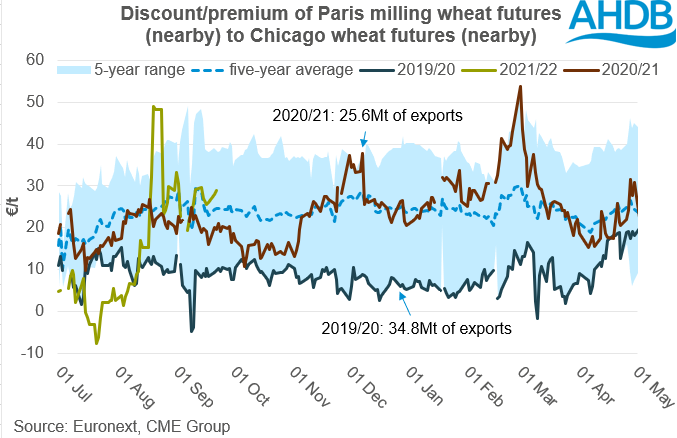

In euro terms, Paris wheat futures are at a less competitive point than they were at the beginning of the 2021/22 season. The premium of nearby Paris milling wheat futures to nearby Chicago wheat futures is around the five-year average level. While exports have remained strong in recent weeks, the premium of Paris over Chicago is currently more than it was last season. Total EU common wheat exports reached just 25.6Mt last season. If trade is to reach the level required, then Paris milling wheat futures may need to reduce their premium to Chicago wheat futures, the global benchmark for wheat pricing.

UK pricing tends to follow the trend seen in Paris milling wheat futures, effected by the exchange rate. As such, any reduction in the premium of Paris milling wheat futures over Chicago wheat futures is likely to impact UK markets.

If Paris milling wheat moves lower to find demand, then we could see UK markets move lower also. One major caveat is the shape of the grain market globally this season. With reduced competition for exports this season; reduced Russian, Canadian and US exports, Paris futures may not need to reduce the premium over Chicago to the same degree as in previous seasons to capture demand.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.