Global markets waiting for today’s WASDE: Grain market daily

Friday, 9 April 2021

Market commentary

- UK old crop (May-21) feed wheat futures gained £3.90/t yesterday, to close at £195.00/t. New crop futures (Nov-21) gained slightly less, £2.50/t, to close at £166.40/t.

- The markets await the April world supply and demand estimates (WASDE) from the USDA due today. Prices also gained from a weakening US dollar.

- US maize futures are set for a second weekly gain due to high export demand. According to official census data, February US maize exports totalled 6.3Mt. This is the highest monthly volume since July 2018. Export data collected weekly indicates March exports will likely exceed 9Mt: a record monthly total (Refinitiv).

- Argentina’s 2020/21 soyabean crop was cut 1.0Mt to 43.0Mt by the Buenos Aires Grain Exchange (BAGE) yesterday due to dry weather. Over 5% of the first soyabean crop has now been harvested. The 2020/21 maize production estimate remained at 45.0Mt, of which 12% has been harvested.

Global markets waiting for today’s WASDE

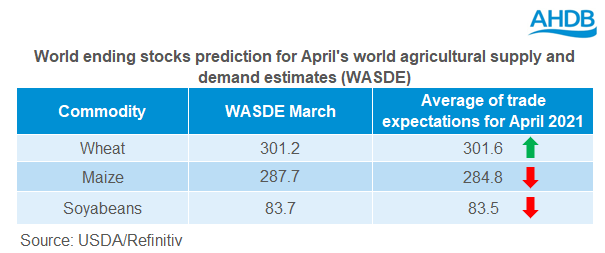

At 4pm today, the latest world agricultural supply and demand estimates (WASDE) are due to be released. After last week’s quarterly grain stocks, global markets have been awaiting the latest figures to steer old-crop prices. But, not much change is predicted by analysts.

A small fall is expected in maize world ending stocks. Analysts expect some small reductions to maize and soyabean production in both Argentina and Brazil, according to Refinitiv.

There’s been mixed reports for South American maize recently. For example, the latest US attaché report for Brazil kept the maize crop forecast at 105.0Mt. This is 4.0Mt below March’s WASDE, which may indicate a possible reduction in April’s WASDE. However, Conab increased 2020/21 maize production by 0.90Mt yesterday to 109.0Mt.

Meanwhile in Argentina, the Buenos Aries Grain Exchange yesterday kept its maize production estimate at 45.0Mt.

What impact might the WASDE have on global prices?

If the April WASDE brings a surprise to the market, there could be sizable shifts in global grains and oilseed prices. But, if the estimates are as expected, markets could drift sideways as the market is relatively quiet and mostly awaiting news on new-crop conditions. Despite old crop pricing shifts, new crop pricing has remained relatively stable in recent weeks.

Arguably, the May WASDE will be of more importance to the market, as it is the first to include new-crop figures. We will also be well into the key weather window for 2020/21 Brazilian maize crops and 2021/22 northern hemisphere grain crops. As such, weather will be a critical driver of markets and prices over the next month and more.

What are some watch areas for new-crop grain pricing in the weeks ahead?

US

Weekly US crop condition progress reports resumed on Monday. The first report of 2021 indicated winter wheat condition was behind last year. As at 4 April, 53% was rated ‘good’ or ‘excellent’, lagging last year by 9% likely due to dryness in the US. Maize planting has also began (2% complete). The next report is due 12 April.

Russia

Dry conditions have been eased slightly by recent rainfall, though conditions are still drier-than-average in the Southern and North Caucasus regions (AMIS).The dryness could impact both winter and spring wheat crops. On 8 April, 12Kha of spring wheat (0.1% of the forecast area) had been sown according to the Center of Agroanalytics. In 2020, this figure was 427.5Kha.

EU

As at 5 April, a high proportion of French barley and wheat are developing well according to FranceAgriMer. Growing conditions are looking good, with 87% rated ‘good’ or ‘very good’ for soft wheat, 85% of winter barley and 92% spring barley. The recent cold snap has brought fresh concerns to conditions, though any impact of this will be uncovered in upcoming reports. Meanwhile, as Thomma reported on Wednesday, current UK crop conditions are looking well.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.