Free-from moves mainstream

Wednesday, 20 June 2018

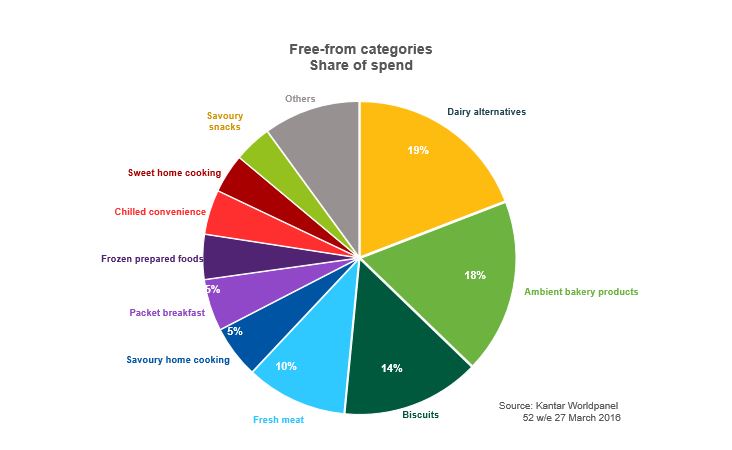

The UK free-from foods market is forecast by Mintel to grow to £673m in 2020 - 43% higher than in 2015. These products have moved from medical necessity to mainstream products and ranges are increasing to cater for demand. But is it here to stay or will consumers move on to something new in the future?

Mintel suggests that just over half of the free-from market comprise gluten and wheat-free products. Use of these claims has been rising and is now seen across a number of categories, including meat products such as burgers and sausages.