First 2021 GB wheat production forecast: Grain Market Daily

Wednesday, 14 April 2021

Market Commentary

- UK feed wheat futures (Nov-21) closed yesterday at £169.50/t, a gain of £2.55/t on the day. Similarly old crop (May-21) futures gained £2.35/t, to close at £199.00/t.

- UK futures largely followed the direction of Paris milling wheat futures. The Dec-21 Paris milling wheat futures contract closed yesterday at €202.00/t, up £2.25/t.

- For wheat, dry weather in the Northern Hemisphere continues to be a key driver of markets. The EU and US look set for normal to low levels of rainfall in the coming weeks. With soil moisture in both regions already below normal.

- Finally, for UK prices, currency has been a key influencer, sterling has fallen 2.2% against the euro since reaching its most recent peak on 5 April.

First 2021 GB wheat production forecast

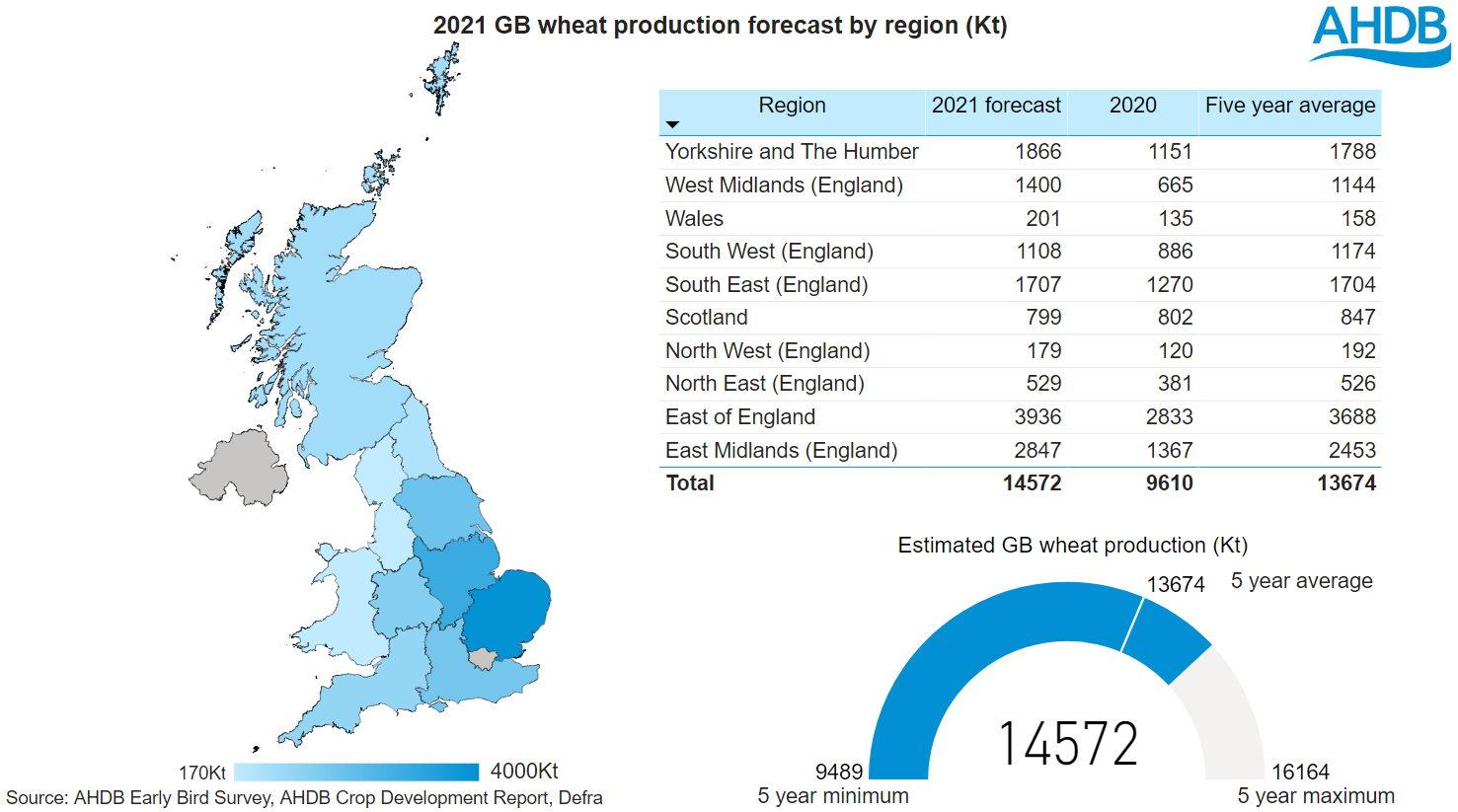

Last week we published our latest AHDB Crop Development Report, the report details the condition of crops in Great Britain. Using the report, we can produce an indicative forecast for 2021/22 wheat production.

In order to produce the estimates the following rules have been applied for estimating yield from crop condition ratings;

- Excellent – five year maximum yields

- Good – five year average yields plus 5%

- Fair – five year average yields

- Poor – five year average yields less 5%

- Very poor – five year minimum yields

- Unplanted or non-emerged wheat is considered to be average.

Using these values suggests GB wheat production could reach 14.57Mt, well ahead of last year’s poor crop and 6.6% ahead of the five year average. With tight production in 2020/21 and minimal carry out stocks, a 14.57Mt crop will only go some way to fulfilling demand and imports will be required.

Demand for wheat next season is likely to be strong, with the return to production at Vivergo in 2022. An important area in which to consider the supply of wheat is the North of England and Yorkshire. With strong demand in the region from bioethanol, starch, milling and feed, the area is often in deficit.

Wheat production in Yorks., the North East and North West is provisionally forecast at 2.57Mt, just 68Kt ahead of average. If there are production issues between now and harvest we may need to see delivered premiums stretch to pull wheat north or drag in imported wheat.

With this in mind, we also need to pay very close attention to the East Midlands and East of England. Production in those two regions is forecast at 6.78Mt, ahead of the five year average of 6.14Mt. If premiums extend in the North this wheat will be pulled up the country.

The current available data provides the first indication of GB wheat supply. In order to provide the best possible data to form assumptions and inform the UK grain market, please take 5 minutes to complete the Spring Planting and Variety Survey.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.