Export issues ahead as Russia invades Ukraine: Analyst’s insight

Thursday, 24 February 2022

Market commentary

- Markets rise sharply as Russia invades Ukraine. There were significant price rises yesterday and markets are trading far higher again today (midday).

- UK feed wheat futures for May-22 rose £7.25/t yesterday to £235.25/t. The Nov-22 contract gained £7.85/t to a new high of £216.15/t.

- Paris rapeseed futures for May-22 gained €10.75/t yesterday to €740.25/t, approx. £618.00/t. The Nov-22 contract gained €10.00/t to a new high of €642.75/t, approx. £536.50/t.

- Initial forecasts from the USDA point to the US soyabean area rising 0.9% year on year for harvest 2022, while the maize planted area could fall 1.5%. These projections are ahead of the USDA’s annual Agriculture Outlook Forum today and tomorrow.

Export issues ahead as Russia invades Ukraine

Wheat, maize and sunflower oil exports from Russia and Ukraine face disruption following Russia’s invasion of Ukraine.

Interfax, a Russian media source, reported this morning that commercial ship movements in the Sea of Azov are suspended. Russia controls the Kerch Strait, where the Sea of Azov joins the Black Sea. Both Russia and Ukraine export from the sea of Azov, though most exports are from the Black Sea.

Yesterday, UkrAgroConsult said that shipments from Ukraine were said to be continuing without complications, though enquiries for new business were slowing.

The situation is now changing rapidly. There are now reports of shelling in the region of Odesa, which contains several key ports, including the port of Odesa. And Ukraine’s military has reportedly stopped operations at the country’s ports (Refinitiv).

In addition, Ukraine has asked Turkey to prevent Russian ships leaving the Black Sea (Refinitiv). Turkey controls the Bosphorus and Dardanelles straits but has yet to respond to Ukraine’s request.

This morning, Refinitiv reported the Russian Transport Ministry as saying Russian ports in the Black Sea are working ‘as usual’.

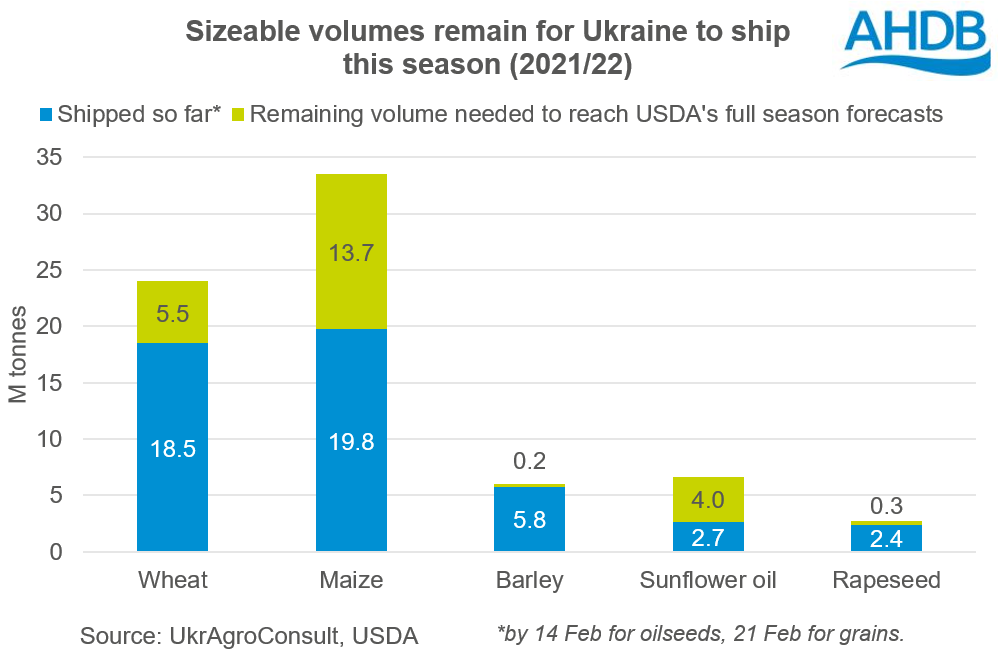

However, we’re still likely to see disruptions to exports from the region and there are significant volumes of wheat, maize and sunflower oil left to ship this season.

Given the importance of Russia and Ukraine to global grain exports and sunflower oil exports, prices for these commodities are rising rapidly.

Where could fill the gap?

Stocks in other major exporters are already expected to fall to low levels by the end of this season. This amplifies the global price impact and so, the impact on UK values.

For grains, disruption in exports from Russia and/or Ukraine is likely to push more demand to other major exporters. For wheat, this could be the EU-27 or US. The options for maize are less clear given the issues with South American crops of late.

However, for sunflower oil, Russia and Ukraine were expected to account for 78% of global exports this season. Disruption could mean a need to switch to other vegetable oils. In turn, this would lead to support for rapeseed oil as well as rapeseed prices.

Impact on 2022 farm costs

The escalation may also have impacts beyond the global grain and oilseed trade and prices this season. It could also increase costs for UK farmers for the 2022 crops, through fuel and fertiliser prices:

- Fuel prices. Yesterday, Brent crude oil futures (nearby) closed at $96.84/barrel, the highest price since September 2014. The contract is now trading at over $104/barrel (2pm today). Higher crude oil prices is already contributing to paying more at the pump in the UK and will likely lead to a rise in red diesel costs as well.

- Fertiliser. Natural gas prices have also jumped up this morning, with the UK nearby futures contract back at its highest levels since just before Christmas. This could push up nitrogen fertiliser prices. Also, Russia is a major exporter of fertiliser products, though its export controls have reduced volumes recently. Yesterday (23 Feb), no sanctions against Russia by the US, UK or EU targeted fertiliser products (Argus Media) but the situation needs to be monitored. Higher prices or reduced supply from Russia would make things more difficult for anyone yet to buy or take full delivery of their fertiliser.

AHDB has advice on dealing with higher nitrogen fertiliser costs here. Plus, you can watch the recording of our webinar on the topic from December here. Also, Farmbench can help with understanding your cost base and budgeting.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.