How will Covid-19 lockdown impact our eating habits?

Monday, 6 April 2020

Key points:

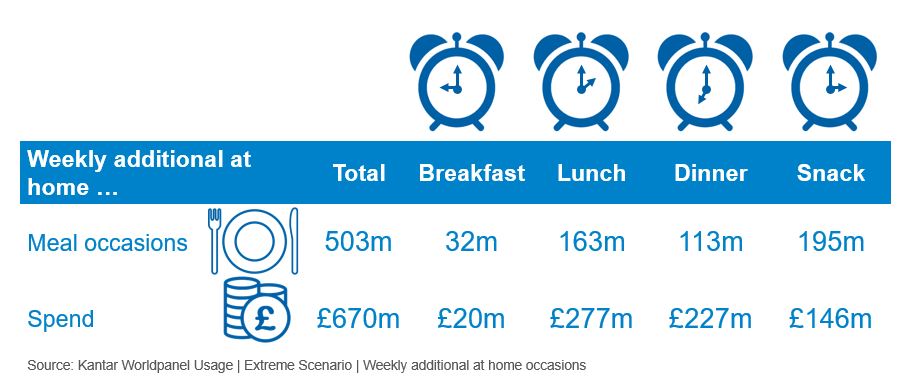

- It is estimated by Kantar Worldpanel that there will be 503 million more (+38%) in-home meals eaten per week in this lockdown period. The majority of these uplifts are expected at lunchtime.

- The dynamics behind meals eaten in the home are significantly impacted in a lockdown – for instance without the morning rush, we may see people spending more time preparing and eating breakfast together as a family. This may present unique product opportunities.

- Consumers are unlikely to directly replicate meals they would have eaten out of the home. Firm family favourites such as Italian, stews and those meals which are simple, hearty, filling or comforting treats for families may benefit the most. Meal choices made by consumers are also weather dependent, for instance BBQ related products like burgers and sausages could do well if the sun shines.

What impact will Covid-19 lockdown have on eating habits in the home?

Covid-19 has begun to impact our lives, more than any other event in recent memory. The impact on our behaviour will be on a scale never seen before. There are two major influences on our behaviour – staying at home and stockpiling.

In this article, we will look at how Covid-19 has changed our eating habits, using estimates from Kantar Worldpanel that look at the potential rise per week of meals consumed during lockdown. AHDB has analysed this data to give a thorough overview of the impact across key sectors so far and the possible ramifications going forward. It looks at what the impact would be each week while the country is in a hard lockdown and which sectors are likely to see an impact as the home becomes the ‘restaurant hub’ for all the family. These predictions relate to the current hard lockdown scenario faced by consumers, depending on how stringently lockdown measures are enforced, we can expect to see a range of changes for a prolonged period.

Buying behaviours and meal occasions

Prior to the lockdown, people would be more inclined to do a ‘top up’ shop with savvy shoppers using several stores during the week. This has been replaced with essential shopping trips, a period of stockpiling and empty shelves. We are now starting to see signs of stockpiling easing with some restrictions on core products being slightly relaxed by retailers.

Kantar Worldpanel estimate 503 million more in-home meals will be eaten per week in this lockdown period – that’s a rise of 38%. In January, Kantar reported a total of 69 billion in-home meals were consumed during 2019 – a figure that wouldn’t take long to reach during prolonged periods of lock down. Even if measures were lightly relaxed, Kantar predict 304 million more in-home occasions per week. Kantar highlight that normally we can expect 69% of meals to be eaten in the home, with 31% out of the home. (52 weeks to Jan 2020). During these lockdown periods that’s almost a third of meals coming inside.

Breakfasts

Breakfasts will get the smallest boost as it is normally eaten at home, however we can still expect to see at least a 9% growth. And while we are not eating dramatically more in the mornings, what we eat could change.

Without the morning rush, we may see people spending more time preparing and eating breakfast – with the popular British fry up featuring more often. This could bring a boost to the pork sector with bacon and sausages appearing more frequently on the menu, ingredients usually reserved for the weekends.

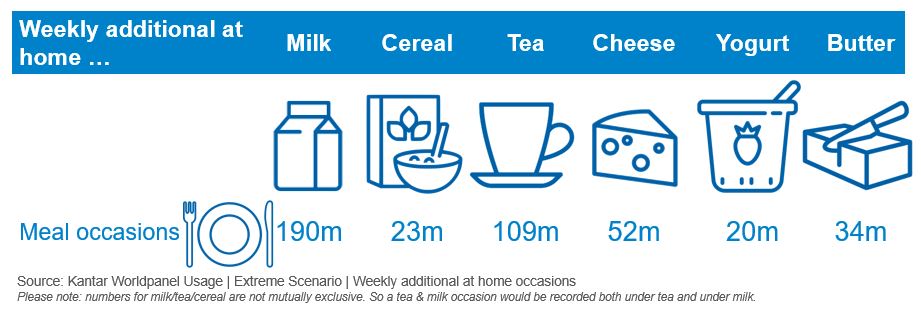

More than half of all breakfasts (55%) already include cereals and this is likely to remain a popular choice, especially among children, as is toast and jam. This will mean a boost for the dairy sector (with milk and butter being key) and the cereal sector.

Lunch

Lunch is likely to see the most significant change as more than half of all lunches (54%) were eaten out-of-home prior to the lockdown. While sandwiches and quick toast meals, such as beans on toast, will remain popular, ‘pester power’ from young children will influence lunch choices.

Savoury snacks are expected to feature at 10% of all lunches as well as fromage frais (11%) and ice cream (7%) bringing a further boost to the dairy sector.

Dinner

Spend on items for evening meals tend to be higher than that of breakfast/lunch so Kantar’s predicated a rise of 113 million more occasions per week – resulting in £227 million extra spend per week. We may well see more time spent around food preparation or researching new dishes. But it is also important to remember that consumers are less likely to experiment in uncertain times. This lends itself well to firm family favourites, especially those that can ‘fill up’ the family e.g. stews/casseroles, curries, Shepherd's/Cottage pies.

Snacks

With people looking for some ‘pick me up’ moments due to the lockdown, we can expect to see a significant rise in home snacking. Indulgent categories including chocolate and sweets as well as ice cream will see an uplift as people look to make themselves feel better.

Category Context

Meat

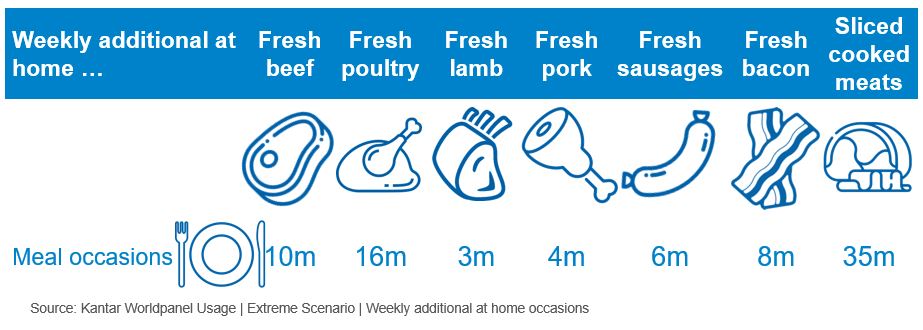

Sliced cooked meats are estimated to feature in an additional 35 million more meals a week – with a staggering 91% of this growth predicted at lunchtime. Ham would be expected to be the biggest beneficiary as it holds the largest slice of the category. Looking at primary meats, fresh beef will be a big winner, featuring at ten million more meals per week – with 70% of this growth expected to be in the evening. Fresh poultry remains common place with consumers and is estimated a rise of 16 million additional meals. It is anticipated that pork will feature in four million more meals per week, with 61% expected in the evening and 38% at lunchtime. Three million more meals will feature lamb – 49% at dinner and 50% at lunch. Essentially because of the sizeable rise in meals eaten in the home, all categories are expected to achieve growth, ranging from 20 to 72%, with the average for primary red meat standing at 31%.

Fresh bacon will be served in eight million more meals per week and chilled burgers and grills will be boosted by an additional one million occasions. Mince will feature in six million more meals per week– the majority in the evening (74%) and roasting joints will make up five million new occasions.

Potatoes

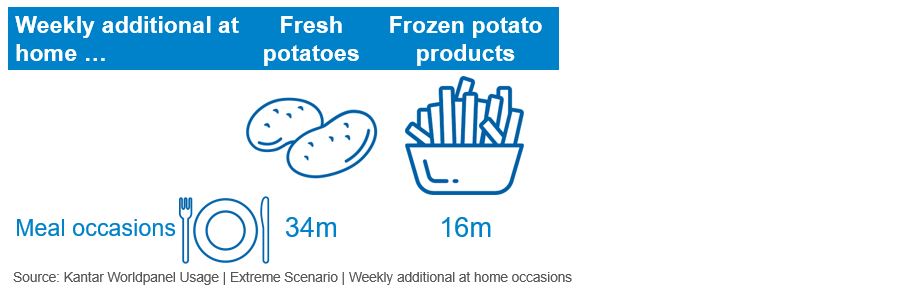

The estimated uplift for fresh/raw potatoes is 34 million occasions per week – with 56% of those gains coming from evening meals and 44% coming from lunch. Categories like frozen potatoes will benefit more from evening meals accounting for 67% of the anticipated rise of 16 million occasions per week. The average estimated uplift across fresh and frozen potatoes products is 33%.

Dairy

Kantar estimates an increase of 190 million occasions per week of milk, largely driven by more teas, coffees and cereal being eaten in the home. The tendency to have a ‘cuppa’ with the estimated rising in ‘snacking’ is likely to sit well with liquid milk consumption as it looks to balance with liquid milk which may have gone into foodservice. More details around this topic is featured in the latest AHDB Dairy podcast.

For cheese there is a bigger weighting towards the lunch occasions with 71% of the estimated rise of 52 million weekly occasions per week occurring at lunchtime. A similar pattern occurs for yoghurts with just under half coming at lunchtime. Kantar estimates that butter occasions will rise by 34 million per week with 67% of these occurring at lunchtime. All categories shown in the table above show strong gains from the increase for in-home meals, they range from 11 to 52%.

Will the uplifts in home replace lost out of home sales?

It is difficult at this stage to predict if the estimated rise for in-home meals will offset the impact of foodservice closures. AHDB has done initial analysis into this area by looking at the expected performance in foodservice during April-June last year. It outlined one example for beef where it was estimated that retail sales would need to increase by around 27% to offset foodservice losses. AHDB intend to explore the retail volumes impact and publish an analysis of this on the AHDB website over the coming week.

One critical element that plays a significant role is that consumers are unlikely to directly replicate exact meals in the home that they would have eaten when out. Often foodservice provides an opportunity for people to try new dishes/meals that would be too complex to re-create in home. For instance, for meat it may find product volumes by cuts do not directly transfer into homes. So, it may well be that uplifts in mince are higher than that of steaks. Looking at the types of dishes, it’s likely to be those which are firm family favourites such as Italian, stews and those meals which are simple, hearty, filling or comforting treats for families which benefit the most. Meal choices made by consumers are also weather dependent, for instance BBQ related products like burgers and sausages could do well if the sun shines.

Outlook: But what happens post shut down? What lessons come from looking at past habits?

When the current lockdown is lifted consumers are still very likely feel ripple effects further down the line, mainly linked to economic uncertainty. This will impact behaviour further. While some may look to ‘crystal ball’ moments to know how this might impact behaviour, it’s worth remembering vital lessons can be learnt by looking at past behaviour during times of uncertainty.

For instance, in the credit crunch of 2007/2008 markets saw big spikes of in-home meal occasions. Foodservice struggled as people faced tough economic circumstances, but there were trade up opportunities in retail. Many shoppers remained price conscious but a fancy in-home meal kit can still be cost effective when compared to dining out with the family. To a certain extent the Covid-19 pandemic and potential economic ripple effect to consumers may well fast track some of the recessionary behaviour which Kantar observed and AHDB reported on initially during Brexit uncertainty. Adapting to consumers demand is really challenging when the size of the shift in lockdown has never been seen before. Adapting and evolving as the consumer needs change over the coming months will be pivotal to long term success.

Listen to the podcast

Related content

Topics:

Sectors:

Tags: