Analyst Insight: Northern and Scottish ex-farm wheat basis rising

Thursday, 18 November 2021

Market commentary

- May-22 UK feed wheat futures rose £2.00/t yesterday to £228.25/t. The Nov-22 contract also gained £2.50/t to £201.75/t, its highest price yet.

- This followed a rise in global markets due to continued international import demand for wheat, and concerns about political tensions between Ukraine and Russia.

- May-22 Paris rapeseed futures lost €9.25/t yesterday to €664.50/t, roughly £559/t. The Nov-22 contract fell €3.50/t yesterday to €573.00/t or approximately £482/t.

- The pull back in rapeseed prices followed falls in soy oil and Canadian canola prices. Crude oil prices have also been softer over the past couple of days due to worries about demand from COVID 19 case numbers.

Northern and Scottish ex-farm wheat basis rising

Ex-farm feed wheat prices in the North East of England and Scotland are historically high, compared to UK futures prices.

The relationship between ex-farm feed wheat prices and UK feed wheat futures is known as the basis. It represents, in part, the local supply of, and demand for, grain. A higher basis points to higher local demand compared to supply; conversely a lower basis means lower demand compared to supply. The basis changes between seasons and as each season progresses. Basis also varies by region.

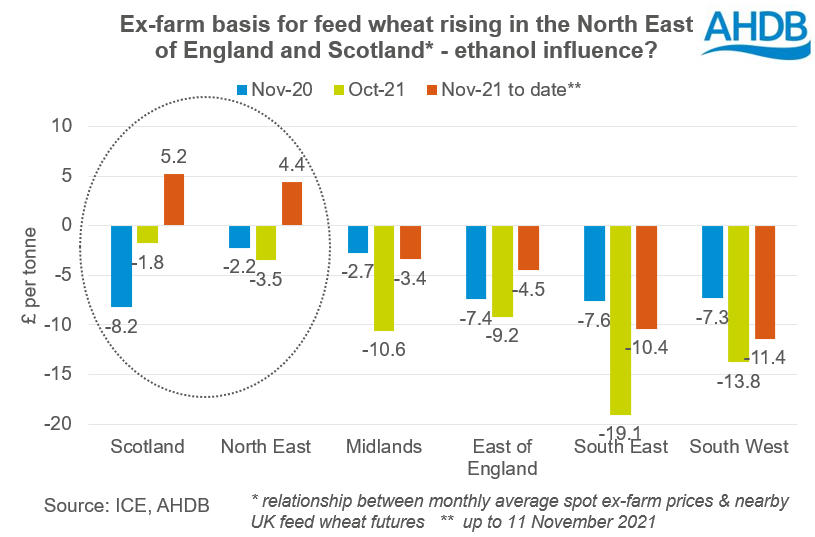

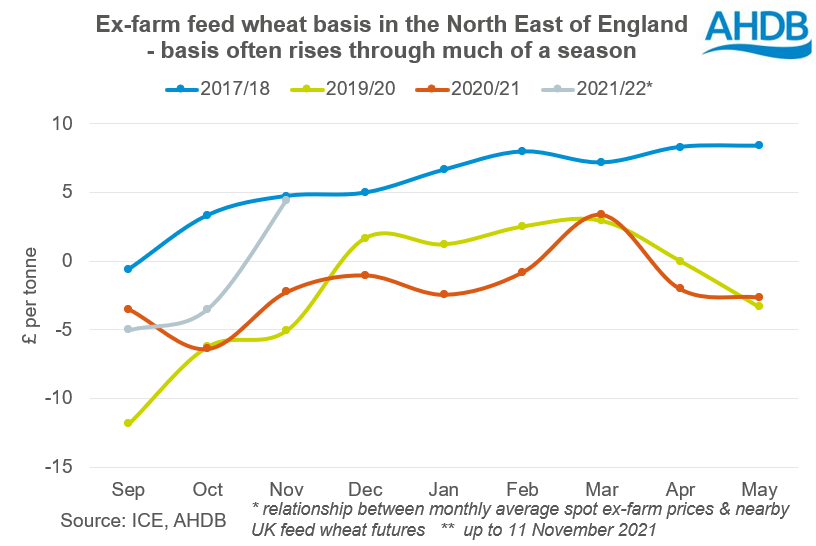

This season, the basis in the North East of England and Scotland has risen quickly. In November so far (up to 11 Nov), ex-farm spot feed wheat prices averaged £4.40/t more than the nearby futures price. This is considerably higher than in November last year, when ex-farm prices averaged £2.20/t below the nearby futures price. Similarly in Scotland, the average basis so far in November is +£5.20/t, the highest for November since 2017/18.

In 2017/18, UK supply and demand also looked relatively tight. This was due low opening stocks following high demand in 2016/17 (export and ethanol) and continued strong domestic demand, in part from the bioethanol sector.

Why’s the North rising?

- The national haulage difficulties mean shorter journeys are easier to source. This creates a premium for local grain in areas with higher demand, as it may be easier to get the grain moved.

- Higher demand from the ethanol sector. Both of the UK’s ethanol plants that run on grain are in the North East. Ensus is currently operating and Vivergo anticipates re-starting production in early 2022 following the introduction of the E10 blend in the UK. This higher demand in the North of England is helping push up local prices.

- Changes to registered futures stores. Currently, a smaller number of stores are registered to ‘deliver’ wheat against UK feed wheat futures contracts than in other seasons and are more concentrated in Eastern England, with just a couple in Southern England. In previous seasons, there was a greater spread of futures stores across the UK. Therefore, the futures market arguably primarily represents the price of wheat in Eastern England. As a result, Northern and Scottish ex-farm prices now need to be higher compared to the futures price, than previously.

What’s the situation further South?

The situation is different for the East and South East of England. Basis has also risen since the start of the season although here, ex-farm prices are at lower levels compared to the futures market than in recent seasons.

This is likely to be due to haulage and freight challenges. Haulage to ports – risky when there’s a boat waiting. Also, there are issues around the cost and availability of sea freight, especially coasters.

These regions often export more than others due to a higher production of wheat compared to local demand. However, this season there are potential similarities to 2017/18. Human and industrial usage of wheat this season is forecast, at 7.2Mt, to be the highest since 2017/18 (7.8Mt). Demand from the ethanol sector was relatively high in 2017/18 and was one of the factors limiting exports of wheat, despite a 14.8Mt crop. In July – September of this season, the UK exported just 91Kt of wheat, 67% lower than the average for the first quarter of the past five seasons.

Where next?

Basis generally strengthens through a season i.e. ex-farm prices increase compared to the futures price as local supplies are used up. This could be a bigger premium or smaller discount to the futures. With UK supplies looking tight this season, I’d expect the basis to strengthen as the months pass, especially in the North of England and Scotland.

The main caveat would be if imports, especially maize, start to look more attractive. Currently, our import parity calculations don’t show this, and so far this season (Jul-Sep), maize imports are down 51%.

But, things may change if the South American maize crops look good come spring. An increase in grain imports would cap how high UK prices can rise compared to the world market. It could also cap the basis levels in the North of England and Scotland.

For the East and South East of England, the basis may strengthen through the season. However, unless the haulage situation eases or exports rise, the basis is likely to stay lower compared to other seasons.

What you can do is check your local price relationship to the futures regularly. Knowing the current basis for your farm helps understand what a movement in the UK futures price means for your business.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.