High new-crop UK wheat prices, what can be done? Grain Market Daily

Friday, 30 April 2021

Market Commentary

- European and domestic wheat prices fell yesterday amid a degree of profit taking. A bumper Romanian wheat production forecast also lent pressure, as the country is a key wheat exporter in the Black Sea region. The UK May-21 contract lost £2.25/t to £204.75/t, though the Nov-21 price fell further, by £5.75/t, to £184.25/t. Similarly, the May-22 price fell £5.60/t to £186.60/t.

- The EU Commission lowered its 2021/22 wheat production forecast for the EU-27 to 124.8Mt from an initial estimate of 126.7Mt last month. As a result, ending wheat stocks for the 2021/22 season are lowered to 11.4Mt from 12.9Mt. Ending wheat stocks for this season are estimated at 9.9Mt, up from 9.5Mt owing to increased imports.

- Brent crude oil prices rose to six-week highs yesterday, supported by strong US economic data and demand recovery expectations. This was partly offset by concerns of Covid-19 infection rates in India. Brent crude oil futures (nearby) closed at $68.56/bbl yesterday, up 3.7% from Friday.

High new-crop UK wheat prices, what can be done?

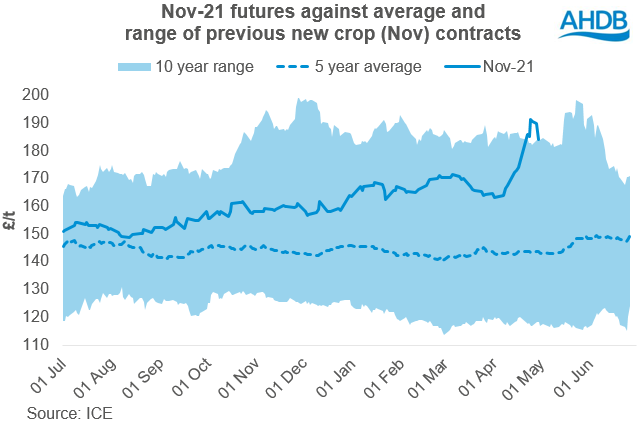

The global weather market pushed the UK November futures contract to its highest point in ten years, for this week of the year. However, weather markets always bring a level of volatility to prices.

From 22 April open, the Nov-21 contract jumped £15.00/t in four trading days to a life-of-contract high of £195.00/t, then dropped to £184.25/t by yesterday’s close. Attempting to trade a bullish weather event brings the inherent risk of a potential bearish weather system developing and ceasing the rally. This brings the potential for a ‘stairs up, elevator down’ price direction.

How can we take advantage of this rally?

New-crop prices rallying before harvest give the opportunity for tonnage to be sold forward. Selling forward is a relatively simple marketing strategy on the surface, but dive deeper and there is the choice of futures contracts or options contracts too. These enable growers to take advantage of current market drivers that are likely to change in the short term. This is despite having no physical new-crop tonnage in store yet.

Selling forward and futures contracts give an obligation for stated tonnage and quality to be delivered on a specific date. This can bring monetary charges if the tonnage or quality requirement is not able to be met. So it is important to remain under-exposed to the market if selling forward. Selling a proportion of your budgeted tonnage per hectare for Nov delivery could provide a starting point for sales, whilst leaving plenty of scope for changes.

Selling grain forward over the course of the season can also help mitigate price volatility. Using Thursday’s East Anglia basis to futures from our delivered survey, minus a theoretical haulage cost, gives an indicative East Anglia ex-farm value of £185.80/t for Nov delivery. So even if markets rise further, present prices aren’t a bad ‘worst price’ for the 2021 crop.

A wheat cost of production figure on a per tonne basis is largely determined by the crop yield. Hence it is important to get a marketing strategy in place to maximise returns, especially if yields are below desired levels.

Could an options contract help me?

At the start of the month, I covered an in-depth look at what options contracts are and how they can be used. In this case, with forward prices near record highs, a put option can be a method of ‘insurance’ for physical tonnage against prices tailing off.

An ‘Out of the Money’ (OTM) €190/t put option on Paris Dec-21 wheat futures cost €2.40 per contract yesterday. A minimum purchase requirement of 50 contracts means the total cost is €120. This type of option means the holder expects the Dec-21 futures contract (closed at €218.25/t yesterday) to fall below €190/t at some point before expiry. If this occurs, then profit is made when selling the options contracts. This profit would help offset any loss from selling the physical grain tonnage at a reduced domestic price.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.