Global weather driving price rises in grains and oilseeds: Feed market report

Wednesday, 28 April 2021

By Megan Hesketh

Grains

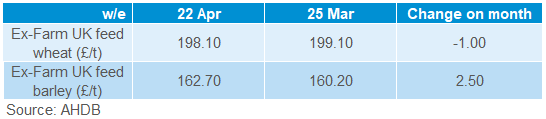

UK ex-farm feed wheat eased back marginally over the last month (25 Mar-22 Apr), quoted down £1.00/t to £198.10/t on the 22 April. Whereas ex-farm values for barley increased over the same period, rising £2.50/t to be quoted as £162.70/t. This narrowed the discount of barley price to wheat further, reducing £3.50/t to £35.40/t.

That said, recent global weather concerns have reversed ex-farm prices to near levels seen at end of March. Cold and dry US weather has caused concern to global new-crop maize and wheat supply. The market reacted strongly to adverse weather, coming at a time when US maize planting and spring wheat drilling are due to take place and in a market already experiencing low stocks and high demand projections for next year.

Other weather concerns contributing to grain price increases, include the reduction to the Brazilian Safrinha maize crop due to planting delays and dry weather, as well as dry/cold weather seen across the UK and Europe. Small yield revisions have already been made to the EU’s 2021/22 grain crop. Weather concerns are likely to continue into May, until a substantial amount of rain falls.

Finally, using the second AHDB crop report published as at the end of March, an indicative forecast for 2021/22 wheat production has been calculated as 14.57Mt, 6.6% ahead of the 5-year average. The USDA Foreign Agricultural Service (FAS) also recently published a UK wheat production figure in the 14-15Mt bracket, concluding that the UK to remain a net-importer next season due to demand exceeding supply.

Proteins

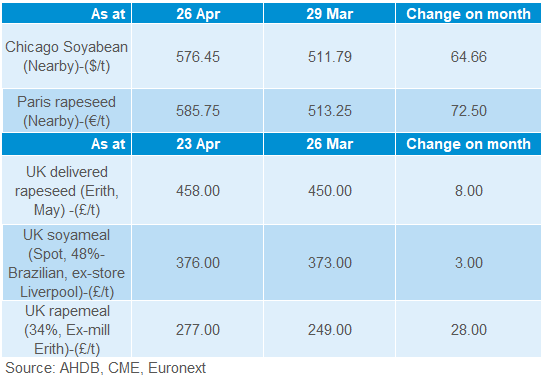

Global oilseeds futures contracts saw substantial rises last month (29 Mar – 26 Apr). Chicago soyabeans (nearby) gained $64.66/t, to close on 26 April at $576.45/t. Paris rapeseed futures (nearby) rose by €72.50/t last month, to close on 26 April at €585.75/t.

These large price rises were mostly down to US and South American weather concerns combined with rising global vegetable oil prices. As mentioned above, US weather has been dry and cold in the Midwest and plains, key soyabean producing regions. Whereas, in Argentina wet weather has severely delayed the soyabean harvest.

Rising global futures prices have contributed to UK price gains. UK 34% protein rapemeal (spot, ex-mill Erith) rose £28.00/t last month (26 Mar-23 Apr). Brazilian soyameal (spot, ex-store Liverpool) values only gained £3.00/t over this period.

Rapeseed prices are likely to remain supported into next month, on a tight supply and demand outlook. This month, UK rapeseed production for 2021/22 has been forecast by the USDA’s FAS at 995Kt, highlighting a large import requirement needed next season to meet demand.

Dry weather in Europe, Canada and the UK are all points to watch for new-crop rapeseed supply and potential further price rises in protein costs.

Currency

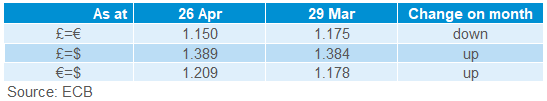

From the 29 March to 26 April, the sterling weakened 2.1% against the Euro, to close at £1=€1.150 on 26 April. Europe’s vaccination programme and economic recovery from the pandemic is considered positive, whereas sterling suffered last month from concerns over UK vaccine shortages.

Against the dollar, sterling marginally strengthened last month. The US dollar weakened early-April due to concerns over the economy and effects of the pandemic.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.