UK rapeseed - Long term veins of support? Grain Market Daily

Wednesday, 25 November 2020

Market Commentary

- The May-21 UK feed wheat futures gained yesterday, up £1.15/t to close at £194.00/t. These gains were lesser in the Nov-21 contract, up £0.50/t at £160.50/t.

- With continuing optimism over coronavirus vaccines, Brent crude oil prices have risen of late, up $3.66/t from Friday to close at $47.86/t yesterday.

- Russian wheat export forecasts for this season were raised by SovEcon yesterday. The Black Sea consultancy firm increased export estimates by 1.0Mt to 40.8Mt, owing to larger crop estimates and export pace. This estimate is 0.1Mt below the record Russian export campaign set in the 2017/18 season and based on the assumption that the export quota will be imposed.

Longer term support veins for domestic rapeseed?

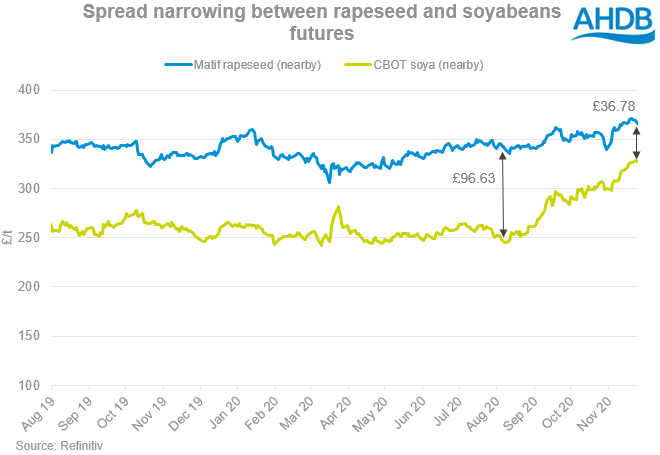

Global oilseed markets were off to a strong start this week with the ongoing price rally pushing up to new levels. Paris rapeseed futures (nearby) closed at €415.50/t (£369.25/t) on Monday, the highest close since January this year. Chicago soyabean (nearby) futures closed at $11.92/bsh ($437.80/t, £328.61/t), the highest close since August 2014 in dollar terms.

After hitting a new contract high on Monday, Feb-21 Paris rapeseed futures eased back €3.75/t to close at €411.75/t (£366.49/t) yesterday. From a technical analysis view, Monday’s highs almost breached relative strength index (RSI) channels which can indicate an imminent pause or change in current price trends. A degree of profit taking could be cited for the fall, with global price direction disrupted this week by the US thanksgiving holiday closing US markets tomorrow.

Longer term rapeseed support veins present?

Short-term support has been seen from consistent Chinese oilseed purchases, with the meal used as feed for the recovering pig herd. Longer term, rapeseed markets have support from anticipated planted area declines.

Stratégie Grains expect a third consecutive season of very low rapeseed planted area for the EU+UK 2021/22 season. There are exceptions, with Germany and Romania seeing the largest year-on-year increases in hectarage. Anecdotal conversations with industry suggest some UK farmers have either opted away completely or reduced their rapeseed area, due to the pest damage risks from cabbage stem flea beetle (CSFB). France and the UK are forecast the largest area declines, due to a combination of risk aversion and inconsistent rainfall, according to Stratégie Grains.

It’s not just the EU though. Ukraine, a major rapeseed exporter, has seen extended soil dryness slow planting pace. The intended planted area was estimated at 1.01Mha, down from a planted area of 1.35Mha last season. As of 16 Nov, 86% of the intended rapeseed area had been sown. It is unlikely the intended area will be completed as winter temperatures close in. In the two weeks since 2 Nov, only a further 5.2Kha had been planted, with the total area now forecast to reach 0.9Mha according to UkrAgroConsult.

In closing

Whilst rapeseed markets are enjoying the bullish sentiment in soya markets, as mentioned above there are indications for longer term supporting factors specific to rapeseed markets. In the event of a no-deal Brexit, rapeseed tariffs would remain at €0.00/t, meaning domestic prices are able to price closer to European equivalents, currency depending.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.