Shoppers looking for new ways to buy during lockdown

Monday, 20 July 2020

Covid-19 has put a strain on the traditional grocery routes to market as many shoppers have been fearful or unable to shop through their regular channels, while simultaneously needing to make more meals at home.

This has led to a surge in interest in businesses that are already selling directly to consumers, including meal kits, while many ‘bricks-and-mortar’ operators have adopted a direct-to-consumer model alongside their traditional operations allowing them the flexibility to pivot between the two as needed. This has also provided some outlet for excess stock that would originally have been bound for food service.

The meal-kit sector

Existing meal kit operators, such as Hello Fresh and Gousto, have seen their customer base increase sharply through the lockdown period as consumers looked for quick and easy meal solutions delivered to their door. According to IGD, even pre-Covid HelloFresh alone expected its first-quarter total revenue to be up 69% year on year (YoY) and has had to increase its workforce in its UK factory by 50%. Gousto had to stop accepting new customers in March as demand for its service was so high. Newer, more specialist players, such as Pasta Evangelists, have also performed well.

At the height of lockdown in March, high-end burger specialist Patty & Bun colloborated with independent butcher HG Walter to produce a DIY Patty kit, priced at £25 for 4 burgers, including buns, salad and relishes.

Direct-to-consumer opportunities for meat and dairy specialists

As the lockdown came in, we saw consumers’ purchasing habits diversifying and particular growth in the performance of independents such as butchers, growing by 42% year on year. (Source: Kantar MFP volume sales 12 w/e 17/5/20). These independents have the advantage of lower footfall than supermarkets, and generally seemed able to avoid the empty shelves that were a feature of visits to larger stores early in the lockdown.

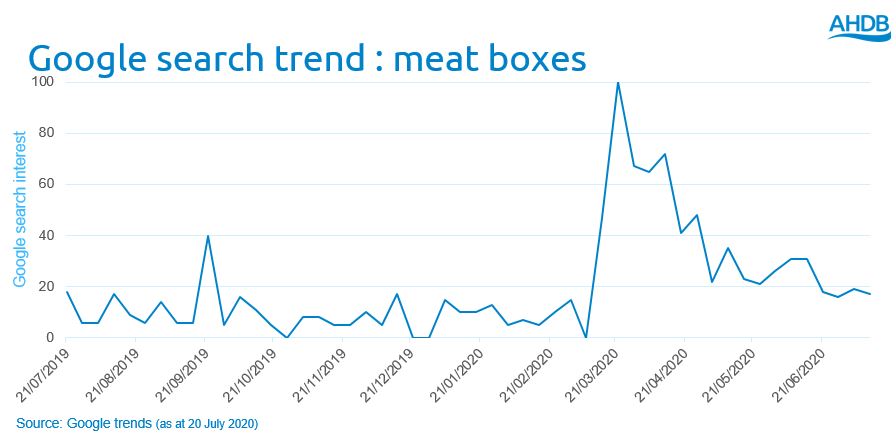

Taking this to the next level, many independents have recognised the scope for home delivery as a service that consumers are now more willing to pay for. This presents an opportunity for farmers, processors and retailers to supply direct to consumers. Online interest in meat boxes, as measured by Google trends, spiked to its highest levels during the week lockdown was announced. Although interest has since softened, it is still three times higher than it was prior to the lockdown.

To further demonstrate consumer interest, in May, HIM asked consumers if they were aware that wholesalers had started selling directly to consumers and if they would be interested in using this service. While only 6% of consumers had used it, 26% were aware of it and 54% of consumers said they would be interested, even higher amongst London based and younger consumers.

Case studies:

Fairfax Meadow impressively switched to a consumer-facing business model in less than a week. Their online delivery service, which is available to customers in the South East, offers meat products ranging from restaurant-quality dry-aged beef chicken breast fillets, plus packs of pork loin steaks and back bacon. According to MD Penny Tomlinson, speaking to The Grocer, their “wide logistical reach” and swift action and dedication of their team had “stepped up to deliver and act fast”, was key to their success.

Direct Meats, based in Essex, is traditionally a catering supplier, but has switched to supplying both meat boxes and pantry basics such as bread and milk. They supply a whole range of boxes including steak and BBQ boxes, meal kits and boxes offering child-friendly meals.

Cheese club Homage2Fromage has launched an interactive cheese box, offering a blind taste-testing experience delivered straight to customers’ doors. The club typically runs all-you-can-eat events across the UK, but since the lockdown has looked to reach its customers in innovative ways.

Huson Farm based in Harwarden, Flintshire, have diverted much of their supply, destined for pub and restaurants to their shop and veg box scheme. Speaking to the BBC, Mr Huson said: “Our veg box scheme has taken off, with a lot of new customers. And the food co-op has gone through the roof. I'd say we've probably seen a 500% increase altogether. “

AHDB offers support farmers or suppliers who may be interested in exploring direct-to-consumer routes to market.

The post-COVID world

As the lockdown gradually eases, the big question is how well the boom in direct-to-consumer sales will last. The key to successful direct-to-consumer businesses is meeting shoppers’ fundamental needs: delivering strongly against value, choice and convenience.

Growth in online channels is expected to continue beyond full lockdown due to the need to limit social contact where possible. However, convenience generally comes at a premium and this comes under pressure as household budgets decrease. To succeed, suppliers must consistently demonstrate their quality and convenience credentials and adapt to changing circumstances, perhaps offering more budget-friendly boxes of cheaper cuts and products, or making their added-value/time saving credentials clear.

Related content

Topics:

Sectors: