Improved situation for EU winter cereal crops: Grain market daily

Tuesday, 24 November 2020

Market commentary

- Old crop (May-21) UK feed wheat futures dipped slightly yesterday, down £0.15/t to £192.85/t. Meanwhile, the Nov-21 contract was unchanged at £160.00/t.

- Global wheat and maize futures gained yesterday because of further US maize export sales and an unexpected drop in US winter wheat crop condition scores. UK prices did not follow the global prices higher because sterling rose against the US dollar.

- New crop (Nov-21) Paris rapeseed futures closed at €396.00/t yesterday, up €1.00/t from Friday’s close.

Improved situation for EU winter cereal crops

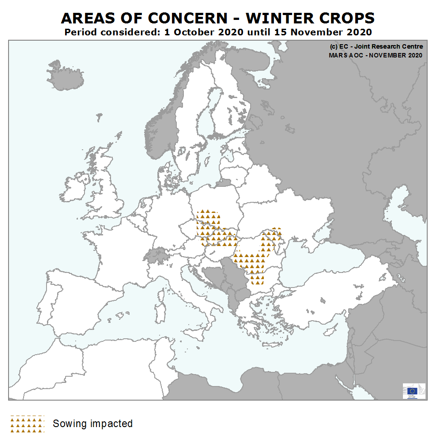

Heavy rain in October delayed planting across Europe, but dry weather in November has allowed many areas to catch up, according to the EU’s crop monitoring service.

Winter cereal crops in top growing countries Germany and France are generally in good condition. Pest pressure, including aphids, is higher in France and the Netherlands, which needs to be monitored.

Because of the drier weather, the area of winter cereals is expected to be bigger than last year in France, Germany, Slovenia and Croatia. In some countries, including Belgium, the Netherlands and Poland, the area may be above average.

However, planting is still delayed in eastern countries. This includes big cereal growers, Romania and Hungary. Winter wheat planting can still be finished on time in parts of the Czech Republic, Slovakia, Hungary, Bulgaria and Romania, if there’s dry weather over the coming weeks. However, it’s now mostly too late to plant winter barley, so the area might be reduced.

Also, more heavy rain fell in eastern Czech Republic and Slovakia in November. As a result, crops have had a poor start and it might not be possible for planting to be finished here.

Impact on UK cereal prices?

European winter cereal crops have had a good start overall and this could cap gains for new crop European prices compared to other major exporters.

The UK may need to compete for wheat and barley exports next season, if a larger domestic wheat area is planted and the barley area remains relatively high. Should we need to export, our prices will need to closely track those of our European and other competitors.

We’ll know more about the potential UK crop area on Friday, when the results of our Early Bird Survey are released.

Rapeseed area to fall

The EU crop monitoring service expects the European rapeseed area to be smaller than last year, although stopped short of estimating an area at this time. However, some countries are forecast to buck this trend. Rain in mid-September supported late plating in Germany, which could result in an area increase here on the year.

A smaller European rapeseed area means that Europe will likely need to again import large volumes of oilseeds in the 2021/22 season. As a result, new crop European and so UK rapeseed prices will need to stay high compared to global oilseed markets, to attract imports and detract exports.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.