How self-sufficient is UK cheese production?

Wednesday, 4 November 2020

By Kat Jack

The end of the Brexit transition period is looming ever closer, and at the time of writing our trade status is still uncertain. If a worst case scenario completely disrupts trade, could the UK supply its own cheese market? By looking at production, imports and exports, we can estimate our self-sufficiency.

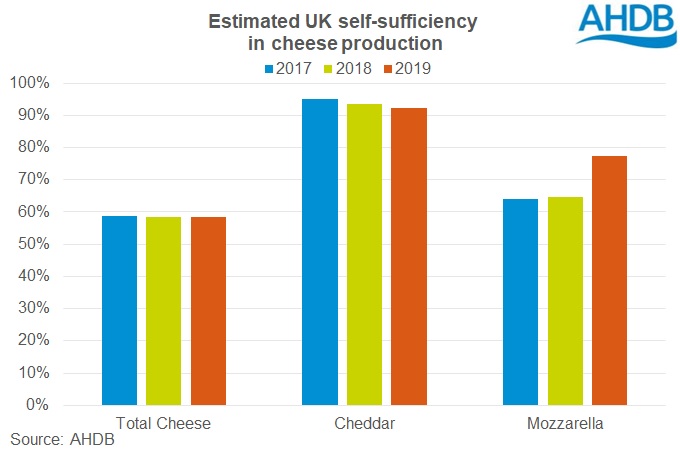

Overall, the UK is 58% self-sufficient in total cheese production. This figure has been relatively steady over the last three years (2017-2019). However, there are of course many varieties of cheese, and the self-sufficiency for each will vary. While we cannot compare them all, we will look at two of the more prominent varieties: Cheddar and Mozzarella.

High self-sufficiency in Cheddar

For Cheddar, the picture is relatively strong, as estimates indicate we have been around 94% self-sufficient over the last three years. There has been a slight decline in self-sufficiency over that period, from 95% in 2017 to 92% in 2019. Although production was similar in both years, imports rose*. However, in 2019 we did see uplifts in imports in advance of the March and October Brexit deadlines, as people sought to secure and store stock ahead of a potential hard Brexit. This may have driven the boost in imports in 2019. Exports did also rise in 2019, but to a lesser extent.

Growing self-sufficiency in Mozzarella

For Mozzarella, the UK has grown in self-sufficiency over the last few years, as production capacity has been expanded. With the information available, we estimate that mozzarella self-sufficiency has grown from 64% in 2017 to 77% in 2019, and averaged 68% over the three-year period. However there are a few caveats to note: We do not have official production statistics, but can estimate production based on the milk processing capacity of mozzarella-producing sites. Additionally, although we can get trade figures for fresh mozzarella, it is not known how much may be traded under processed or grated cheese codes instead.

For a more detailed look at the cheddar supply balance, and at the impact of EU Exit on self sufficiency, please watch our market update video.

*Please note that trade data is based on the cheddar trade code, but cheddar might also be traded under codes for grated or processed cheese of unspecified variety.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.