How is the UK sheep meat outlook shaping up?

Friday, 23 October 2020

By Bethan Wilkins

In the July Sheep Market Outlook, we forecast a sharp decline in UK sheep meat production this year. We expected this would feed through into lower export volumes, also driven by COVID-19 disruption to European demand. Imports were anticipated to be lower as well, with product availability in New Zealand and Australia down year-on-year.

For the year to date, sheep meat production and trade volumes have been lower than in 2019, however the trends have not been as strong as we expected. Here, we take a closer look at what happened and explore possible reasons why.

Lamb Slaughter

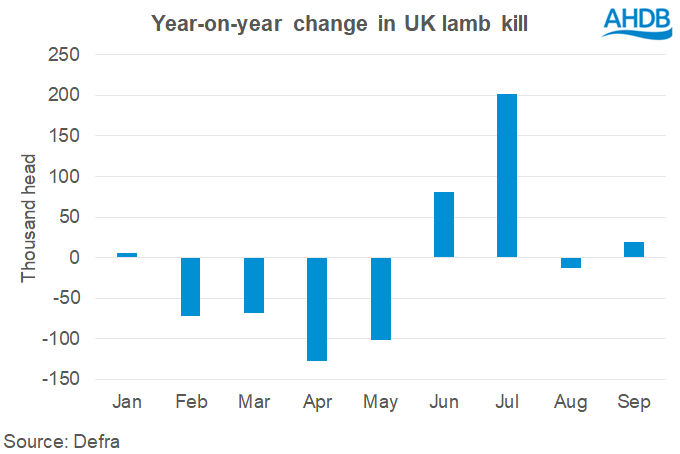

In the July forecast, we anticipated that UK lamb slaughter for 2020 overall would fall by 4% from last year to stand at about 12.6 million head. This was largely due to low slaughter levels recorded for Q2 at the time. Volumes in the second half of 2020 were expected to be similar to 2019, reflecting the fact we’d estimated a similar lamb crop to last year.

Since the July forecast was published, Defra has increased the April and May slaughter figures.by 200,000. This means slaughter in Q2 is now 11% higher than we thought in July, at 2.8 million head.

Lamb slaughter in Q3 was also 5% higher than forecast, at 3.7 million head (+6% year-on-year). This means that for January-September, UK lamb slaughter totalled 9.4 million head, only slightly lower than last year.

A couple of factors have influenced the higher lamb slaughter levels. Firstly, the additional lamb slaughter in Q2, suggests the 2019 lamb crop was larger than we previously estimated. This also increases the estimate for the 2020 crop, as we still think that this year’s crop is probably similar to last year, since the breeding flock was stable last winter and the weather at lambing was fair. The provisional UK census results support this view; however note that these results should be interpreted with some caution as only trends from England and Scotland (65% of the UK flock) are accounted for.

Secondly, it seems that lambs have been coming forward for slaughter earlier than usual. We now estimate the 2020 lamb crop at around 17.5 million head. Using this estimate, slaughter from June to September was about 61,000 head (5%) higher than a typical kill pattern would suggest. It is not surprising that lambs have been presented earlier than normal this year, encouraged by high prices and uncertainty over trading conditions with the EU next year.

Adult sheep slaughter

Adult sheep slaughter was down 14% on 2019 levels between January and September, at 1.1 million head. Cull ewe slaughter was high last year and so we expected a decline in 2020. Slaughter has largely been in line with our expectations from June-September.

Sheep meat production

We had forecast sheep meat production in 2020 overall to fall by 7% to 287,100 tonnes, reflecting lower lamb and adult sheep slaughter levels. With lamb slaughter running ahead of expectations though, the latest Defra figures only show a 4% decline in sheep meat production for January-September, at 214,400 tonnes.

Trade

Imports

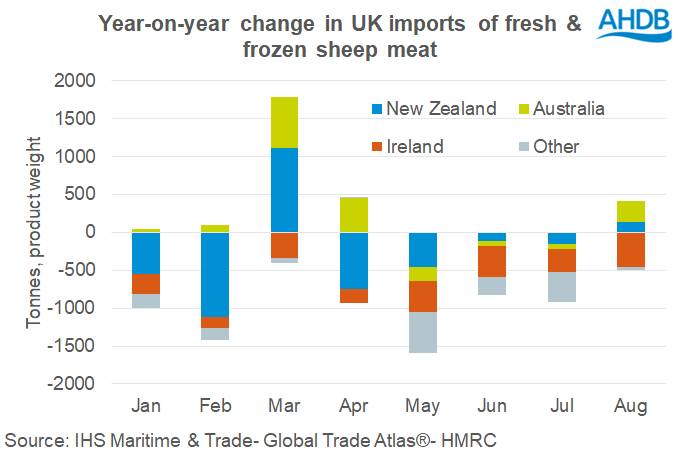

In the July forecast, imports were forecast to decline by 17% this year, driven by tight production in New Zealand and Australia as well as ongoing strong Chinese demand. The HMRC data shows that imports have fallen by 12% in the year to August totalling 49,000 tonnes (carcase weight equivalent).

The decline has not been quite as large as expected, with imports in recent months more similar to year-earlier levels. Lamb prices in the southern hemisphere have been under pressure this year, with COVID-19 particularly disrupting demand for high-value exports destined for global foodservice markets. Increased price competitiveness is probably supporting import levels.

Exports

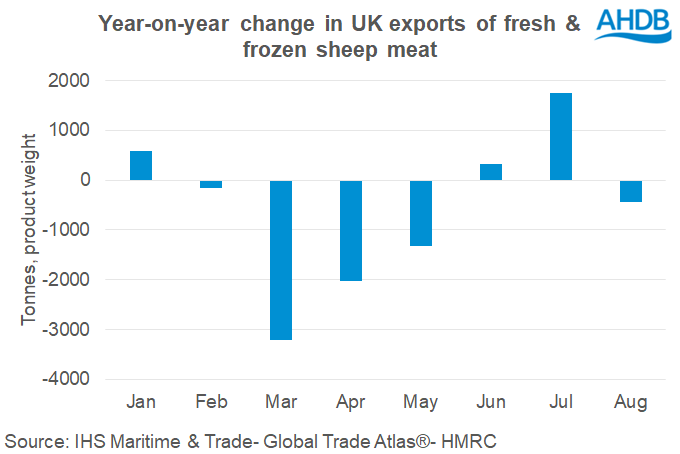

Exports are typically reflective of domestic production levels. In July, we anticipated a 16% decline in exports this year. For the year to August, HMRC data shows that sheep meat exports totalled 56,900 tonnes (carcase weight equivalent), only 7% less than a year earlier.

Considering that production has been higher than our previous forecasts, it’s not surprising that exports have also been higher.

Consumption

Supplies of lamb available for consumption in the UK were 7% lower than year earlier levels between January and August, at 177,900 tonnes (carcase weight equivalent). The scale of decline is similar to what we anticipated in the July forecast; production and imports were larger than we expected, but this was compensated for by higher exports.

Despite the drop in supply availability, the latest estimates for retail sales and out-of-home consumption suggest that the amount of lamb sold actually increased by 2% on 2019 levels for the 24 weeks to 9 August. This would mean product has come out of storage to supply the market. Tightening supplies at a time when demand is elevated will be influencing the ongoing elevated finished lamb prices.

What does this mean for the coming months?

With farmgate lamb prices still high and Brexit uncertainty ongoing, lambs may well continue to come forward earlier than usual. This would mean lamb slaughter remains above forecast for the remainder of 2020, at higher levels than in 2019. The larger lamb crop estimate also means slaughter could be higher than forecast in early 2021, though this will depend on the extent to which lambs are marketed late this year.

If production does continue to run higher, then there is the potential for exports to do the same. Uncertainty over trading relations with the EU after January might also prompt some stockpiling on the continent. On the other hand, the COVID-19 pandemic presents a significant downside risk, with ongoing restrictions potentially limiting European demand.

On the import side, the increased price competitiveness of imported product may mean volumes remain ahead of forecast in the coming months. However, demand levels in the UK may also influence this trend. Demand growth is expected to ease towards the end of 2020 due to the likelihood of increasing economic pressures as we continue to face challenges stemming from the COVID-19 pandemic.

New forecast figures for UK sheep slaughter, production and trade will be released in the New Year.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.