How could EU exit affect agricultural input costs?

Thursday, 3 December 2020

By Mark Topliff and Felicity Rusk

At the time of writing, there are only 29 days until the UK leaves the European Union on 1 January 2021. But what could the EU exit mean for agricultural input prices?

Currently, any products that the UK imports from outside of the EU face the EU’s Common External Tariff, and so a number of inputs already face tariffs and certain regulations. However, from 1 January, the UK Global Tariff will replace this. All UK imports, regardless of source, would be subject to the tariff regime, which will result in some changes to tariff rates for certain products.

- The UK imports most of its fertilizer requirements from either the EU or countries such as Morocco, Algeria or Egypt.

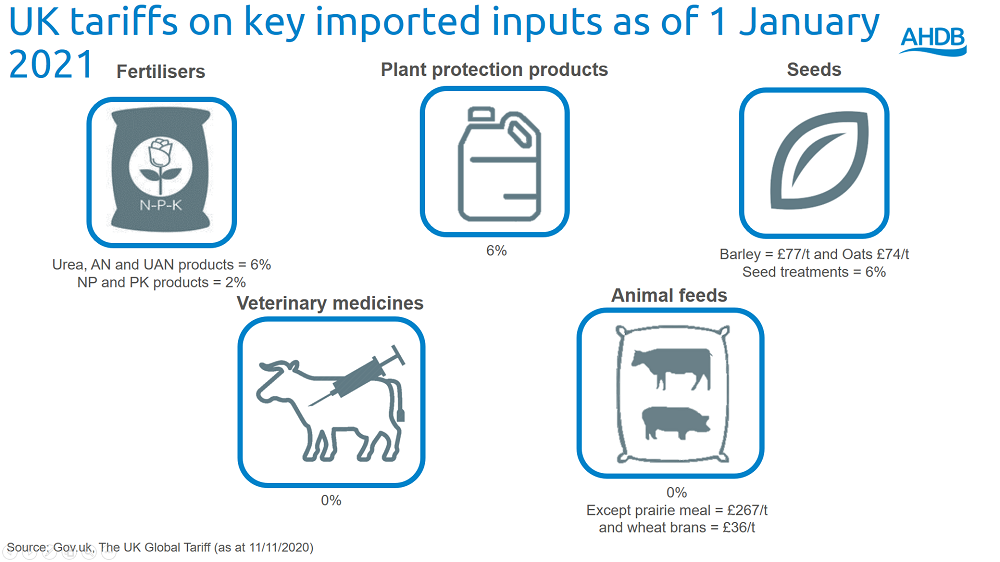

- Imported urea, ammonium nitrate (AN) and urea ammonium nitrate (UAN) will be subject to a 6% tariff, down from 6.5% under the EU’s Common External Tariff.

- Imported nitrogen/phosphate and phosphate/potassium products will be subject to a 2% tariff, down from 3.2% under the EU’s Common External Tariff.

- The existing domestic framework which allows fertilisers to be sold in the UK will remain in place because it is separate from the EU framework.

- To ensure continued supply, there will be a time-limited period during which “EC fertiliser” could be placed on the UK market as now.

- All fertilisers currently marketed in the UK can continue to be imported and marketed in the UK provided they meet government requirements.

- The UK currently imports the majority of plant protection products via the short straits (Dover – Calais). Imports will be subject to a 6% tariff rate, which is in line with the previous EU’s Common External Tariff.

- All current active substance approvals, PPP authorisations, would remain valid in the UK so businesses could continue to trade and products would still be available

- Imports of seed treatments would be subject to a tariff of 6%, which is unchanged from the EU’s Common External Tariff.

- Imported barley and oats would be subject to an additional per tonne tariff of £77/t and £74/t respectively.

- The main food and feed crop varieties marketed in the UK will need to be on the UK national list in order to be marketed.

- Seed and propagating material from outside the UK will need to comply with normal international requirements.

- Most of the medicines used on UK farms are imported via the short straits (Dover-Calais). However, there are no tariffs applied to animal medicines under the UK Global Tariff.

- To ensure continuity of supply, the UK would for a time-limited period continue to accept batch testing of veterinary medicines carried out in the EU, European Economic Area or any third countries with whom the EU has made arrangements.

- Any veterinary medicines imported into the UK from any other third country would continue to require batch testing in the UK and certification – except where third countries and the EU have made appropriate arrangements with each other.

- Animal feed imports would not be subject to tariffs under the UK Global Tariff, with the exception of maize gluten meal/prairie meal at £267/tonne, and wheat brans at £36/tonne.

- Import controls will be risk-based in the event of a no-deal. No new controls are planned for imports from the EU of animal feed categorised as high risk because the risk does not change on day one.

- High-risk feed encompasses all products of animal origin and some specified products not animal origin. Border checks are currently made on high-risk food and feed from third countries. There are no routine checks on the import of food and feed from other EU countries.

- For shipments from further afield, a new notification system is being developed because the UK will no longer have access to EU import controls. High-risk feed imported from third countries via the EU will be checked on entry to the UK at a designated point of entry.

What does this mean for input prices at the farmgate?

Unfortunately, it is difficult to know at present for a number of reasons. Firstly, currently there is no trade deal in place with the EU, and it is still unclear whether there will be one in place before the January deadline. If an agreement is reached, the UK Global Tariffs will not apply to the EU-27. Secondly, there is lack of clarity over the requirements at the border controls, and subsequently any additional administrations friction and costs that could be controlled. Finally, exchange rates will continue to have an influence, depending on the reaction of the money markets come the New Year.

Of course, the impact on individual business will be determined by when and how inputs are purchased and used.

What can you do to prepare

- As far as is practically possible, confirm or plan what inputs you may need in the coming months

- Speak to your suppliers now to see whether they anticipate any supply disruption or volatility with regards to any of those inputs

- Maintain regular contact with all your suppliers

- Any livestock producers stockpiling feed must ensure stores meet assurance scheme requirements. Talk through any planned changes to feeding regimes with feed advisers

- Use herd/flock health plans and work with prescribers to ensure that herd/flock animal health and welfare needs can be met during the months ahead

- If you want more information on how you can prepare your farm business, see our EU Exit webpages. If you have any questions which we can help with, please email questions@ahdb.org.uk

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.