Retail gains offset cautious return to out-of-home dining

Wednesday, 16 September 2020

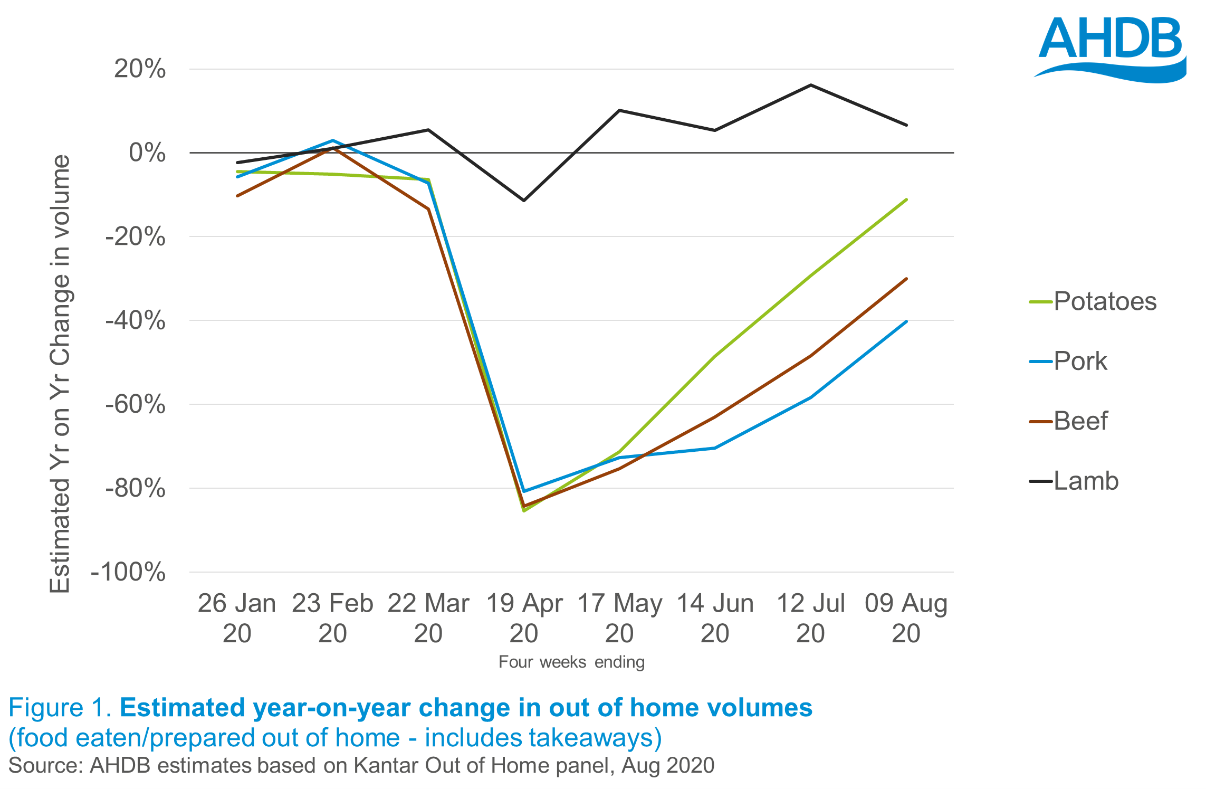

The reopening of cafés, pubs and restaurants following lockdown has helped ease losses in the out-of-home market and has benefitted all AHDB sectors. However, the impact of Covid-19 is still being felt and, for most sectors, estimated out-of-home volumes are yet to return to growth. Retail gains have offset these losses and, with consumers eating more in-home, total volumes are estimated to be up in the six months to 9 August.

Despite cafés, pubs and restaurants reopening in July, the initial uptake was slow, prompting the launch of the Eat Out to Help Out scheme. From Monday to Wednesday, throughout August, participating restaurants, cafés, bars and pubs offered a 50% discount on food and/or non-alcoholic drinks consumed on premise (up to a maximum of £10 discount per diner).

Results from the ONS’ Opinions and Lifestyle Survey, showed that of those who had left their homes in the seven days up to 9 August, almost 3 in 10 (28%) said they had visited a café, pub or restaurant, an increase from 10% four weeks prior.

In the week to 16 August, more than 1 in 10 adults said they had already eaten out and received the discount, and a further 41% said they were very likely or likely to make use of this scheme during August. But many remain cautious; of those who said they were unlikely or very unlikely to use the scheme, 51% said they were worried about catching COVID-19.

Impact of eating out closures

The impact of eating out closures on the individual sectors is mainly dependent on the role of takeaways. AHDB estimates, based on Kantar out-of-home data, suggest that lamb has been least affected, and actually achieved growth over recent months. This is due to the fact that takeaways are estimated to typically account for around half of out-of-home consumption of lamb.

However, pork and beef have taken a bigger hit. In 2019, it was estimated that almost 80% of out-of-home beef volumes were from non-takeaways, and with the temporary closures of big fast food brands in the first few months of lockdown, takeaways were also impacted. Pork is the least reliant on takeaways, but important volumes come from on-the-go consumption of sandwiches and pastry products.

Balancing out of home losses with retail gains

Overall, out-of-home losses have been largely compensated for by retail uplifts, despite both having very different requirements.

|

Estimated total volumes 24 weeks ending 9 August 20, year-on-year |

|||

|

|

Percentage change |

Volume change |

Read more on the sector impact |

|

Potatoes |

+12% |

128kt |

|

|

Beef |

+7% |

+23kt |

|

|

Pig meat |

+3% |

+18kt |

|

|

Lamb |

+2% |

+1kt |

|

|

Source: AHDB estimates based on Kantar grocery and out of home data |

|||

The four weeks ending 22 March 20 was the biggest month for grocery on record. While retail volumes have remained elevated, due to more meals consumed at home, the uplifts have now started to slow.

As this data period only runs up to 9 August, the findings only include the first week of the Eat Out to Help Out scheme. While some consumers may have been encouraged to dine out, many remained cautious and the footfall generated by office workers is still not there. We will have to wait and see whether the scheme created enough confidence for people to continue eating out throughout Autumn, or if recovery will remain at a slow pace.

Outlook

Recovery will not only depend on confidence in pubs, restaurants and cafés to operate safely, but also on the economic outlook. With the UK now in recession, and the government job retention scheme soon to end, consumer confidence, and therefore spending power, is vulnerable.

The AHDB Agri-Market Outlook was published back in June, which forecasted total volumes for our sectors, for the remainder of the year.

Based on our most likely scenario, the forecast suggested that retail volume gains would slow from their significant uplifts at the start of the pandemic. This latest data shows that, while retail volume increases have eased, they haven’t eased at the same rate we predicted.

It also assumed that volumes in the eating out market would return to around 50% in July, and for the remainder of the year. While there are signs of recovery, the initial return to the eating out market isn’t to the same level we predicted. However, it’s likely that August/early September data (available next month) will be more positive thanks to the Eat Out to Help Out scheme.

However, with the furlough scheme soon to end, some restrictions being reintroduced and Autumn/Winter just around the corner, it’s likely that this more positive trajectory may not continue and is likely to plateau for the second half of the year.

Our previously forecasted trend anticipated overall volume losses for the second half of the year. While these latest estimates suggest that out of home losses have been offset by retail gains in the six months to 9 August, it’s likely that trends for the second half of the year will be more subdued, and are more likely to align to our previous forecasts by the time we are in the final quarter of the year.

Future updates from AHDB will monitor the trend – sign up to receive our bi-monthly newsletter.

Notes:

Out-of-home volumes include takeaway, dine-in and on-the-go.

Public sector (e.g. schools, hospitals) not captured