How lockdown has influenced the consumer landscape

Friday, 5 June 2020

The consumer landscape has changed dramatically over the last two months since the introduction of the UK lockdown.

Changes in shopping behaviour, the rise of in-home eating and the media focus on coronavirus have all influenced consumer behaviour and views of our sector products. Consumers’ trust in the industry and view of farming has also been impacted. Research by AHDB and YouGov in April gives an insight in to how consumers are acting during lockdown.

Consumer confidence and recessionary behaviours

An uncertain future, economic decline and political instability can all lead to a decrease in consumer confidence. Consumer confidence is a measure we often use to understand consumer attitudes towards price, willingness to experiment and need for comfort foods. A period of low consumer confidence can bring about a return to recessionary behaviours, as we had seen starting to creep in towards the end of 2019.

In the current climate, IGD’s Shopper Confidence Index has dropped to its lowest level since 2013.

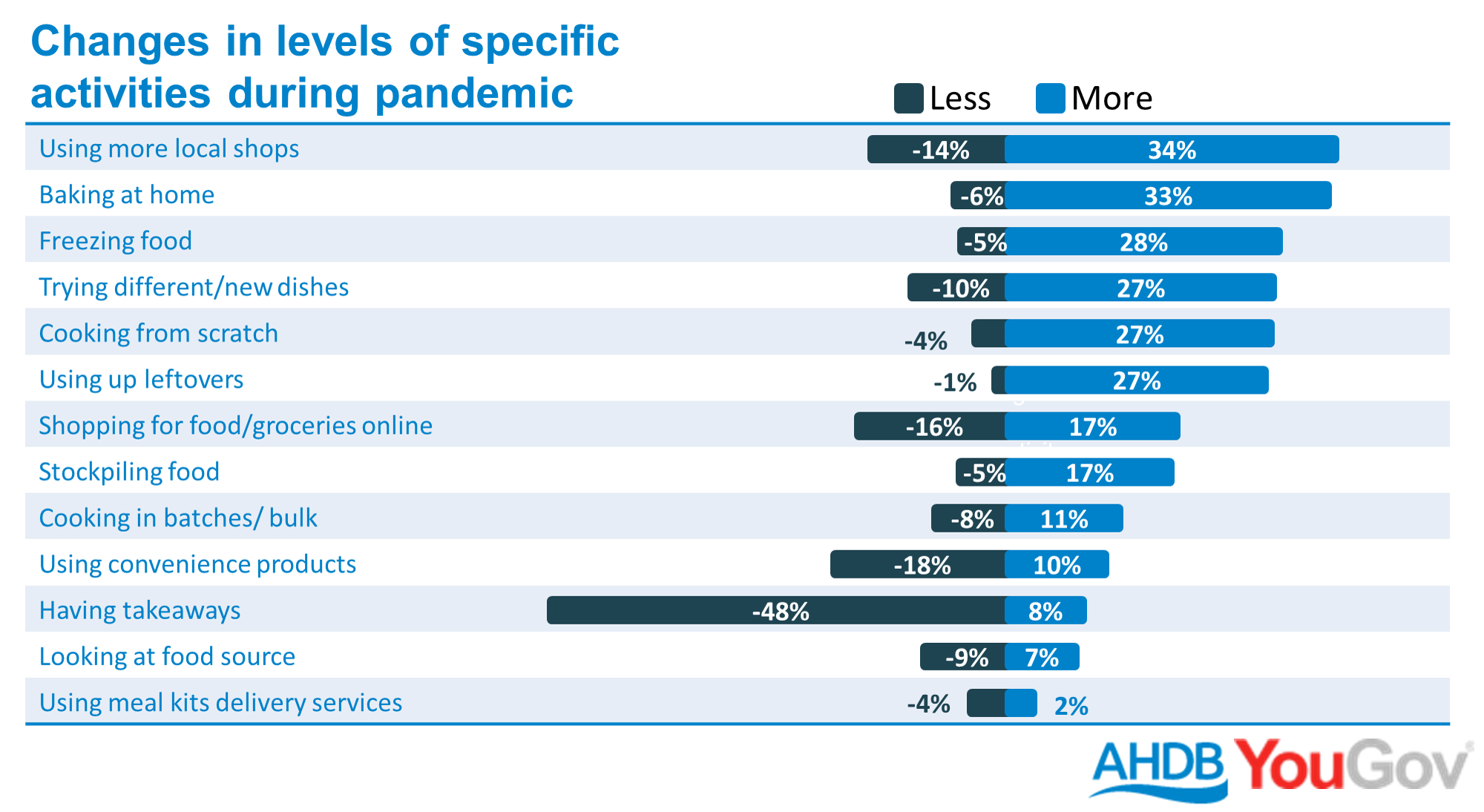

Claimed changes in behaviour

Source: AHDB/YouGov April 2020

Cooking habits

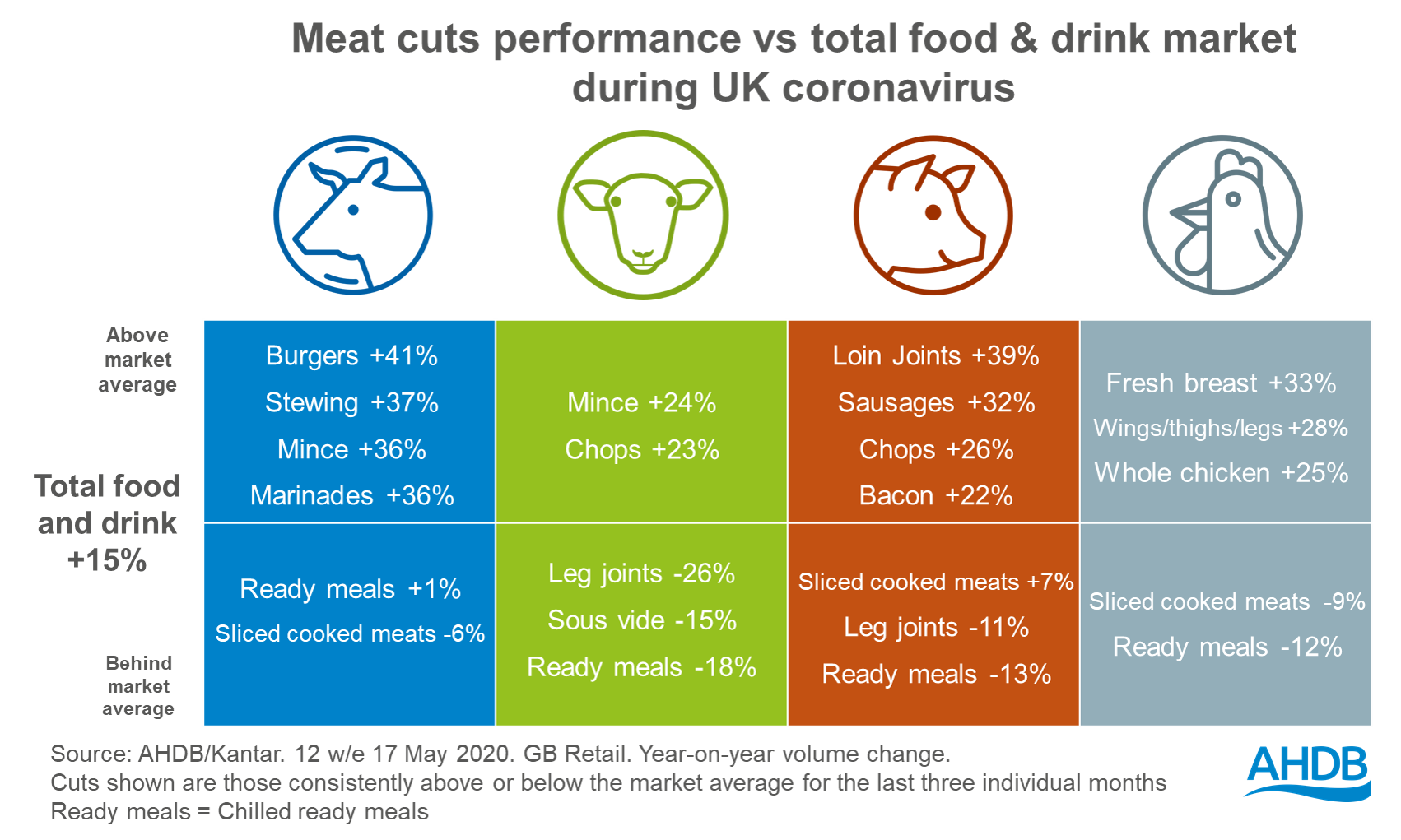

With many people spending more time at home, we have seen an increase in at-home meals. The number of consumers who enjoy cooking has remained unchanged since before the lockdown (72%), however 27% have said they are scratch cooking more now than they did previously and the same number have been using up leftovers more often. Nearly a quarter of consumers say they are cooking from scratch more than six times a week, up from a fifth pre-lockdown. A third have been baking more and 27% have tried cooking new or different dishes. More people scratch cooking tends to benefit versatile cuts such as beef mince and chicken breasts. We have seen an increase in the number of consumers who think beef, lamb and pork are suitable for a mid-week meal, which may be due to them having more time to cook or cooking a wider variety of meals.

Price vs quality

Our consumer tracker demonstrates diverse consumer attitudes towards price, with a third of consumers agreeing they have adjusted their food budget and a third disagreeing. The financial impacts so far appear asymmetric, with some consumers unemployed or furloughed and others on full pay with fewer outgoings on leisure and travel.

Of those consumers who have become more price conscious or adjusted their budget (48%), trading down is the main way they are making their money go further, with 46% buying fewer brands and 38% buying more from value/basic ranges. Likewise, 39% of all consumers claim to have bought more treaty or indulgent foods for their households, whilst 35% disagree with this. In tough economic times, we tend to seek solace in small, affordable treats.

Consumer confidence towards eating out will be impacted both in terms of social distancing measures and tighter household budgets. Over a third of consumers claim they will reduce the amount they eat out in order to save money. As a result, some consumers will spend more on value tier supermarket products, while those consumers who may have eaten out in high end restaurants may trade this for premium tier offerings. Consumers who are celebrating special occasions at home or looking for a treat are also likely to trade up tiers.

Health

When consumer confidence is low, health often becomes less of a priority, as consumers become heavily price focused and look for meals which offer them comfort. We may therefore see a decrease in meals eaten for health. However, this may be lessened compared to previous recessions as consumers look to keep healthy through food, trying to offset the reduction in opportunities to exercise. Only a few consumers claim health credentials of products have increased in importance since the lockdown, but we do know that Google searches for ‘healthy’, especially when searching for recipes, increased throughout April.

We will continue to track how the number of meals eaten for health reasons evolves. The level of consumer confidence will impact to what extent this trend is paused in favour of price and comfort.

Changes in attitude towards AHDB sectors

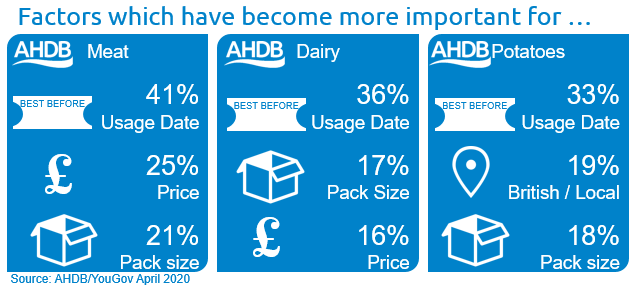

The lockdown has also seen changes in the importance of some purchase drivers. The use by date has become more important for consumers shopping for meat, dairy and potatoes, as they have made less frequent shopping trips. Across all categories, brands are seen as the least important factor by far.

As discussed in previous articles, consumers claim to be eating more dairy and meat, and potatoes are following a similar trend. Consumers claiming to eat fresh potatoes more than once a week has increased by five percentage points to 62%. Versatility remains the number one reason people eat fresh potatoes, followed by taste.

Conclusion

With all of these different dynamics at play, it is critical that the retail sector adapts to changing consumer needs, particularly as lockdown eases and households reassess their behaviours in and out of the home.

The intensity of trends will differ depending on government policy, consumer confidence and how quickly the country emerges from lockdown. AHDB will continue to track and monitor consumer attitudes and behaviours to bring you the latest insights. We will also look at a range of potential scenarios and how consumer reactions could affect demand for meat, dairy and potatoes – this will be featured in our upcoming Agri-Outlook Report planned for release at the end of June.