- Home

- News

- Chinese demand for agricultural commodities continues to support global prices: Grain Market Daily

Chinese demand for agricultural commodities continues to support global prices: Grain Market Daily

Wednesday, 11 November 2020

Market commentary

- Both old and new crop wheat futures closed up £0.25/t yesterday, at £191.35/t (May-21) and £159.60/t (Nov-21). UK markets followed the global market, with Paris and Chicago futures up 1.3% and 1.8% respectively.

- Gains in domestic markets were muted compared to the global wheat markets as sterling strengthened against both the euro (+0.81%) and dollar (+0.82%), to close yesterday at £1 = €1.1233 and £1 = $1.3271 respectively.

- Data released yesterday by the Malaysian Palm Oil Board (MPOB) showed that palm oil inventories in October slumped to their lowest level in more than three years (1.57Mt, down 33% year-on-year), driven by tighter production and strong exports. As a result, palm oil values have rallied, although this is expected to be capped by slower export demand in the coming months.

Chinese demand for agricultural commodities continues to support global prices

The latest USDA world agricultural supply and demand estimates (WASDE), released yesterday evening, provide further useful insight into where markets could be going.

Some key highlights from the report include:

- Global outlook for 2020/21 wheat is for increased consumption, higher exports (Russia +0.5mt and the EU +0.5Mt) and reduced stocks, compared to last month’s report. The sum of beginning stocks and production are raised 0.7Mt to 1,073Mt, with higher beginning stocks offsetting lower global production, which remains at a record.

- Argentina’s wheat crop is seen at 18Mt, reduced by 1Mt from October’s update, driven by drought and local frost damage. Argentina's Buenos Aires Exchange pegs production at 16.8Mt.

- For soyabeans, US production is lowered to 113.5Mt, and ending stocks are down to 5.2mt, if realised this would be the lowest ending stocks since 2014/15. The cuts to production are driven by lower yields reported in several major producing states.

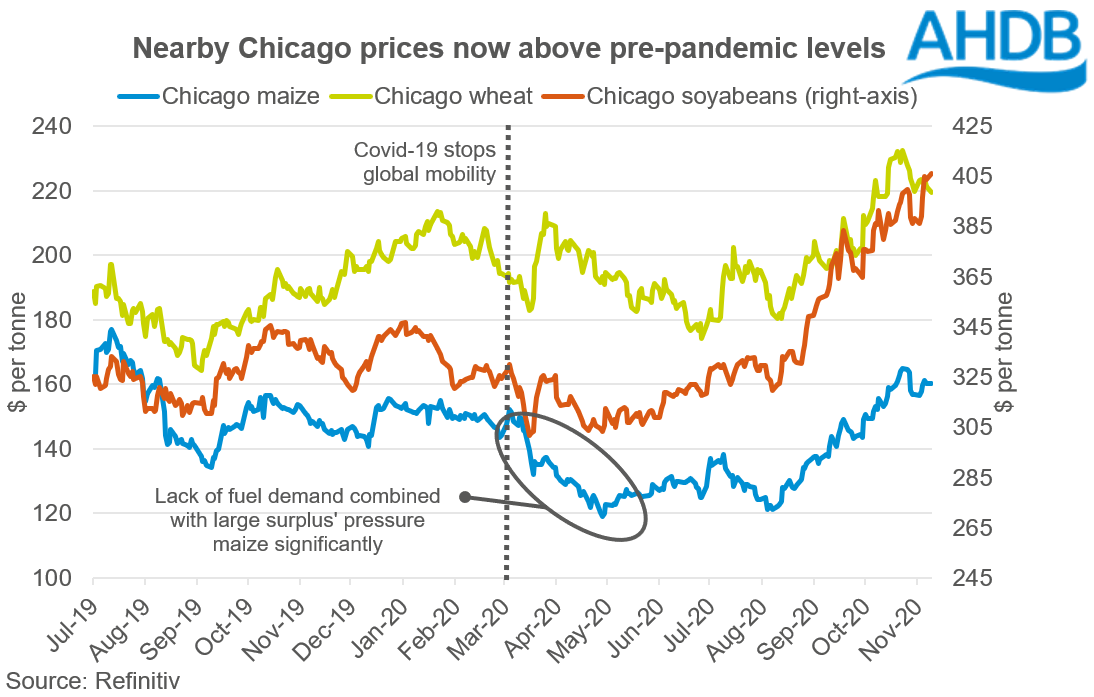

It was anticipated at the start of this marketing year that we were heading into a relatively bearish market for grains and oilseeds, especially with covid-19 stripping the demand aspect out of many commodities.

However, over successive months we have seen maize and soyabeans push to their highest level in November since 2012 and 2013 respectively. This latest WASDE paints a further bullish picture for maize and soyabeans.

What is supporting maize?

Reduced stocks

As yields are reported from the US harvest, production for maize is forecast down 5.5Mt, to 368.5Mt, further to that US exports are increased by 8.3Mt. The combination of reduced production and increased exports has pushed US ending stocks to 43.2Mt, 11.8Mt down on October’s WASDE.

Further to this Ukrainian maize production has been revised down to 28.5Mt from 36.5Mt, with exports also down 8Mt on October’s estimates.

At a global level, ending stocks are now forecast at 291.4Mt, down 9.0Mt on the month.

Increased Chinese purchasing

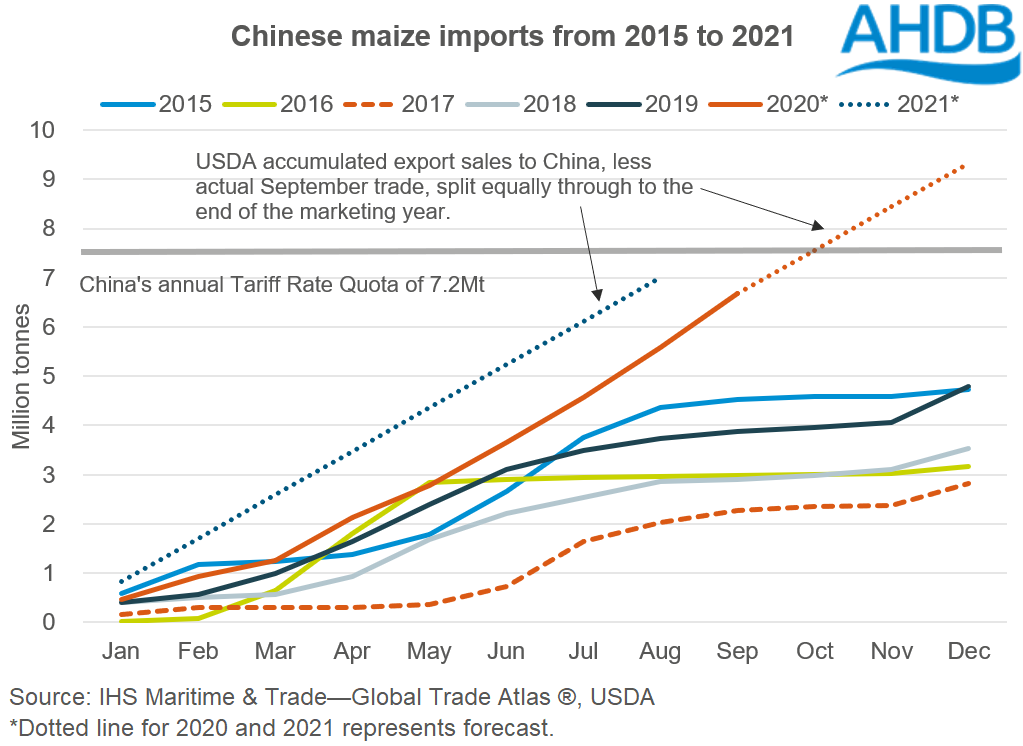

Chinese maize imports were revised up from 7Mt to 13Mt for 2020/21, however the market already anticipated this to a degree.

Chinese imports for Jan-Sep 2020 stood at 6.7Mt, when they have an annual Tariff Rate Quota (TRQ) of 7.2Mt. Furthermore, China have already committed to purchasing 10.8Mt of maize for this marketing year (Sep to Aug), with 2.2Mt already exported post-September. This buying above the TRQ level has continued to support grain markets.

If China’s current buying patterns continue demand could well exceed the 13Mt forecast in yesterday’s WASDE. The USDA Beijing office has pegged it’s 2020/21 outlook for maize imports at 22Mt.

What do we need to look out for?

The other two key exporters of maize that we still have to consider are Argentina and Brazil, where recent dry weather has hampered planting progression and germination of crops.

One key focus will be the Brazilian Safrinha (second) crop planted between January and March. With the crop following the delayed soyabean crop, late planting of this crop could have an impact on yields which could alter the global supply for maize markets.

For further analysis of this and weather implications that could affect this be sure to read how La Niña weather event could impact your domestic grain prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.