Are you thinking about new crop? Grain market daily

Thursday, 3 December 2020

Market commentary

- Yesterday UK feed wheat futures (May-21) closed at £191.00/t, the fourth day of falls in a row. In the past two days, the value of the May-21 contract has fallen through the 20-day rolling average.

- The move lower in UK feed wheat futures follows recent strength in the value of sterling. Despite closing down yesterday, it still closed above the key 1 September resistance level against the dollar (£1=$1.3383). Further, sterling was back above that level as of 11.30am, at £1=$1.3428. This move follows optimism surrounding an EU-UK deal.

- Global grain markets have also lost ground in the past week, with an improved weather outlook in South America.

Are you thinking about new crop?

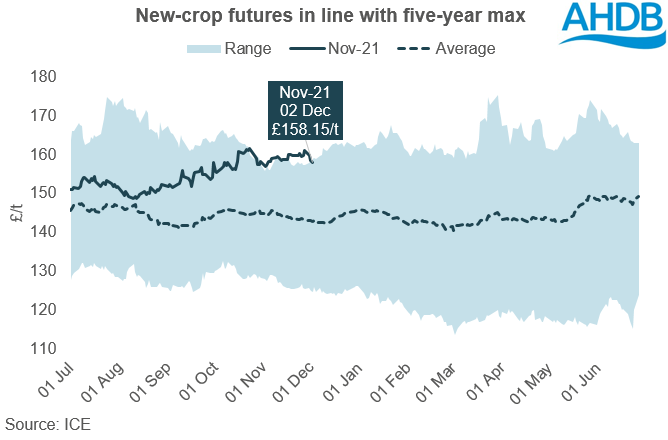

Over the past couple of months, we’ve seen significant rallies in the value of grain markets. These rallies have not been isolated to old crop values, with new crop (Nov-21) UK feed wheat futures closing yesterday at £158.15/t, £7.05/t above the start of the season.

Looking at new-crop values in a longer-term context, we can see that they are currently at the highest they have been at this point in the season, in the past five years. While the UK is set to see an increase in area, giving potential for price pressure, other Northern Hemisphere regions have not been without their challenges.

We have talked extensively in recent weeks about Black Sea crop conditions, and the potential for a smaller crop in Russia. Meanwhile, US winter wheat conditions, although improved on the week, are poorer on the year (46% Good or Excellent vs. 52% last year). These factors will now be priced in, and without fresh news, new crop markets could continue to drift into the New Year.

What do we need to look out for?

Old crop drivers will continue to be key, affecting the carry from old-crop to new-crop. Southern Hemisphere grain production and ongoing global import demand will need watching.

As far as domestic new crop goes, our next signal of how big the new crop could be will come on Friday, with the release of our Crop Progress Report – as at the end of November. Following this, attention will turn to the weather. Improved conditions could signal pressure for domestic new crop, depending on demand dynamics.

For global new crop, the weather watch will be in full flow. We will be looking to temperatures and snow cover in the Black Sea, for signs of potential impact on crops. Data from the European Centre for Medium-Range Weather Forecasts currently shows Ukraine and South West Russia overall, to be milder and drier than normal going into January.

For the US, we will continue to look at the US crop condition reports, although these typically stop in early December until April. Beyond that, the USDA seedings report for winter wheat is published in January, which gives the first indication of US wheat area.

What about new-new-crop?

Yesterday Nov-22, closed at £153.60/t, ahead of the five-year average of £144.07/t for similar contracts at the same time of year (i.e. Nov-21 on 2 Dec 2019). At this stage in the season Nov-22 futures are the wider futures complex.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.