- Home

- Markets and prices

- Dairy markets - Prices - Farmgate milk prices - Projected farmgate milk prices

-

Beef markets

- Beef markets home

- Beef and lamb at a glance

- Market analysis

-

Prices

- Auction market prices

- Deadweight prices

- Global cattle prices

- Supermarket red meat prices

- Farm costs

- Exchange rates

- Supply and demand

- Imports and exports

- Cost of production and performance

-

Lamb markets

- Lamb markets home

- Beef and lamb at a glance

- Market analysis

-

Prices

- Auction market prices

- Deadweight prices

- Global sheep prices

- Supermarket red meat prices

- Farm costs

- Exchange rates

- Supply and demand

- Imports and exports

- Cost of production and performance

-

Pork markets

- Pork markets home

- Pork at a glance

- Market analysis

-

Prices

- Deadweight pig prices

- Weaner prices

- Supermarket red meat prices

- Farm costs

- Exchange rates

-

Supply and demand

- Industry structure

- Slaughter and production

- Carcase information

- Consumption

- Imports and exports

- Cost of production and performance

-

Dairy markets

- Dairy markets home

- Dairy at a glance

- Market analysis

-

Prices

- Milk price calculator

- Farmgate milk prices

- Wholesale prices

- Retail prices

- Farm costs

- Exchange rates

-

Supply and demand

- Industry structure

- Dairy production

- Composition and hygiene

- Consumption

- Imports and exports

-

Cereals and oilseeds markets

- Cereals and oilseeds markets home

- Cereals and Oilseeds at a glance

- Market analysis

- Prices

- Supply and demand

- Imports and exports

- Carbon markets

- Retail and consumer insight

- Agri market outlook

- Farm standards review

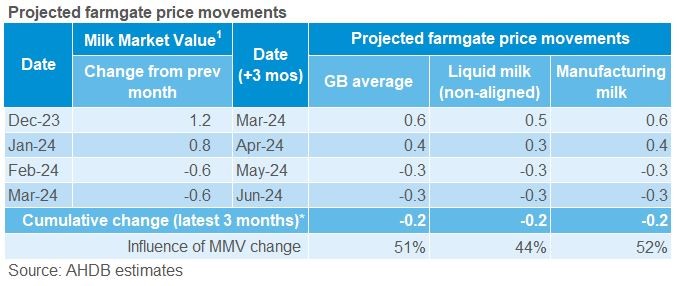

Projected farmgate milk price changes

Updated 25 March 2024

These projections indicate the expected movements in farmgate milk prices for the next three months, based on movements in the dairy markets.

Overview

- UK wholesale prices were more subdued in March as we begin to approach the spring flush. Average prices for butter stayed the same month on month, while SMP saw prices ease further by 5%. AMPE subsequently moved down 1.0p to 36.6ppl.

- MCVE also recorded a slight decline in March, down 0.5p to 36.3ppl as prices for mild cheddar fell 1% month on month.

- These price changes overall resulted in the market value of milk (MMV) falling by a further 0.6p to 36.3ppl.

- With milk production running tight, future adjustments to farmgate milk prices are likely to be based off the performance of the incoming northern hemisphere flush as processors evaluate their supplies.

- The market indicators have been updated to reflect returns based on cost data up to Q3 2023 and will be updated with Q4 2023 data in April 2024.

Additional information

- The projected change is based on the strong link found between movements in the value returned to manufacturers from the market (MMV) and movements in farmgate milk prices.

- On average, it was found that a 1ppl change in the MMV will lead to around a 0.5ppl change in the overall GB average milk price, generally three months’ later.

- Differences will arise due to the markets in which milk buyers operate as well as the mechanism they use to set the milk price. These will impact the timing of price movements as well as the size of the change.

- Other factors which are likely to impact milk prices will be the degree of competition for milk in the market, changes to available processing capacity, import competition and contract negotiations.

- [1] The Milk Market Value (MMV) is a weighted average of AMPE and MCVE on a 20:80 basis. This was found to be the best predictor of movements in farmgate prices based on historical data. The analysis was done excluding prices paid on retailer-aligned contracts. The impact of the adjustment of AMPE and MCVE following the 2020 review has been accounted for, and the model updated.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.