- Home

- Beef Market Outlook

Beef market outlook

February 2024

- UK beef production to remain largely stable in 2024.

- Domestic prime cattle slaughter to increase by 1% based on population data. Heifer slaughter expected to remain supported by contracting national breeding herd.

- Domestic beef consumption forecast to rise slightly as cost inflation eases.

- Tighter Irish market could offer support to GB cattle prices.

Current market situation

Despite some fluctuation, GB finished cattle prices continued to set records in 2023. The market saw support from tighter cattle supplies generally, alongside consistent consumer demand. Prices have continued strongly into the early weeks of 2024.

The GB deadweight R4L steer price averaged 488p/kg for the full year, up 11% from 2022. Meanwhile, the GB overall cow price averaged 344p/kg, up 3%. This came as throughputs of both prime cattle and cows fell compared to the previous year.

International trade of beef remained somewhat subdued compared to 2022, although 2022 was a stronger year generally for exports. In 2023, UK beef exports were hampered by strong beef prices, weaker demand on the continent and lower domestic production. Imports fell too but to a lesser extent. When coupled with production, this pointed to relatively robust domestic demand for beef.

While the cost of some inputs did ease in 2023, they remained historically high. We explore prospects for farm inputs in our dedicated outlooks:

We have also produced a wider economic outlook for the year ahead. Read the full analysis here.

Beef production

Prime cattle slaughter

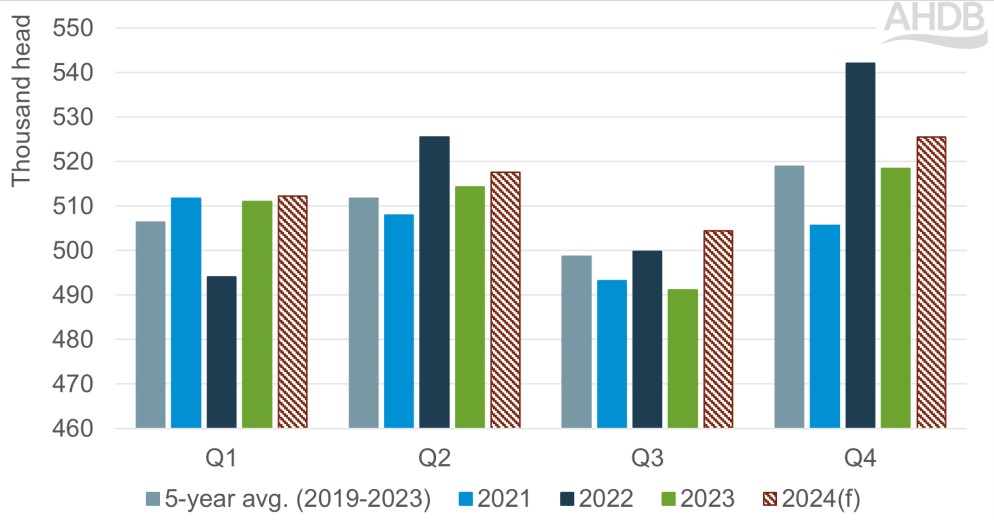

UK prime cattle slaughter fell by 1.3% in 2023 against the year before, to 2.04 million head, according to Defra figures. The first quarter saw uplift in throughputs, boosted by a stronger January, before dipping through the spring. Kill levels remained below 2022 levels through the third and fourth quarters, despite some monthly fluctuation. December’s slaughter level was particularly low.

Average carcase weights were persistently lighter through 2023, likely a reflection of poorer forage reserves over winter, continued pressure from increased feed costs, and adverse weather at various points in the year. A greater proportion of dairy-bred beef and increases in native registrations have also likely reduced average weights on a longer-term basis.

Looking ahead, the latest cattle population figures from BCMS continue to point to slightly more 12-30 month-old cattle on the ground in GB versus the year before. It is also anticipated that heifer slaughter will remain elevated generally, with fewer replacements required for a contracting national breeding herd. Factoring in historical slaughter seasonality, prime cattle slaughter is expected to edge up by 1% in 2024 to 2.06 million head.

However, supplies may begin to tighten up towards the end of the year and into 2025, based on the number animals aged under 12 months. Of course, exactly when cattle are marketed depends on numerous factors, with cattle population being just one element.

Actual and forecast UK prime cattle slaughter

Source: Defra, AHDB forecasts in hashed bars

Cow slaughter

UK cow slaughter totalled 612,000 head in 2023, down 2.5% from the previous year. The continued contraction of the suckler and dairy breeding herds, coupled with higher heifer kill over the past two years, is expected to lead to a 2% reduction in cow slaughter in 2024 to 600,000 head. Uncertainty over milk prices may incentivise some dairy culling in the short-term.

Both the dairy and suckler breeding herds are expected to remain pressured by a higher cost of production, market volatility and reducing direct subsidy. Equally, uncertainty remains over uptake – and subsequent effects on industry profitability – of environmental schemes, be those funded by government or private companies. We have produced and will continue to publish analysis of payments from such schemes, including the Sustainable Farming Incentive.

Further analysis concerning agri-environmental policy can be found on our Environmental Land Management Scheme webpages.

Total production

These slaughter forecasts are expected to contribute to largely stable beef production for 2024, up 0.2% compared to 2023 to 902,000 tonnes. Average carcase weights are assumed to maintain the longer-term trend of gentle reduction, reflecting increasing registrations of dairy crossed animals and native breeds.

Changing dynamics in beef production

Despite the dairy and suckler breeding herds remaining in a state of contraction, UK beef production has remained broadly stable over the past few years. Since 2018 for example, the combined UK dairy and suckler breeding herd has contracted by 6%, while beef production has grown by 0.3%. This reflects the increased use of sexed dairy and beef semen in dairy inseminations, and industry changes to dairy calf management. Together, these factors have put more young beef animals into the supply chain, despite the pool of breeding cattle shrinking.

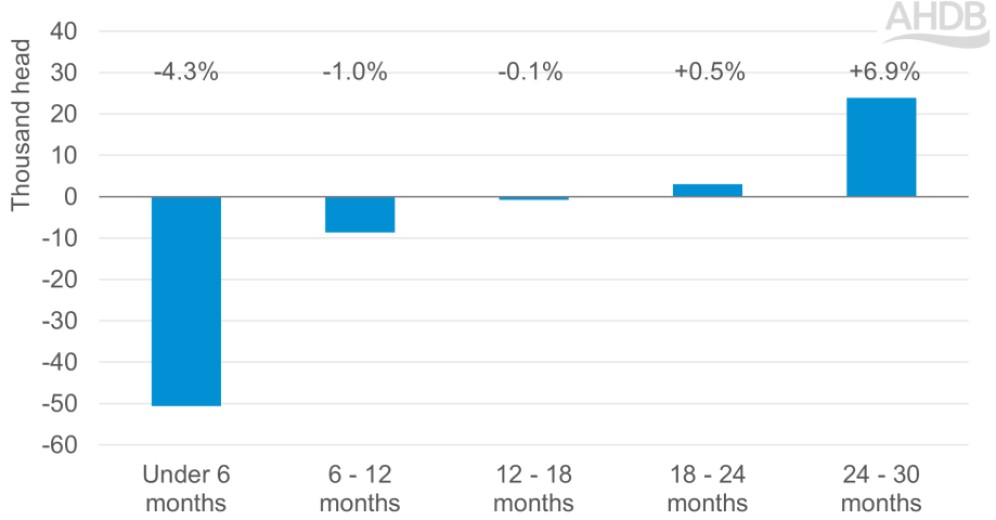

However, recent data from BCMS indicates that the population of younger beef cattle has begun to reduce, for the first time in several years. As of 1 October 2023, there were 1.7% fewer beef animals aged under 12 months old on holdings in GB compared to the previous year, particularly fewer 0-6 month old animals. Numbers of dairy male cattle remained in decline. When combined with the number of beef animals, this put the total number of cattle for beef production aged under 12 months down 3% year-on-year.

Year-on-year change in the number of cattle in GB available for beef production on 1 October 2023

Source: BCMS. Data includes beef males, beef females and dairy males.

Indeed, registrations of calves for beef production (beef animals plus dairy males) showed a steeper decline in 2023. Within this, registrations of beef cattle fell for the first time since 2018, while dairy male registrations remained in decline. The reduction in beef calf registrations was driven by suckler-born animals, as registrations to the dairy herd continued to increase. In recent years, growth in dairy-born registrations have outweighed suckler declines.

Does this data suggest that the contraction in the national breeding herd is beginning to outweigh beef semen usage in the dairy herd, and therefore have a larger impact on future slaughter cattle supply? The continued growth in registrations of beef calves to the dairy herd in 2023 would suggest that there is still room for expansion in dairy-beef production. The trajectory of the breeding herds – particularly the suckler herd – will be a key dynamic in beef production levels going forward.

Disease risk

These abnormal risks are likely to impact herds throughout 2024, and we are aware of an increased number of cases. However, we have assumed a minimal impact on production at the UK level in 2024 as this is difficult to predict and quantify. A more severe impact would make our production forecast look optimistic due to potential issues with calving and productivity.

Bluetongue virus: depending on the strain of virus, scale of any outbreak, and the timing of a disease incursion, the virus can lower productivity, cause sickness, reduce reproductive performance and cause abortions. Calves may be born small, weak, deformed, or blind and result in increased calf mortality. The impact is difficult to predict but could be high for some herds, and potentially significant if a largescale outbreak were to occur.

Other impacts from Bluetongue include disruptions due to impact of prolonged animal movement and trade restrictions, administration, and additional costs as a result of restrictions. This includes the need for a license to move animals out of the zone, that can take up to 5 days to process, as animals can only exit the zone to move directly to slaughter and may require farmers to change their usual routes to market. Farmers may incur costs from reduced market access, including export markets. We will continue to monitor the situation closely.

Schmallenberg virus: the severity of this disease varies between species and ages of animal. In cattle it can cause abortion, stillbirths, foetal abnormalities leading to calving difficulties, reduced milk yield and loss of body condition. The impact is difficult to predict but likely to result in a reduction in productivity and number of calves in 2024 for affected herds.

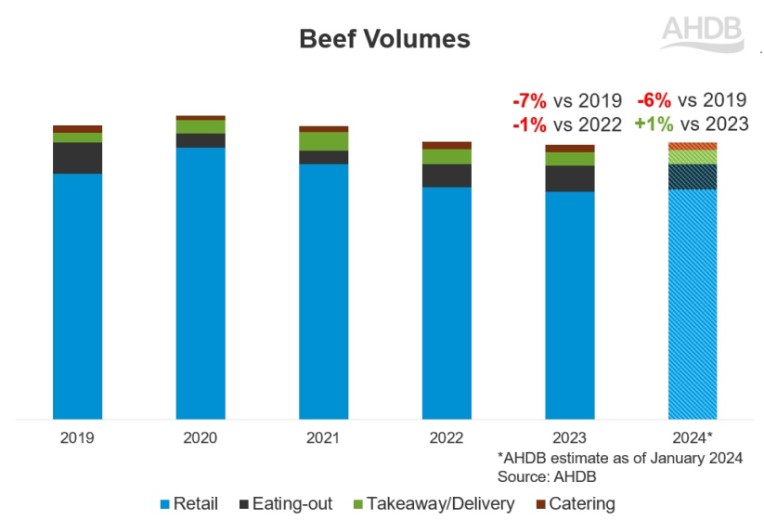

Beef consumption trends

In 2023, total beef volumes were 1% lower year-on-year. There was reduced demand for beef in retail and takeaway due to cost of living pressures but some boosts as people returned to dining out (Source: AHDB/Kantar, 52 w/e 24 December 2023). For more details on 2023 trends and cut specifics, see our retail and foodservice dashboards.

For the year ahead we expect inflation will continue to fall, and wages will continue to rise. The overall economic outlook will improve, although there are headwinds including world conflicts that have the potential to derail this.

This means that some shoppers will feel genuinely better off, while others will continue to struggle and look to make savings when they can. After three years of overcoming challenges and reconsidering how to spend their money, we expect any changes in shopping behaviour to be gradual.

Beef volumes for 2024 are forecast to be up 1% compared to 2023, but 6% down from 2019 as cost-of-living pressures remain. It is forecast that 2024 will bring increased demand in both retail and out-of-home, with volumes forecasted to rise slightly compared to 2023.

Estimated and forecast beef consumption volumes

In retail, cheaper primary cuts such as mince are expected to do well, and any rises in scratch cooking could further benefit mince due to its low-price point. However, shoppers will continue to restrict how often and how much they buy in store – by reducing waste and stretching meat over more meals. A hopeful return to more normal summer weather following last year’s washout could benefit beef burger volumes at BBQs. Targeting promotions and campaigns towards key events such as this could help boost sales further. However, this remains a watchpoint as greater demand for these cheaper cuts like mince and burgers could create carcase balance issues for farmers through devaluing the carcase. It is also forecasted that beef will see another strong performance at Christmas.

Within the out-of-home market, dining out is forecast to be aided by elevated volumes in the second half of 2024, with a warmer summer expected to boost dining out demand. With cost pressures on consumers and businesses, smaller numbers of office Christmas parties could limit demand in December. Takeaways are the only channel forecast to see volumes increase versus both 2019 and 2023. This will likely come from increased volumes of burgers due to their relative affordability, which could offset declines to more expensive cuts like steaks, continuing trends we saw in foodservice last year.

Opportunities for the beef industry to improve demand include:

- For cheaper cuts, encouraging tasty and versatile beef dishes which play on value for money. Inspire using batch cooking and filling meals, coupled with retail promotional support.

- For more premium products, capturing meal occasions lost from more expensive proteins and the out-of-home market by inspiring treat dinners such as fake aways or restaurant quality dine-in recipes.

- Addressing health concerns by communicating the health benefits of beef, such as B12, iron and protein.

- Encouraging consumers with the right messaging in-store, online, on pack and in foodservice.

- In the longer term, look to maintain and build consumer trust, demonstrating where farming values (animal welfare, environmental stewardship and expertise) are shared with consumers. See our consumer reputation landscape hub for more information.

AHDB has a range of marketing activities planned for the year, including the new Let’s Eat Balanced campaign. Please visit our marketing pages for more information. For more insight around consumer demand visit our retail and consumer page.

.png)

Trade

Imports

According to HMRC data, UK beef imports fell by 3% (carcase weight equivalent, including fresh, frozen and processed) during Jan-Nov 2023 compared to the same period the year before. Lower imports from the EU drove the decline, in particular from Germany, Ireland, the Netherlands and France. There was, however, an uplift in Polish imports. Overall, imports from non-EU suppliers grew – particularly from Brazil – but remained a low proportion of total imported supply.

In 2024, the projected UK market balance of stable production and slight consumption growth, suggests that demand for imported beef may increase by 3% year-on-year in volume terms.

Teagasc (the Irish Agriculture and Food Development Authority) forecast that Irish beef production will fall by 4% in 2024 from the previous year. This follows a fall in production of 2% in 2023, and strong live export levels. Lower cattle supply is expected to support Irish producer prices in 2024. Anticipated market conditions in continental EU could add further support. We explore the Irish beef market outlook in more detail here.

Exports

UK beef export volumes in 2023 remained lower than the year before. This was especially pronounced in the first quarter of the year, as exports at this point in 2022 were particularly elevated. Between Jan-Nov 2023, the UK exported 121,500 tonnes of beef (carcase weight equivalent, including fresh, frozen and processed), down 16% year-on-year. Volumes fell to nearly all EU recipients, but particularly to France, the Netherlands and Ireland.

Drivers of this have included weaker EU consumption levels, influenced by price inflation and poor summer weather. Meanwhile, GB cattle prices have returned to a firm position when compared to the continent, weakening export competitiveness.

In 2024, EU market dynamics could be supportive of UK beef exports. The European Commission forecasts growth in beef imports to the bloc in 2024, as foodservice demand improves, and cattle supplies reduce. Production declines have been influenced by continued structural contraction in cow numbers, plus dry weather and high feed costs hampering carcase weights.

Overall, we forecast UK beef exports could rise by 1% in 2024 in volume terms.

Cattle price outlook

There are several market factors within the outlook that would point to support for GB cattle prices in 2024. These include a tighter supply outlook in Ireland and the EU, and positive projections for UK domestic demand. Lower youngstock numbers would also point to future tightening of GB cattle supply moving into 2025.

However, cattle population data suggests supply could be more plentiful in the early months of 2024 compared to the year before. This may limit upward price movement in the short-term. Additionally, while the outlook points to slight growth in overall domestic beef consumption for the year, the balance of cuts consumed will be crucial to market values.

Sign up to receive the latest analysis and forecasts from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.