Brexit Perspectives: What can we learn from NZ?

Tuesday, 15 January 2019

What can the UK learn from New Zealand’s experience of agricultural reform?

Summary

Farm support has been a big talking point for the agricultural industry following the EU referendum, with many citing New Zealand as an example of how the industry can thrive without subsidies. However, as this briefing note highlights, there are many fundamental differences between the New Zealand economy and agriculture industry in 1984 and how the UK economy and agricultural industry performs in 2018.

Some comparisons can be drawn between the two experiences. However, there are fundamental differences between New Zealand’s experience and what the UK may experience, which makes drawing meaningful comparisons and conclusions difficult. The table below summarises some of the key differences:

|

Measure |

New Zealand – pre-1984 |

How does the UK compare today? |

|

Population |

3.2 million |

In 2017, the UK population was 66 million |

|

Support systems |

Market-related support, through compulsory meat purchases and input subsidies. Comprehensive system of farm financing |

Predominantly decoupled direct payment (CAP) |

|

Currency |

New Zealand dollar was devalued by 55% in 10 years to 1984 |

Since the vote to leave the EU, sterling has devalued by 14.9% |

|

Land Prices |

Linked to inflated commodity values – but still based on market values |

Complex system with a number of independent drivers |

|

Farming systems |

Largely driven by livestock farming, with year-round grazing. Only limited arable sector |

Mixed industry |

|

GDP ($bn USD) |

22.4 |

2,622 |

|

Contribution of agriculture to GDP (% of GDP) |

5.7 |

0.52 |

|

Trade |

Exportable surplus (now) Lamb and Mutton – 98% Dairy – 95% Meat (all types) – 90% (amount that production exceeds consumption) |

Exportable surplus Beef and Veal – -25.1% Lamb and Mutton – -0.3% (amount that production exceeds consumption) |

Background

In September 2018, the government published the Agriculture Bill, setting out the framework for the future Domestic Agriculture Policy. From 2021, direct payments for farmers in England and Wales will be phased out over a 7-year transition period, with those receiving larger payments seeing reduction at a quicker rate. However, during this transition, direct payments will also become separate from the requirement to farm the land. As a result, payments may be made in a single lump sum of several years’ worth, allowing farmers to: invest in their farming enterprise, diversify or even retire from farming.

The example that is commonly discussed in the industry and media when we look at the ‘success’ of subsidy-free farming is New Zealand, which began the removal of subsidies for agriculture in 1984. However, to what extent is it fair to draw parallels between the New Zealand experience and UK agriculture? This article will assess:

- The events in the run up to subsidy removal and how they differ to UK situation

- The impact over time on New Zealand agriculture compared to UK agriculture

- Whether the results of subsidy-free farming could be replicated in the UK

The change process is one of which very few countries have experience. The aim of this article is to provide some insight around what New Zealand’s farming sector actually experienced when subsidies were removed.

The New Zealand economy pre-reform

In the run-up to the removal of agricultural subsidies, New Zealand was experiencing a deep foreign exchange crisis. In the ten years to June 1984, the value of the New Zealand dollar relative to the US dollar had devalued by more than 55%, falling from $1 NZD = $1.46 USD to $1 NZD = $0.65 USD.

New Zealand was also hit by high levels of inflation in the run-up to the 1984 general election, which was ultimately the catalyst for reform. In 1980, consumer price inflation hit new and unsustainable heights, peaking at 18.4% – some six percentage points higher than the inflation of the G7[1] nations for that year.

In the run-up to agricultural reform in New Zealand, the annual change in GDP was on par with levels experienced by the major advanced economies, at around 1% growth in 1980. However, government debt as a proportion of GDP was significantly greater than that of the advanced economies. In 1984, the general government net debt as a proportion of GDP stood at almost 154%. This compares with just 42% of GDP for the UK for the same year.

New Zealand’s economy in the run-up to agricultural reform had been driven by large agricultural exports, particularly to the UK, a market into which New Zealand had guaranteed access. As the UK joined the European Economic Area in 1973, it had less control of trade agreements; this in turn had a detrimental effect on New Zealand’s exports.

New Zealand agriculture pre-reform

In 1984, farming provided the sixth largest sectorial contribution to New Zealand’s nominal GDP at 5.9% and the largest contribution of any of the primary industries. It was a sector largely in growth. By comparison, UK agriculture in 2017 contributed just 0.52% to GDP. The wider agri-food sector contributed 6.4%.

According to Stats NZ[2], between 1970 and 1984 the number of agricultural holdings in New Zealand increased by 17% to 76,633. Similarly, the average area of farmholdings increased marginally over the same period from 267 Ha to 277 Ha (4%).

As you would expect with an increase in the number of farmholdings, the number of people employed in agriculture had risen in the run-up to the agricultural reforms. Between 1980 and 1984, there was an increase of more than 4,000 workers employed in agriculture. The rise in the agricultural workforce was largely driven by a rise in the number of casual workers, making up 83% of the 4,000 worker increase.

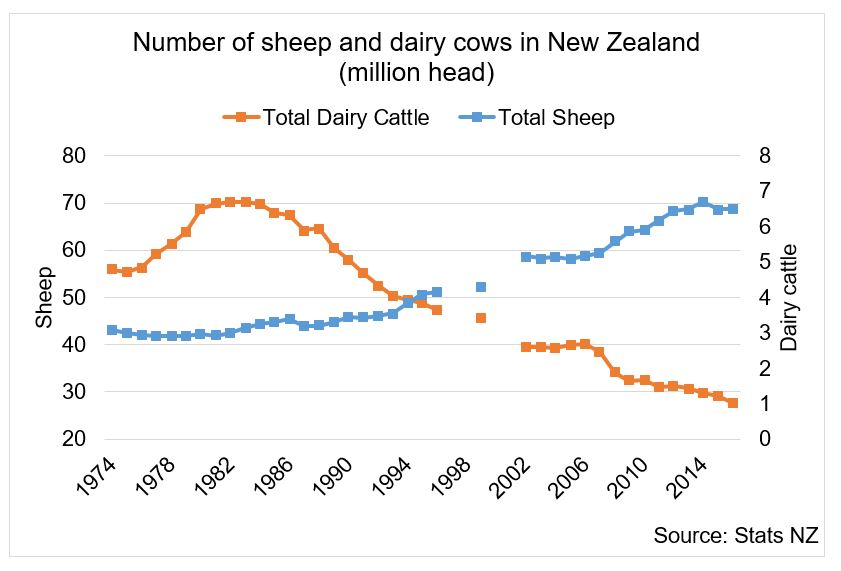

The shape of farming in New Zealand pre-reform, as it is today, was dominated by sheep and dairy farming. In the ten years to 1984, the number of sheep in New Zealand had grown by 25% to 69.7 m head. Other livestock numbers were declining over the same period, with cattle and pig populations falling by 16.5% and 5.5%, respectively.

The large rise in sheep numbers was largely driven by market distorting price supports. In 1978, the government introduced its Supplementary Minimum Price Scheme (Jardine, 2010[3]), which maintained a minimum commodity price for meat through compulsory purchases of carcases when market prices fell below the set price floor. Sandrey and Reynolds (1990[4]) postulate that, between 1982 and 1986, compulsory purchases of sheep meat cost the New Zealand Meat Board $766m NZD. Meanwhile, other reports suggest as much as $1bn NZD was spent on minimum price payments.

Horticulture and viticulture (wine) in New Zealand pre-reform was much different from how it is now. The fruit, vegetable and wine industries were being squeezed by wider agriculture. Between 1984 and 2004, Jardine (20103) states that the wine industry grew by 491%. However, it is worth noting that in the run-up to reform, horticulture was receiving very few subsidies.

Farming in New Zealand pre-reform also benefited from subsidised inputs, which reduced the cost of fertiliser, weed control and irrigation for farmers. The combined impact of such farm supports had distorted farmers’ views of the state of the market and led to poor allocation of resources and production at greater levels than the market required.

Finally, the ease of access to finance also caused problems in the years after agricultural reform, with investment decisions based on inefficient, artificially inflated and uneconomic production levels.

What was removed?

Following a snap election in New Zealand in 1984 and the subsequent change of government, a new budget was presented in November 1984. The budget outlined wide-scale austerity, with budget cuts and price supports being removed from a number of sectors, including agriculture.

The previous level of support for farming had led to significant market distortion, most notably overproduction and levels of investment way above a ‘free-market’ level, which also drove over-production. Their sudden removal, in an export-led economy, left producers vulnerable to market forces, with many finding themselves operating at uneconomic levels of output and unable to recoup the return on investment previously expected.

The 1984 budget highlighted a number of key policy changes for the agriculture industry, including:

- Rural lending interest rates brought into line with market rates

- Fertiliser transport subsidies were removed and fertiliser price subsidies were terminated in March 1986

- Removal of investment allowance, which agriculture benefited from

Shifts in agricultural policy were combined with a number of shifts in foreign exchange, monetary and fiscal policy, aimed at improving the overall economic situation for New Zealand. The changes made by the government directly to agriculture policy were fiscal changes (adjustment of taxation and subsidy), targeted more at reducing government debt than directly influencing agriculture. The fiscal adjustments largely mirrored the changes experienced in the UK since the financial crisis of 2008, with changes to taxation in the form of the introduction of a VAT-style tax on goods and services at 10% (in the UK VAT was raised to 20% in the wake of 2008).

In essence, policy was being driven by budgetary constraints.

The monetary policy changes brought in by the Fourth Labour Government of New Zealand centred on mechanisms for controlling the level of inflation. Inflation control was particularly important, given the wage controls that were in place.

Arguably, one of the more crucial changes for agriculture was the decision to remove foreign exchange controls by devaluing the New Zealand Dollar by 20% against a basket of currencies in 1984, which was followed by allowing the NZD to float in March 1985. The devaluation and subsequent flotation of the currency improved the attractiveness of exports on the global stage and helped to provide support in the absence of export subsidies.

To try to combat the effect of significantly reduced agricultural support, the New Zealand government focused its restructuring around boosting social welfare. This involved bringing in a number of policies to help farmers exit the industry and to better cope with increased financial burdens.

The government also refocused some of the agricultural spending to improve the provision of public goods. This was managed through provision of research and development, improved education and advice and also through provision of animal inspection services – although costs were recovered where possible.

What impact did the changes have?

The effect of farm support removal, general and agricultural reform in New Zealand was to hold a mirror up to inefficient and uneconomic production. This section focuses on four key areas post-reform – farm debt and land values, livestock farming, the impact on exports and the impact on the allied industries.

The number of farm holdings stayed largely the same, as farmers diversified into other industries or focused on efficiency; for example, the number of deer being farmed increased from 259K head in 1984 to 1.23m head in 1994.

The impact on farm debt

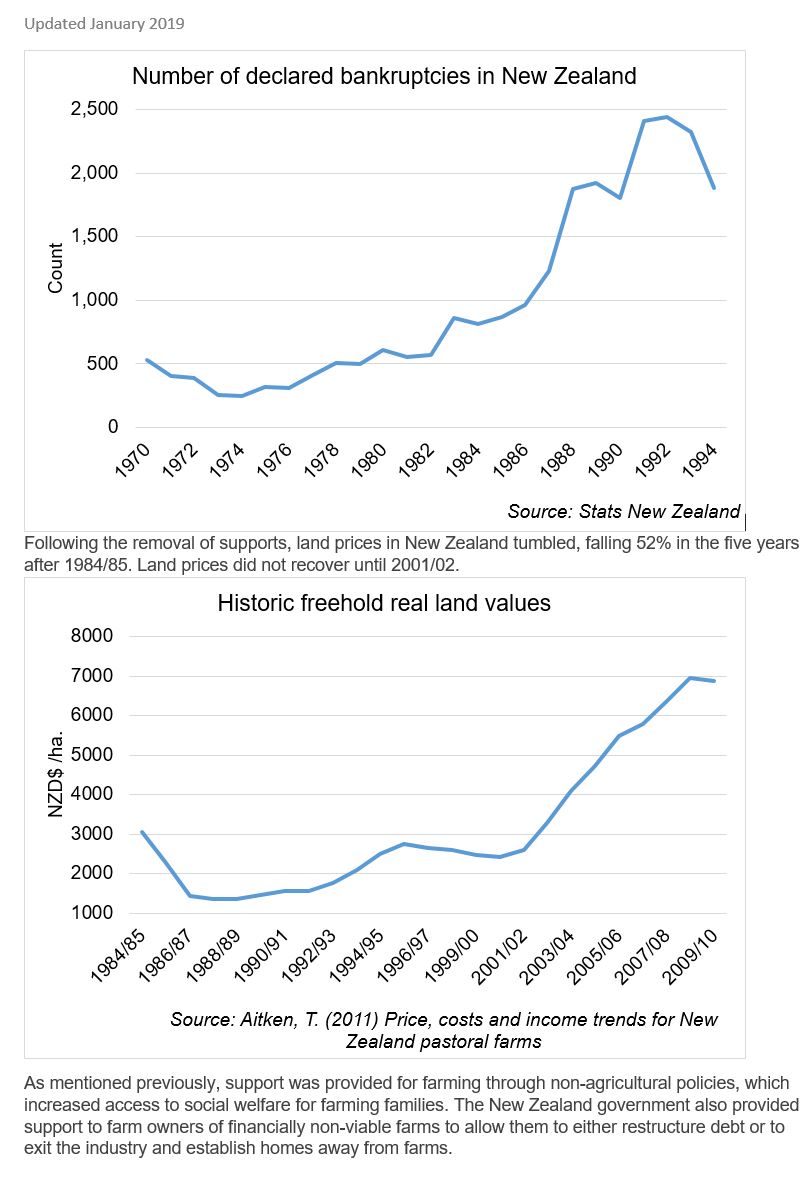

The hardest impact on agriculture came through the changes to farm debt in New Zealand, with reports of a number of farms being hit by increased exposure to their debt. There are numerous anecdotal comments of farms going out of business but finding data to reflect that 33 years later is difficult. As a proxy, we instead look at the total number of bankruptcies in New Zealand as a whole, which increased from 814 in 1984 to 1,922 just five years later in 1989. Evidence from other reports on New Zealand agriculture at the time estimates that around 5% of commercial farmers were declared bankrupt or abandoned their farms.

Furthermore, a New Zealand Reserve Bank bulletin from 1986 suggests that 10% of all farmers were in a critical financial state by the middle of 1986. The fall of land values following agricultural reforms also exacerbated the financial risk many farmers were exposed to, with both farmgate revenues and asset values declining, and the cost of debt rising.

Following the removal of supports, land prices in New Zealand tumbled, falling 52% in the five years after 1984/85. Land prices did not recover until 2001/02. As mentioned previously, support was provided for farming through non-agricultural policies, which increased access to social welfare for farming families. The New Zealand government also provided support to farm owners of financially non-viable farms to allow them to either restructure debt or to exit the industry and establish homes away from farms.

The impact on livestock farming

Sheep farming was arguably hit the hardest by the changes to agricultural policy. The sheep population in New Zealand fell by 29% between 1984 and 1994, a fall of around 20 million sheep. With the number of farms staying largely the same, it appears that farms streamlined and made businesses more efficient, rather than exiting the industry altogether. Sheep farming is presented in a relatively positive light, with increased efficiency and animal productivity, meaning famers can save on costs while maintaining a consistent output.

The experience of dairy farming was a very positive one. Unlike with the number of sheep in New Zealand, the number of dairy cows actually increased in the two years after 1984, rising by 150K head to 3.4 million in 1986. After 1986, the number did decline for three years but recovered and has continued growing since reaching 6.5M head in 2016.

The income of farmers in the beef, lamb and dairy industries was impacted almost immediately by the removal of agricultural subsidies. According to Lattimore (2006[5]), real incomes of beef and sheep farmers fell 60% from 1985 into 1986. The income of dairy farmers was less affected but was still hit quite hard by the removal of subsidies, dropping 25% over the same period. Lattimore comments that dairy incomes were mostly affected by the rising cost of debt servicing and the removal of fertiliser subsidies.

Impact on inputs and allied industries

The ability of New Zealand agriculture to establish a longer-term recovery was driven by an increased focus on economising and through promotion and application of efficient farming methods. One such example is the quantity of fertiliser applied in New Zealand – in the two years following 1984, applications of Diamonium Phosphate (the main fertiliser used in New Zealand at the time) fell by 58%. The reduction in fertiliser use on grassland has also been seen in the UK, with usage of nitrogen, phosphate and potash all falling, following the decoupling of support payments in 2005.

Furthermore, in the immediate aftermath of subsidy removal, Lattimore comments that farms survived through restructuring debt and postponing repairs, maintenance and purchases of equipment and machinery.

With New Zealand agriculture largely driven by livestock farming, it increases the ability of the industry to cut down the use of machinery, fuel and purchased fertiliser. The climate in New Zealand also helps to limit costs through reduced overwinter housing of livestock in a way that is more difficult in the UK.

Despite the benefits of reduced overwinter housing through cost reduction, today there is a negative public view on the impact on agroecology. The “Dirty Dairy” publicity campaign is focusing on the impact of overwinter dairying on river pollution. Furthermore, there are still ongoing efforts to reduce the negative impact of overuse of fertilisers. Finally, the increased out wintering of animals has led some to raise questions over animal welfare particularly in years such as this one where a bad winter leads to increased animal health concerns.

Impact on exports

Exports also drove a large proportion of New Zealand’s recovery, the devaluation of the New Zealand Dollar (as mentioned earlier) helped to move a large proportion of the exportable surpluses. Exports of lamb did decline, falling by 31% between 1984 and 2004. However, exports did fall at a slower pace than the number of sheep, which fell 44% over the same period. Exports of dairy products saw a significant increase in the post-subsidy era, with exports of butter increasing by 102% over the same 20 year time period. Dairy products as a whole witnessed a 166% increase between 1989 and 2004.

New Zealand continues to perform well in export markets, largely due to its high exportable surplus and low population. Beef and Lamb New Zealand stated 98% of the Lamb and Mutton produced was available for export in 2014/15. Of meat production as a whole, 90% was stated as being available for export.

With regard to dairy, New Zealand exports approximately 95% of its production, despite only accounting for 3% of global production.

The restructuring of farm support in New Zealand has also helped the arable industry to carve out a niche of its own, with a focus not only on increased vertical integration (increased forage crops for animal industry) but also through the growth of its seed industry (grass seed, clover and field vegetables), which has a strong global export market.

How does the UK compare?

Many of the economic phenomena that affected New Zealand and the subsequent reaction of its government is more representative of the UK in 2008 than the UK now, with contractionary fiscal policy used as a tool alongside expansionary monetary policy.

As indicated above, the saving grace for the New Zealand agriculture industry, in particular, was the ability to devalue the New Zealand dollar substantially against a basket of global currencies and stimulate global demand.

If the UK were to devalue sterling, UK exports would become more competitive on world markets, which would drive demand. However, to put the level of devaluation into context – to drop sterling relative to the euro by 55% would mean going from the current position (7 January 2019) of £1 = €1.11 to £1 = €0.50. For illustrative purposes, assume UK wheat costs £178.50/t, in the EU at present that same wheat would cost €198/t. If the value of the sterling dropped by the same as the New Zealand dollar, that same £178.50/t wheat would only cost the US purchaser €89.25/t. At prices like that, it is easy to see how a nation’s exports can boom.

We have already seen a significant devaluation in the value of sterling over the course of the past year. Between 23 June 2016 and 7 January 2019 the value of sterling relative to the euro fell by 14.9%.

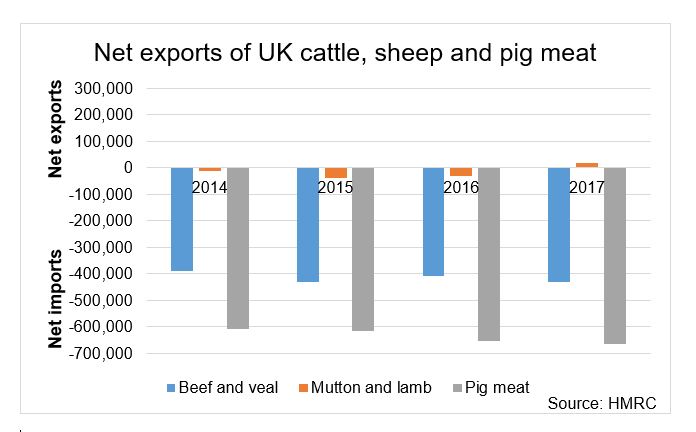

The situation could be favourable for exports, but the level of exportable surplus available in the UK struggles to scratch the surface of global agricultural exports. Moreover, the UK at present is a net importer of cattle, pig meat and, until recently, sheep.

The impact of currency devaluation would more likely benefit the UK by making importing less cost-effective, thus creating opportunities to displace imports with domestic production. This is especially true, given the fact that the UK has a much wider pool of domestic demand than in New Zealand, with a population 14 times the size of New Zealand.

The economic impacts are likely to be much wider-reaching, a devaluation of sterling of the magnitude we are talking about would likely lead to vast inflation due to the inflow of demand for sterling-priced goods. This could potentially spark a rise in interest rates and a domestic consumption crisis. The true impact of the devaluation could take many forms, with a number of different policy routes that could be used to mitigate the risk of recession. This makes forecasting the true impact of changes to agricultural support very complex.

The supports in place domestically for agriculture are also less market distorting than those in place in New Zealand, with no artificial price supports in place apart from CAP. UK farmland values as in New Zealand have risen significantly over the past decade. The determination of land values in the UK is much more complex than that of New Zealand – with both agricultural and non-agricultural drivers behind UK farmland value increases.

Final thoughts

This briefing document has highlighted many differences between UK agriculture now and New Zealand agriculture in 1984. This makes drawing direct comparison difficult on many levels. Furthermore, expecting agriculture to respond and work in the same way as it did 33 years ago is a dangerous precedent to set.

Despite this, there are some key lessons that can be taken from the New Zealand experience:

- With the structure of farm support changing, there is likely to be a challenging transition period

- For the UK agriculture industry to be successful post-Brexit, there will need to be a focus on efficiency and streamlining

- There may be opportunities for the UK to carve out niches and for agriculture to thrive through increased vertical integration

- Agriculture operates most efficiently when decisions are based on actual market returns

Fundamentally, success for UK agriculture post-Brexit will come from the same school of thought as it did in New Zealand – efficient, market-led production.

James Webster

AHDB Senior Analyst, Market Intelligence

024 7647 8844

James.Webster@AHDB.org.uk

[1] Canada, France, Germany, Italy, Japan, United Kingdom and United States

[2] This work is based on/includes Stats NZ’s data, which are licensed by Stats NZ for reuse under the Creative Commons Attribution 4.0 International licence.

[3] Jardine, A. (2010) Agricultural Reform in New Zealand. Liberales Institut der Friedrich-Naumann-Stiftung für die Freiheit

[4] Sandrey, R. and Reynolds, R. (1990) Farming without subsidies: New Zealand's recent experience. Ministry of Agriculture and Fisheries.

[5] Lattimore, R. (2006) Farm Subsidy reform dividends. In North American Agrifood Market Integration Consortium Meetings (Vol. 31).